5 topline insights from the 2019/2020 C-store IQ: National Shopper Study

Defining convenience: New data delves into the minds and habits of Canadian c-store shoppers

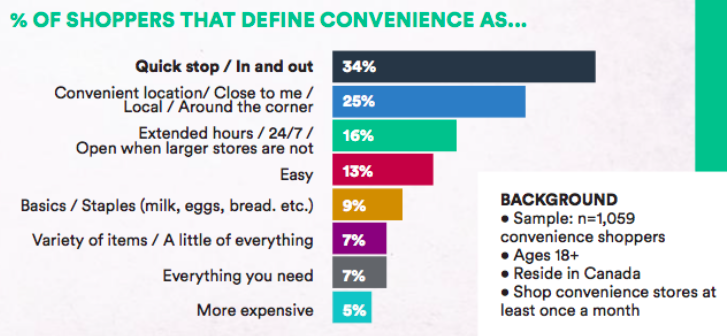

Convenience means different things to different people, but for most c-store shoppers it’s about saving time and effort.

As expected, the definition of convenience includes location, hours and product selection, however, for a growing number of Canadian consumers it also comes down to overall ease of experience.

Convenience stores that prioritize simplifying the shopping and purchase steps are more likely to see rewards with increased traffic and basket size, according to insights from the new C-store IQ: National Shopper Study from Convenience Store News Canada.

C-Store IQ is the first convenience and gas specific study that delves into the wants, needs, perspectives and habits of Canadian consumers. We worked with the research team at EnsembleIQ and Canadian Viewpoint Inc. to survey more than 1,000 convenience shoppers across the country to bring our readers and our partners the insights and data necessary to better understand customers and achieve business success.

Survey participants shared their definitions of convenience and so much more in this comprehensive study: This is a topline report and we will be digging into the data throughout 2020, both in the magazine and online.

For starters, Canadian convenience store shoppers associate the word ‘convenience’ with overall speed—41% of those surveyed said it purely comes down to having a “convenient” experience and 34% define this as a “quick stop/in and out.”

Proximity—to home and work—is important, with 25% of shoppers saying convenience is “close to me,” while 16% said longer hours and being open when larger stores are closed is important.

WHO'S SHOPPING?

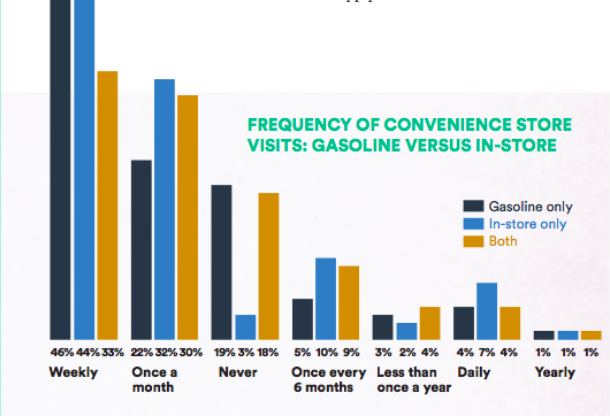

A quick stop at a convenience store is part of the fabric of daily life for most Canadians: 43% shop chain convenience stores and 38% visit independently-owned convenience stores at least once a week.

Millennials lead the charge when it comes to convenience shopping: 50% said they shop a chain c-store at least once a week, compared to 45% of generation X and 36% of baby boomers. For independently owned c-stores, 42% of millennials are more likely to shop at least weekly, compared to 34% of generation X.

WHAT’S DRIVING CUSTOMERS IN-STORE?

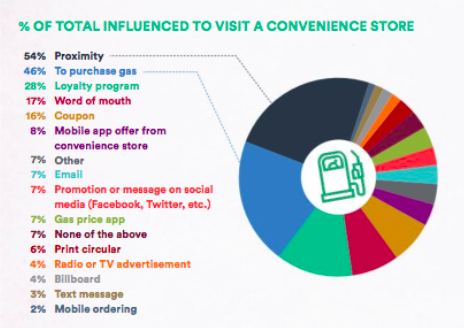

Location, location, location: For more than half—54%—the key element that prompts them to visit a particular c-store is proximity, followed by the need to purchase gas (46%) and loyalty programs (28%).

More than half of c-store customers shop at a convenience store that has a loyalty program and 42% are enrolled in and actively use their store’s loyalty program.

Technology and related apps aren’t huge overall drivers for Canadian c-store shoppers, however when analyzing data by generation, new patterns emerge. Younger shoppers prefer less bulk in their wallets, opting instead for mobile apps.

Millennials respond more readily to digital promotional tactics (mobile app, social media promotions, mobile ordering and email) and younger shoppers in general are influenced by promotional signage or car wash promotions during their shopping trip.

Here’s how digital efforts measure up:

- Mobile app: Millennials (14%) are more likely to be influenced than generation X (8%) and boomers (3%).

- Social media promotion/offer: Millennials (10%) are more likely to be influenced than generation X (8%) and boomers (4%).

