2023 Forecourt Performance Report

In a world of change, retail gasoline stations are a steady presence in communities across Canada, with the number of retail sites fluctuating little in the past decade, despite an array of challenges, disruption and innovation, from a global pandemic to industry consolidation and the rise of electric vehicles.

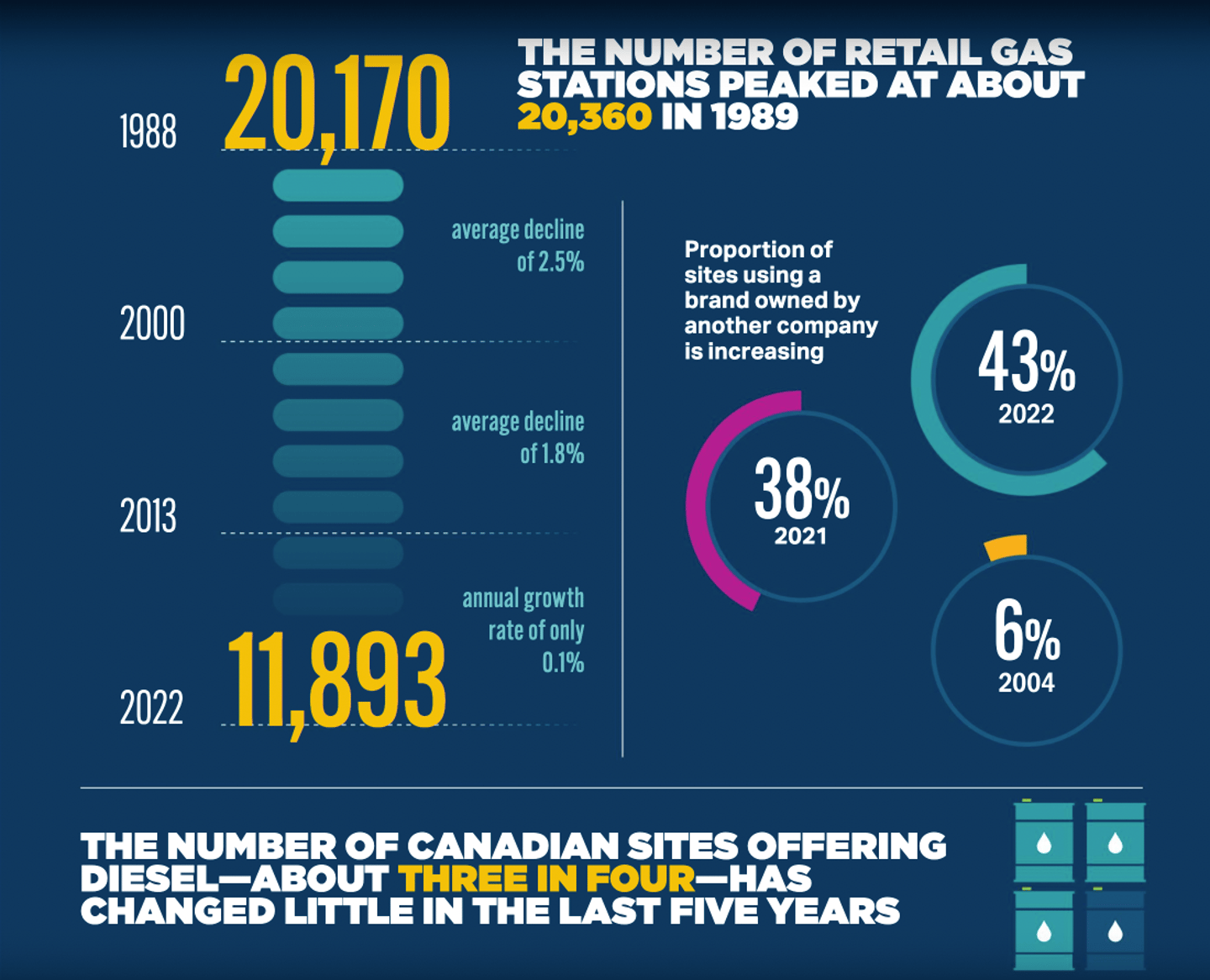

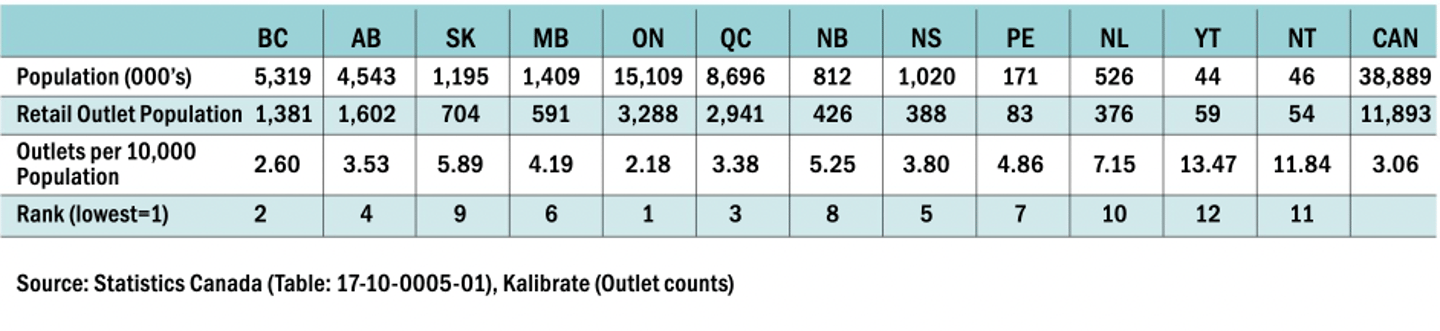

There were 11,893 retail gasoline stations operating in Canada at the end of 2022: This is a decrease of 41 sites over the previous year. Overall, the number of retail sites in Canada has changed little during the last decade, hovering near the 12,000 mark since 2008 after having contracted nearly 40% during the prior two decades.

The data comes from Kalibrate Canada’s latest National Retail Petroleum Site Census Report, the most authoritative research on the Canadian retail refuelling sector. Once again, we’re privileged to share with our readers an exclusive preview of highlights from the report, which comprises nearly 30 pages of rigorous insight.

Researched and published by Kalibrate, a leading data firm with deep roots in the sector, the report launched in 2004 and this marks nearly two decades of valuable comparable data, which provides the retail fuel industry with the information needed to understand consumer behaviour, maximize site potential and make key decisions about the future of their businesses.

Do big oil companies control the pump price at Canadian gas stations?

