2021 Forecourt Performance Report

Each year Kalibrate, through its Canadian subsidiary, The Kent Group, produces the country’s most comprehensive data set on the retail fuelling sector. We are pleased to partner with The Kent Group and Kalibrate to offer this snapshot of the country’s fuel landscape.

The 2020 Kent Report shows that significant trends continue to impact the fuels business as it evolves to meet changing demands. And, while some aspects, such as independent fuel dealer vs refiner marketer comparisons and the number of fuel brands are relatively unchanged from last year, other factors that span from COVID-19 challenges reveal big differences between years.

This year’s study identified 11,908 retail gasoline stations in Canada or 3.1 outlets for every 10,000 population. This number indicates a slight decline over 2020 where numbers showed 11,937 fuel sites in Canada. “The number of retail sites in Canada has fluctuated little during the last decade, hovering near the 12,000 mark since 2008 after having contracted near 40% during the prior two decades,” says Jason Parent, Head of Product, Kalibrate Data Insight & MD Kent Group. “We estimate that the Canadian retail gas station population peaked at about 20,360 in 1989, declining steadily until about 1999, and then at a moderately slower pace through to 2014. Since 2014, the number of sites has grown modestly, rising to just over 150 locations, an annual growth rate of only 0.2%.

“In the late 1980s, the Canadian service station industry was significantly over-represented. Consequently, fuel marketers started to rationalize their networks to their larger volume sites. Kent data shows the proportion of sites pumping less than 2.5 million litres annually has shrunk from more than two-thirds of sites in Canada in the early 1990s to less than a quarter of sites in 2019. Far fewer inefficient sites in operation in the Canadian market led to fewer site closures.”

According to Parent, there was a large decline in fuel demand last year due to the COVID-19 pandemic and reduced travel and transportation. This decline has led to an increase in the proportion of locations pumping less than 2.5 million litres annually, rising to nearly 32%of operations in 2020. “Since the demand for fuel is expected to increase in 2021 and further recover in 2022, it is unclear what effect this will have on site closures,” he says.