- Text message: Millennials (5%) are more likely to be influenced than boomers (0.2%).

- Mobile ordering: Millennials (4%) are more likely to be influenced than generation X (3%) and boomers (1%).

- Email: Millennials (8%) and generation X (9%) are more likely to be influenced than boomers (4%).

All indicators are that the future is digital, which calls for better optimization and integration of stores’ digital infrastructures.

WHERE AND WHEN DO CANADIANS SHOP?

Canadians are a loyal bunch, with 70% of shoppers saying they typically visit the same store each time. When considering the convenience store they shop most often, foundational attributes, including the price of products (40%), fun to shop (18%), quality of prepared foods (20%), loyalty programs (19%) and variety of products offered (16%) are the top five reasons why they favour a particular store.

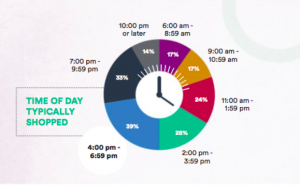

The breakfast hours are ripe for shopper conversion, with only 17% of shoppers starting their day with a trip to the convenience store. Visits gradually increase throughout the day and peak during the rush hour/early dinner daypart, with visits from 39% of shoppers.

In an ideal world, shoppers who purchase gas would also pop into the c-store to spend more money, however only 3% say they purchase merchandise and/or foodservice “every time,” while 17% purchase these items “almost every time.” In turn, 19% of shoppers say they “rarely” purchase merchandise or foodservice.

Of the more than one-in-four people who shop for both gasoline and in-store merchandise at least once a month, 28% say they were recently influenced by frequent buyer/loyalty programs to make the trip inside and spend. About one-in-five were influenced by promotional signage and one in 10 were influenced by mobile app promotions/deals.

WHAT ARE CONSUMERS BUYING?

Shoppers typically visit a variety of stores to satisfy their needs, however convenience stores are the channel choice of choice for a number of categories.

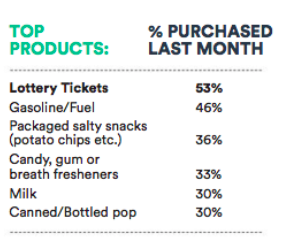

Lottery tickets are a key driver, with 53% of shoppers purchasing lottery tickets in the past month, while 46% purchased gasoline. Traditional convenience products are among the most frequent purchases, with 36% of shoppers buying salty snacks, followed by candy or gum (33%), canned/bottled soda (30%), bottled water (26%) and hot dispensed beverages (25%).

Not surprisingly, among those who purchase cigarettes and other tobacco products, c-stores are the destination of choice: 22% of consumers visit a c-store to buy cigarettes.

Frozen drinks, almost exclusively the domain of chain c-stores, are a big pull, with 19% of shopping buying these within the last month.

And, yes, the milk run is still a huge part of the c-store experience, with 30% of shoppers buying milk in the last month.

There’s still plenty of room for growth in foodservice, with 16% of shoppers stopping for grab-and-go prepared foods (hot dogs, packaged sandwiches, salads etc.) and only 10% buying made-to-order food.

It’s worth noting that those who define themselves as “health-conscious shoppers” are likely to spend more than non-health-conscious shoppers, mostly owing to the higher priced better-for-you products.

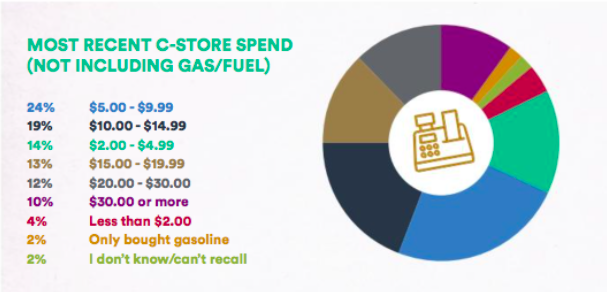

HOW MUCH ARE SHOPPERS SPENDING?

On average, shoppers spent $13.56 during their most recent convenience store trip, not including the price of gasoline. Cards are king, with more than one-third of shoppers (35%) using a debit card, while 31% opted for a credit card. Cash is still a major mode of payment for 30% of shoppers, while mobile payment accounts for only 1% of purchases. It’s worth noting, however, the generational divide when it comes to payment preferences: 38% of boomers and 29% of generation X are more likely to have paid with cash, compared to 22% of millennials. Instead, 41% of millennials said they paid via credit card, compared to 27% of generation X and 25% of boomers.

Younger shoppers already demonstrate higher usage of debit and mobile payment compared to older generations and, as a result, convenience stores will continue to benefit from opportunities to offer more digital or frictionless shopping, payment, and promotional solutions.

According to spending patterns, younger shoppers are the c-store shopper of the future: A large percentage of boomers spend less than the younger generations, perhaps indicating they depend less on quick c-store visits to buy essentials.

Overall, however, as Canadian consumers feel increasingly time-pressed and, in turn, seek solutions to make life easier and more streamlined, c-stores have an important role to play in meeting these needs by delivering the right products, at the right time, right away: It’s all about convenience.