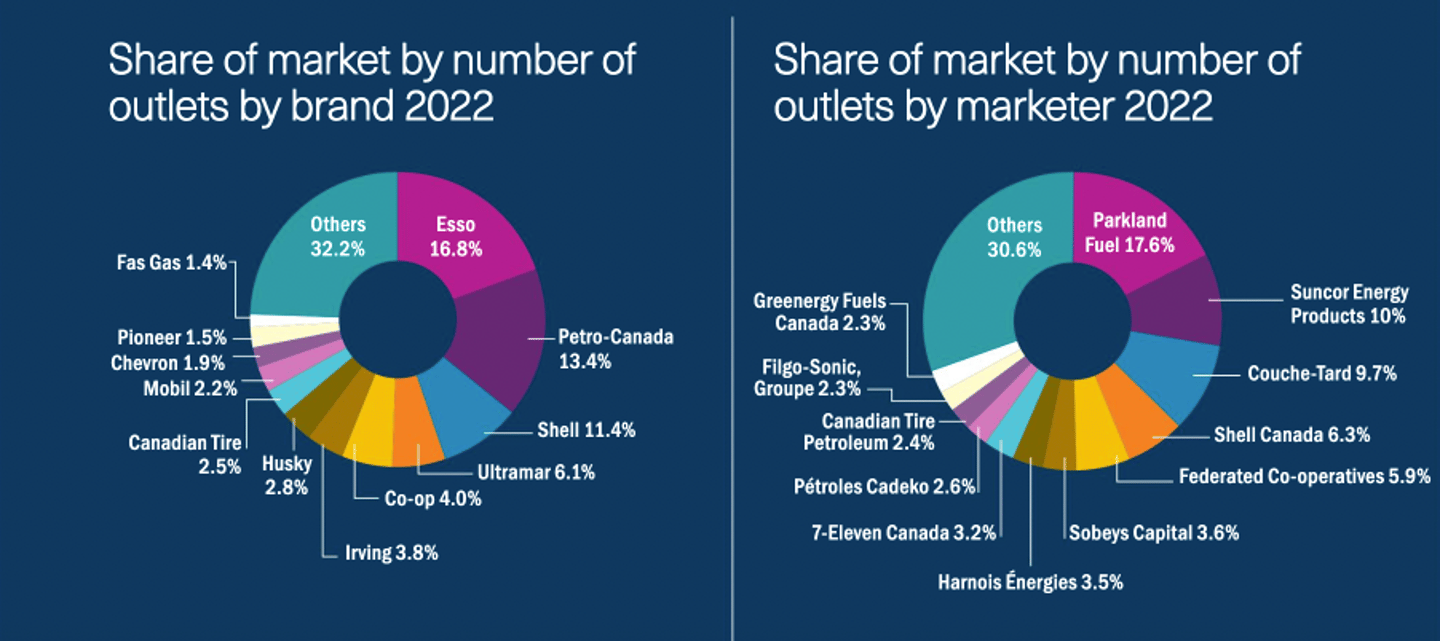

Not as much as you’d think. Refined products sold in Canada originate primarily from just 13 gasoline-producing refineries, operated by eight refining organizations, of which only five are integrated refiner marketers that sell fuel to end-users at Canadian gas stations. In 2022, integrated refiner marketers set the pump price at just 2,563 (22%) of gas stations. The majority—78%—have the pump price set by dealers or non-refiner marketers (aka independents).

Who owns what?

Not all is as it appears. A variety of companies market Canada's high-profile gasoline brands. Esso, for instance, is marketed by 11 different companies. Some Shell sites are marketed under similar arrangements. While Suncor/Petro-Canada traditionally had a smaller stake in this area, that is changing, as the Canadian Tire gasoline station network is being rebranded to Petro-Canada, while North Atlantic and Suncor recently announced a joint venture—North Sun Energy—which involves rebranding Atlantic Canada sites to Petro-Canada.

In 2022, 28 fuel marketing companies in Canada operated a portion of their network under a brand owned by another company, representing 43% of stations in Canada, up from 38% in 2021 and just 6% in 2004. According to Kalibrate: “These marketers typically operate under a branded supply agreement with the brand owner (often a refiner such as Shell or Esso) and benefit from the brand recognition, proprietary fuel additives, marketing support, and loyalty programs of the established brand.”

How is the pandemic recovery fuelling throughput?

