C-store IQ National Shopper Study 2023

More than 50% of c-store shoppers visit a convenience store at least once a month, but the reasons behind those visits are shifting compared to pre- and peak- pandemic times.

Longer hours and changes to routine remain the top drivers for shopping more at c-stores today versus pre-pandemic, however, both decreased significantly when compared to a year ago. That makes sense—grocers and other stores are now open longer (remember when everything closed at 6 p.m.)—and as people return to regular routines, the pandemic plays a lesser role in shaping daily habits: 26% compared to 41% previously.

That said, visits to and spending at convenience remains strong. Shoppers spent an average of $18.06 on their most recent visit (excluding the costs of gasoline), compared to $15.46 in last year’s report and $13.56 in 2019.

For further signs of pandemic recovery, look no further than foodservice. Foodservice as a driver of c-store visits increased 6 percentage points year-over-year to 18%, compared to 12%. Digging deeper, 13% of shoppers say they typically visit to purchase lunch (up from 8%) and purchasing dinner has more than doubled—to 11% in 2023 from 5% previously, according to insights from the 2023 C-store IQ: National Shopper Study from Convenience Store News Canada and the research team at EnsembleIQ.

Now in its third year, C-store IQ is the only convenience and gas specific study delving into the wants, needs, perspectives and habits of Canadian consumers.

This year, we doubled the number of participants to more than 2,000 convenience shoppers across the country. It’s a true snapshot of Canada’s convenience landscape, with comprehensive coverage by age demographics and geographical locations.

This is a topline report. We will be digging into the data throughout 2023—in the magazine and online, as well as events and special reports—to analyze consumers’ attitudes, habits and expectations regarding key categories, foodservice, technology, fuelling, loyalty and more.

Looking for specific data about categories, demographics, urban versus rural shoppers? Reach out. The goal is to provide valuable insights into the evolving wants, needs and habits of your customers to better inform business decisions and drive success.

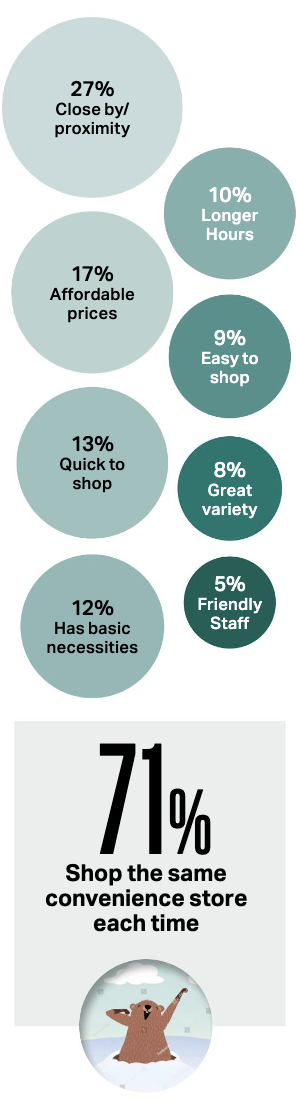

What 'convenience' means to shoppers

For more than one-in-four shoppers, convenience is defined as a store that is in close proximity followed by affordable prices, quick to shop and offering essential items.

Aspects that influence a visit to a convenience store

Although location, longer hours and need for gasoline still have the most potential to sway shoppers to visit a store, when compared to last year, all dropped in influence. In turn, social media, private label, mobile ordering, email and curbside pickup increased.

Usage of expanded services at convenience stores

Significantly more shoppers are using expanded services versus a year ago, with indications that these behaviours are being driven by younger generations, who embrace Wi-Fi, video games, passport photos, mobile ordering, drive-thru and self-checkout. Millennials are most likely to use storage lockers.

Time of day

Like last year, trips increase throughout the day and peak in late afternoon and evening, but lunchtime occasions appear to be on the rise. As shoppers return to school and work, retailers should pursue opportunities to attract more morning occasions.

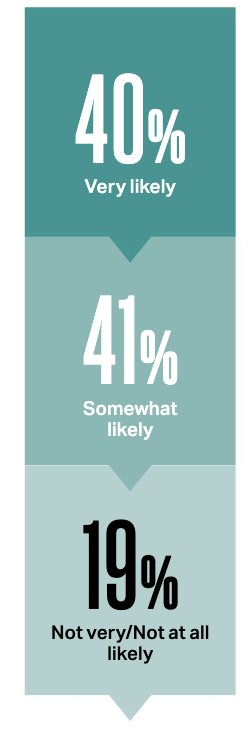

Likelihood to visit different store if items unavailable at current store shopped

It’s now more important than ever to gather the right data to understand your target shoppers’ wants and needs, or risk losing them to the competition. Shoppers in Atlantic Canada are most likely to go elsewhere if desired items are not in stock.

The survey was fielded from December 7, 2022 – January 10, 2023 and responses were gathered from 2,008 people, who were required to be 18+, reside in Canada and shop at convenience stores at least once a month. Quotas were imposed to ensure measurable base sizes for age generations and provinces or territories.