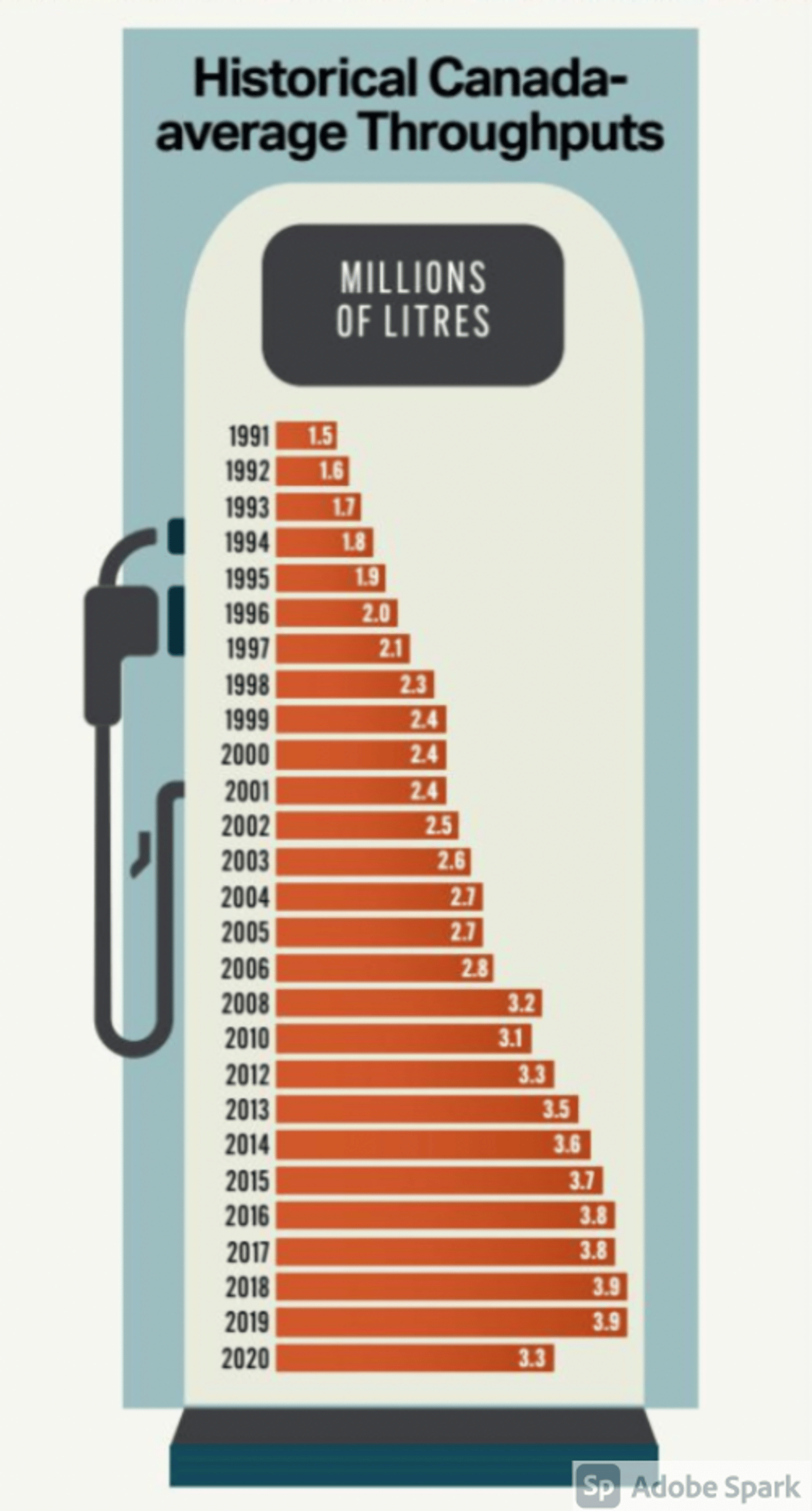

Given the decline in fuel demand last year, it would follow that there would also be a decline in site throughput. This decline is exactly what the Kent Report discovered. “The 2020 average retail outlet throughput in Canada was 3.31 million litres per year, a decrease of 15.8% from 2019, he says. “Since 1990, throughput efficiencies have experienced an upward trend, a consequence of a long-term rise in petroleum demand coupled with a long-term decline in the number of retail outlets. This trend has slowed in recent years and is likely a consequence of slowing growth in fuel demand combined with a plateau in the number of retail sites in Canada during the last decade.”

The Report notes that fuel demand is projected to increase in 2021 and likely fully recover by 2022. However, over the long term, Canadians can expect to see decreasing demand for gasoline because of higher fuel economy standards, alternatives to petroleum in the automotive fleet, and evolving attitudes towards ride-sharing, public transit, or working from home. These factors will lead to lower average station throughputs if station counts remain constant.

Ontario gas stations have the highest average site throughput in Canada. Retail sites in the province dispense on average 4.5 million litres of gas and diesel annually. Interesting is the contrast between Ontario and Quebec. The Report found that Quebec gas stations, on average, pumped 44% less volume than those in Ontario. “The possible reasons for these variations are the same as those explaining per capita outlet representations,” suggests Parent pointing to demographics, geography, and the potential effects of differing provincial regulations affecting the marketing of retail petroleum products.