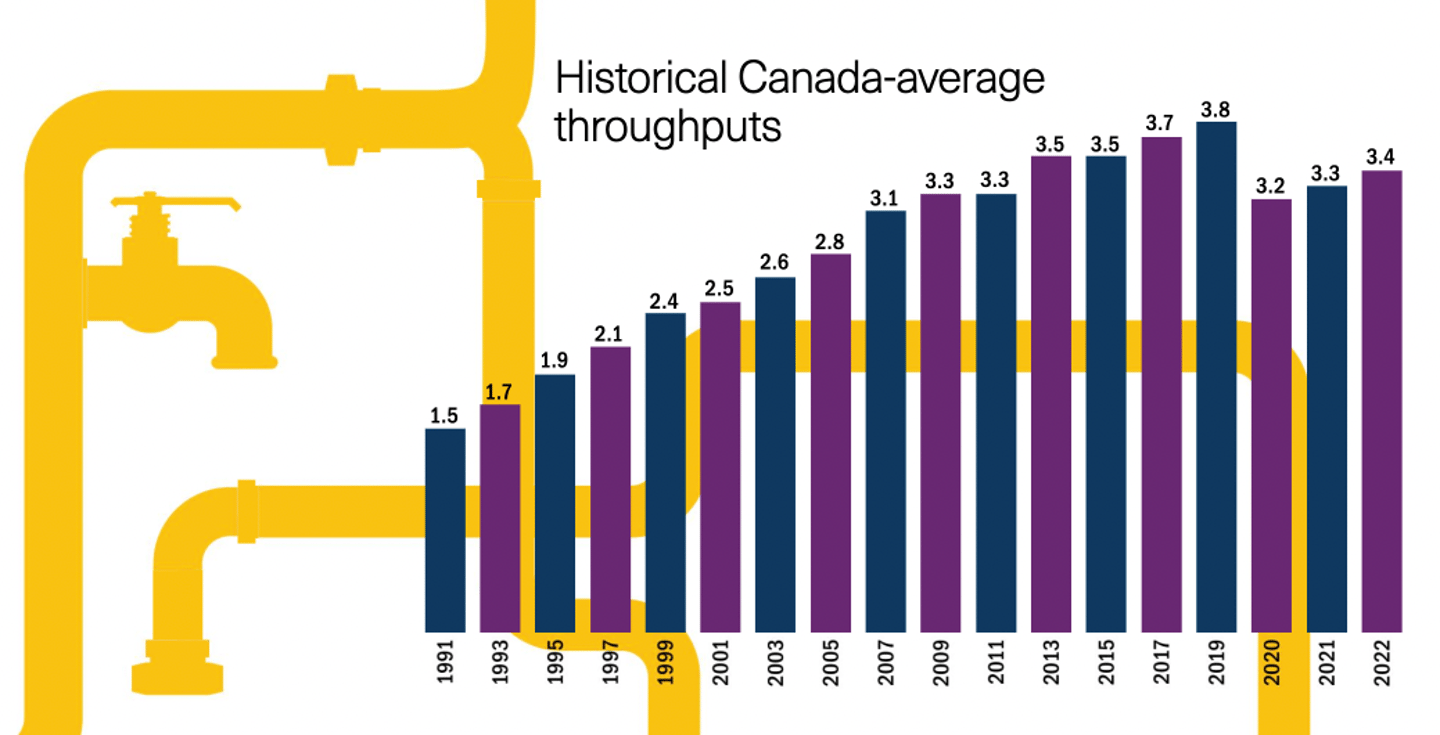

Recovery is slow and steady. The 2022 average retail outlet throughput in Canada climbed to 3.43 million litres, an increase of 3.9% from 2021 but still almost 19% below pre-pandemic levels in 2019. Since 1990 throughput efficiencies delivered an upward trend, due to a long-term rise in petroleum demand, as well as the decline in the number of retail outlets.

However, the decrease in 2020 and 2021 reflected a significant decline in transportation and travel due to pandemic-related lockdown measures. Although the 2022 average site throughput increased as lockdown measures eased, fuel sales at most gas stations remain lower than before the pandemic and that may continue: In addition to more work-from-home and hybrid work arrangements, the decline can also be attributed to Canadians embracing alternatives to petroleum, such as electric.

What role do backcourt offerings play in the bottom line?

Retail gasoline stations are now, more than ever, depending on other revenue streams to remain viable.

Data shows convenience stores and other non-petroleum (backcourt) offerings are critical to supplementing revenues generated from the core petroleum offerings.

Kalibrate obtained detailed back-court site offerings from 10,090 (85%) of the 11,893 sites across Canada and found a convenience store is associated with virtually every gasoline outlet in Canada.

