The ups and downs of tobacco

After a surge in sales during the COVID-19 lockdown, how do c-stores keep smokers coming back for more?

As Canada locked down in the wake of the COVID-19 pandemic, Eyvind Dahl noticed something at his Renfrew, Ont. c-store went up: tobacco sales.

Dahl, the owner of Dahl's Coin Laundry & Convenience, attributes the increase in tobacco purchases to the closure of First Nations’ borders in the province, a protective measure to fight the coronavirus. “When they closed the reserves, our tobacco sales more than doubled,” says Dahl.

He notes that sales of Imperial tobacco alone jumped from 50 to 100 cartons a week. Hand in hand with that increase in business came a surge in impulse purchases. “All my categories shot up,” says Dahl. “We were so busy it was crazy.”

Surge then slide

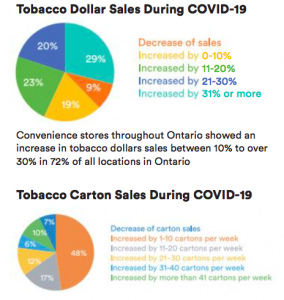

Dahl was not alone in seeing a surge in tobacco. According to a survey conducted by the Ontario Convenience Stores Association (OCSA), retailers throughout Ontario showed an increase in tobacco sales that ranged from 10% to more than 30%. The survey of the association’s 6,000 members also found that proximity to a reserve played little role in the booming business. Sales increased across the board, and almost half of the stores surveyed were more than 30 kilometres from the closest reserve. Dahl's Coin Laundry & Convenience is an hour away from the nearest First Nations community.

The boom has been temporary, however. “Now that the reserves are back open, sales are going down, down, down,” says Dahl. “It’s going back to normal, which shouldn’t be normal.”

The issue of contraband tobacco has been a significant one for retailers, particularly in Ontario. “The illegal cigarette market has been left unchecked for far too long,” says OCSA CEO Dave Bryans, who is based in Oakville. “This can’t go on. In Ontario, 30 to 60% of butts swept are contraband.”

The OCSA is calling on the provincial government to develop an integrated plan to address contraband concerns and other tobacco issues. “The survey demonstrates a need to work with the Ontario government to develop a tobacco strategy from pricing, formats, promotions and incentives to protect small businesses as well as government’s health policies,” says Bryans.

The Convenience Industry Council of Canada noted a similar surge amongst its members. During a recent interview with CSNC, president and CEO Anne Kothawala said CICC is engaging "Ernst & Young to put together a comprehensive study on contraband tobacco across the country. We need much stronger public policy to address this issue."

Competing with contraband

Until then c-stores are looking for ways to enhance tobacco sales. In the current environment, productivity is paramount, says Anthony Ruffolo, vice president, McCowan Design & Manufacturing Limited in Toronto. “Plain packaging has definitely made it more difficult to vend the product quickly. You need to be more efficient and organized.”

Products like McCowan’s secure undercounter tobacco cabinets can help. This may also free up the back wall for new opportunities, space often previously dedicated for tobacco products. “There is an ability to generate profits off the back wall. You may even be able to sell advertising,” says Ruffolo.

Sara Clarkson, president of Storesupport Canada in Mississauga, points out that helping people work through the plain packaging maze will build customer loyalty. “There is still lots of confusion regarding cigarette brands with the start of plain packaging. Knowing what brands to recommend is key and ensuring stock is available of those brands for your regular customers is also of huge importance.”

Bryans recommends c-stores promote the least expensive products they have in inventory as a way of competing with First Nations’ retailers at a basic level.

While that will attract some new customers and keep others coming back, there is no way c-stores can compete head on with contraband sales, notes Dahl. A carton of cigarettes from the reserve is $20. His cheapest brand is $120. “It’s a huge difference. I can sympathize with the customer.”

The focus on tobacco sales includes another harsh reality for c-stores: the category is declining.

Bryans notes that c-stores sell 99% of all legal cigarettes and sales are declining 1.5 to 2% a year. “That is a huge concern for the channel. The time has come for a task force to review the tobacco business in Canada.”

Filling the void

One solution is to look for options that can replace tobacco. Vaping seemed a promising category and the profit margin is greater than tobacco. The product is also very popular, but there are concerns about safety and increasing regulations that are undoubtedly affecting retailers.

Many would like to see c-stores be able to sell alcohol, and the industry has been lobbying the government and raising public awareness for the last seven years to encourage a move to an open retailing market. Doug Ford’s Progressive Conservative government has promised that market will soon be a reality in Ontario, but the wait continues.

Ruffolo also recommends retailers look for products and services that set them apart, such as foodservice or local products. “You need to draw in new customers. The more you know your customers, the more you will be able to retain them.”

It’s also critical to remind customers—through signage, conversation, and any other means—that c-stores offer what competitors, from larger stores to smoke shacks and vape shops, do not. That message resonates more clearly and convincingly in a COVID-19 world, notes Clarkson. “With access to grocery stores being more difficult with line-ups and extra time needed to shop, quick convenience is more important than ever. Ensuring staples are in stock and healthy snacks will promote a quick stop at the convenience store.”