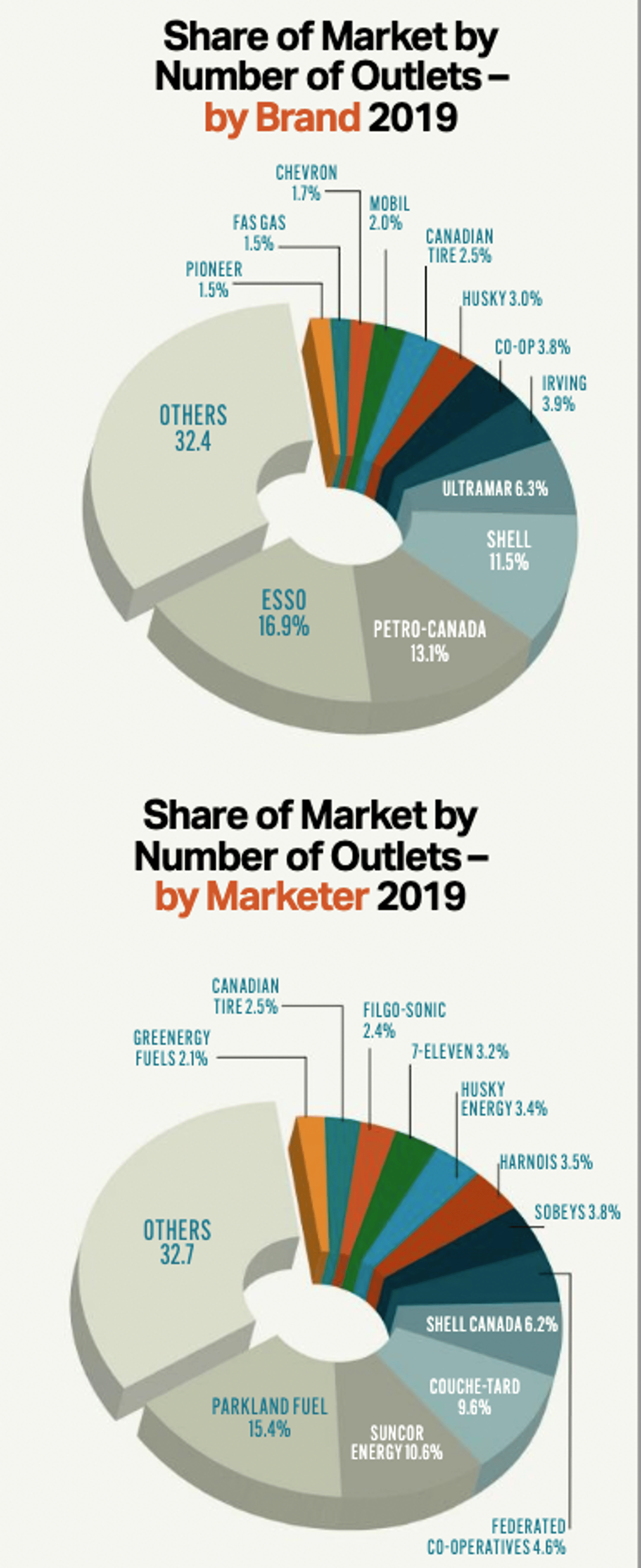

Canada is home to 96 unique brands of gasoline, a number that has been stable over the past ten years. Of the 11,908 gas stations that sell brands nationally, only 11% are price-controlled by one of the three major oil companies. Altogether 21% of gas pricing is controlled by refiner-marketers. The remaining 79% are price-controlled by independent operators, a number that is up from 73% just a decade ago.

In 2020, 40% of the fuel marketing companies in Canada operated a portion of their network under a brand owned by another company. This model represents 38% of gas stations in the country, a sum that is up from 18% over the past decade and 6% in 2004 when the Kent Report first appeared.

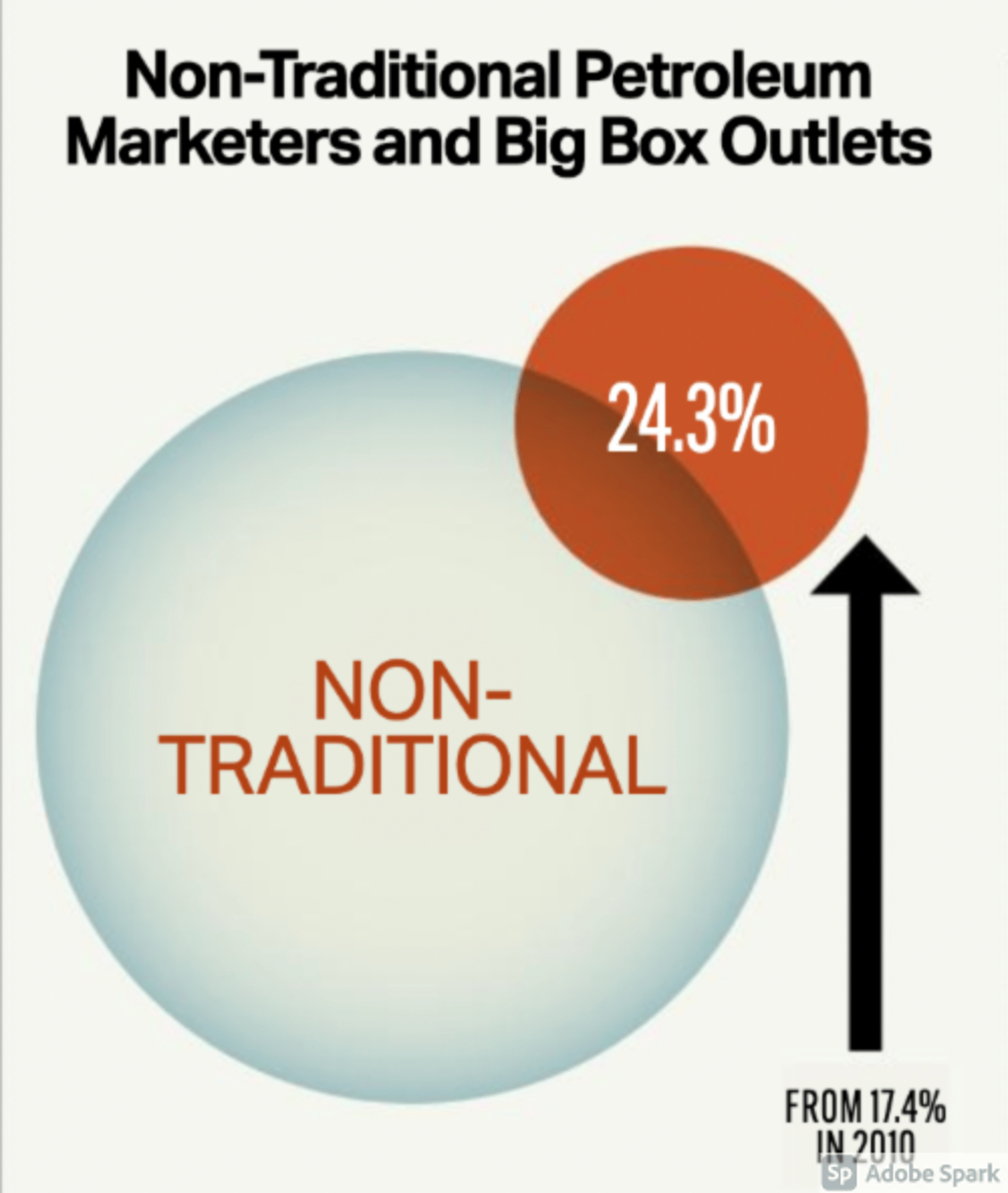

Non-traditional marketers were another area of growth. Non-traditional marketers are businesses where their main source of revenue is not related to fuel. These operators include grocery chains, big-box retailers, and convenience outlets such as 7-Eleven Canada. In 2020 Kent reports this sector held 24.3% of the market, up from 17.4% in 2010. The Report indicates that the strongest growth came from Canada’s central and eastern regions. Sites in Ontario and the Atlantic saw representation in the non-traditional area double. Manitoba and Saskatchewan were the only provinces that saw declines.

With-in the non-traditional sector, big-box operators such as COSTCO and Loblaws hold a 6.1% share of gasoline sites. This number is down from 6.2% in 2010. There is some suggestion that big box retail is divesting itself of fuel sales. For example, Loblaws dealt off 200 fuel sites to BG Fuels (Greenergy Canada) in 2017.

Diesel continues to climb in availability. Last year Kent found that diesel is available at 77.4% of sites nationally. This number is up markedly from 2010 when Kent reported diesel was available at 57% of locations. Diesel holds a 7.8% share of retail petroleum sales.

When Canadians buy gas, they do so most often at self-serve sites. Kent reports that 81.9% of outlets told them this was how they operated. In 2010 24.1% of gas locations offered full service. Last year the number was down to 13%. When the Kent Report first ran in 2004, full service was available at 36% of dispensers. Behind the shift to self-service are pay-at-pump convenience and the higher cost of gas at full-service dispensers.

Backcourt

10,071 of the 11,908 sites across Canada, or around 85% of all outlets, offer backcourt services such as convenience stores, car wash or quick-service restaurants (QSR).

“A convenience store is associated with virtually every gasoline outlet in Canada, ranging from small kiosks to offerings of well over 2000 square feet of store space,” says Parent. “In recent years, the mid-size “c-store” representation has surpassed the large c-store (over 1,500 square feet) as the most common configuration. This investment may be a result of limited site real estate space, as fuel marketers invest in other backcourt facilities such as car washes or quick-serve restaurants.”

Parent reports that over the past ten years there has been a shift in c-store size with smaller footprint stores (less than 500 square feet) being converted to mid-size convenience stores (500 – 1,500 square feet). “This trend is likely a consequence of significant investments in backcourt facilities and the increased involvement of convenience retailing specialists such as Couche-Tard and 7-Eleven in the retail fuel landscape.”

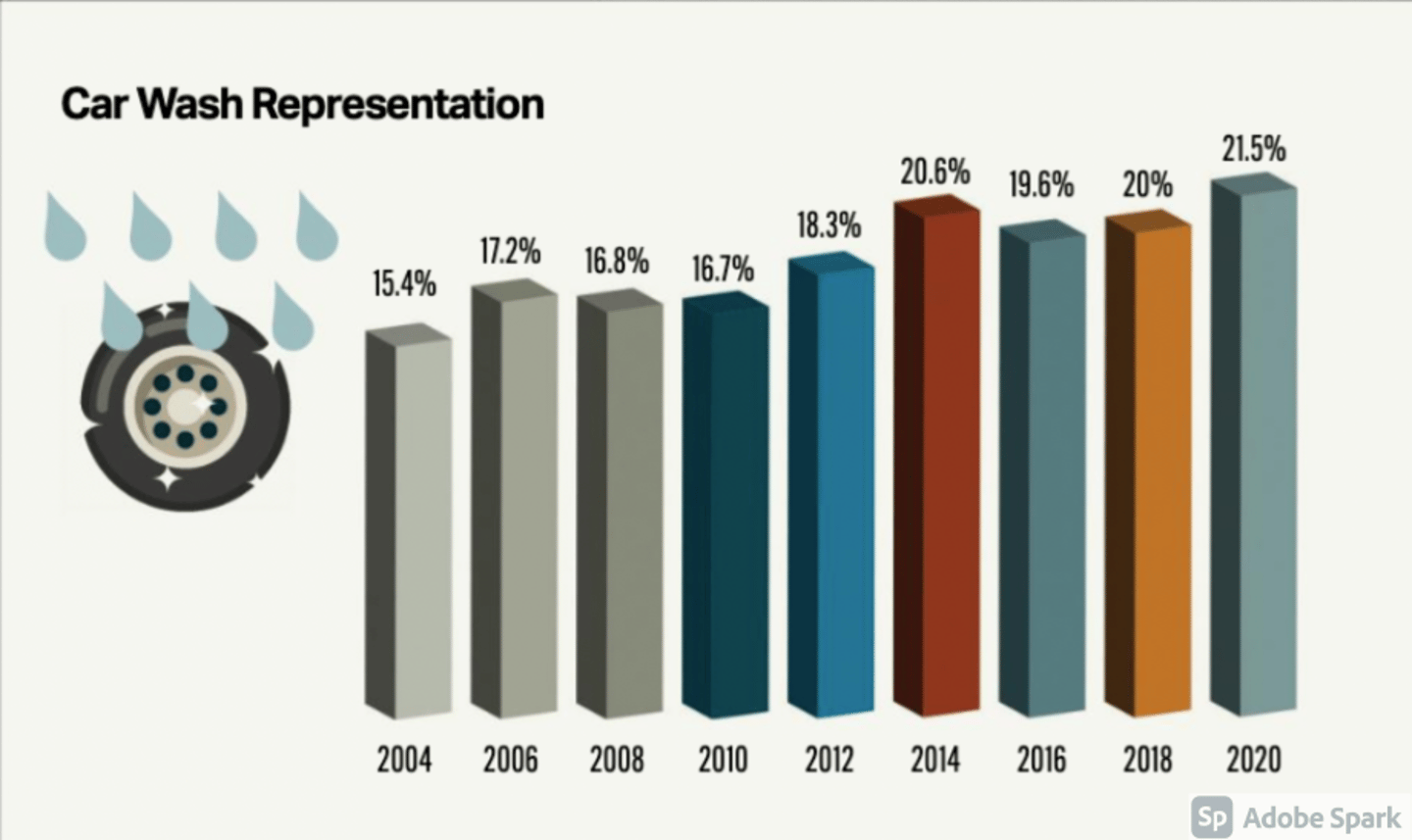

Car wash facilities are featured at 21.5% of the 10,071 gas stations that reported ancillary services. This number is up slightly (+0.5%) from 2019 for a total of 2,162 sites. The leading players in car wash, Petro Canada, Shell and Esso, increased their footprint to 14.5% of the market over last year’s 13.9%.

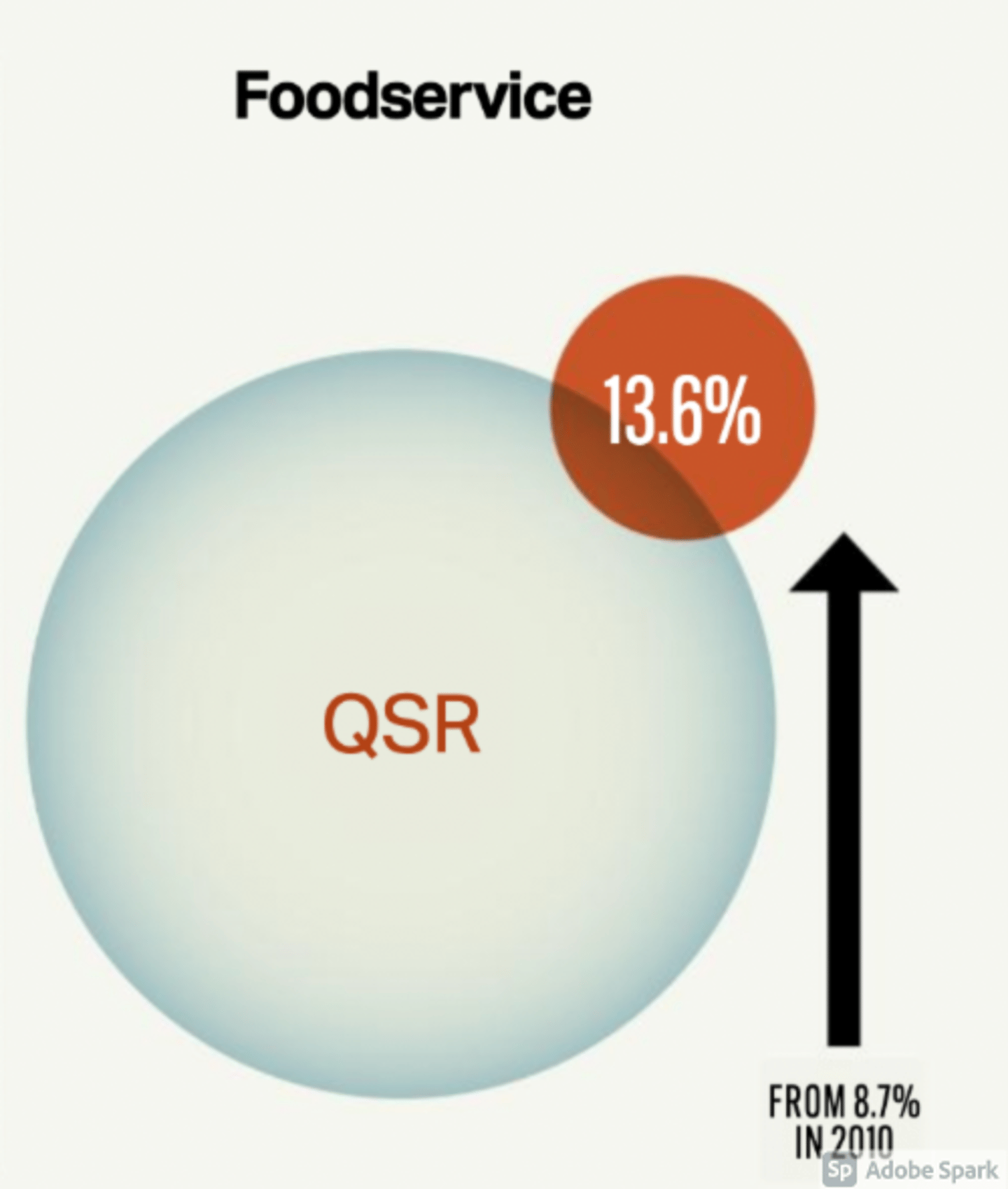

There were 1,367 QSR operations associated with the 10,071 gas station sites that reported extra services. This number spotlights a development increase of nearly double over the decade when just 8.7% of fuel sites offered branded foodservice. Today the number is 13.6%, an increase of 530 locations over the decade.

For those motorists looking to the neighbourhood gas station for a repair, things are getting more challenging. In 2020, only 7.3% of gas stations had service bays, a drop from 15% in 2004.

This report originally appeared in the July/August 2021 issue of OCTANE