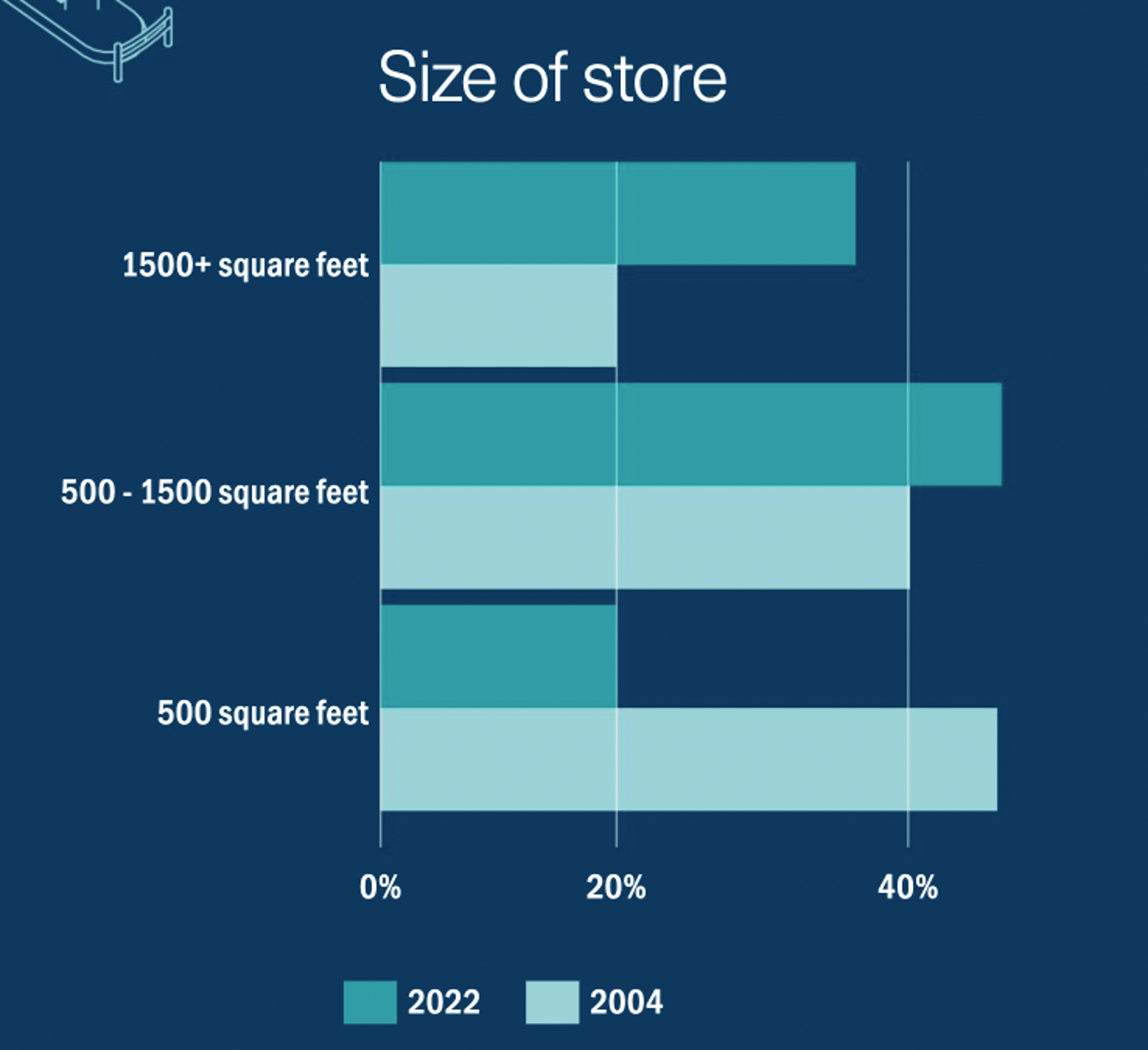

These range from small kiosks to stores of more than 2,000 sq. ft. Since 2004, there has been a shift in c-store size, with small c-stores (less than 500 sq. ft.) converting to mid- (over 500 sq. ft.) or large-sized (more than 1,500 sq. ft.) spaces. In 2004, only 55.4% of sites had a mid- to large-size convenience store, compared to 82.4% today.

According to Kalibrate: “This trend is likely a consequence of significant investments in backcourt facilities and the increased involvement of convenience retailing specialists such as Couche-Tard and 7-Eleven in the retail fuel landscape. In recent years, the mid-size c-store has surpassed the large c-store as the most common configuration at 48% of sites. It may be a result of limited site real estate space, as fuel marketers also invest in other back-court facilities such as car washes or quick-serve restaurants.”

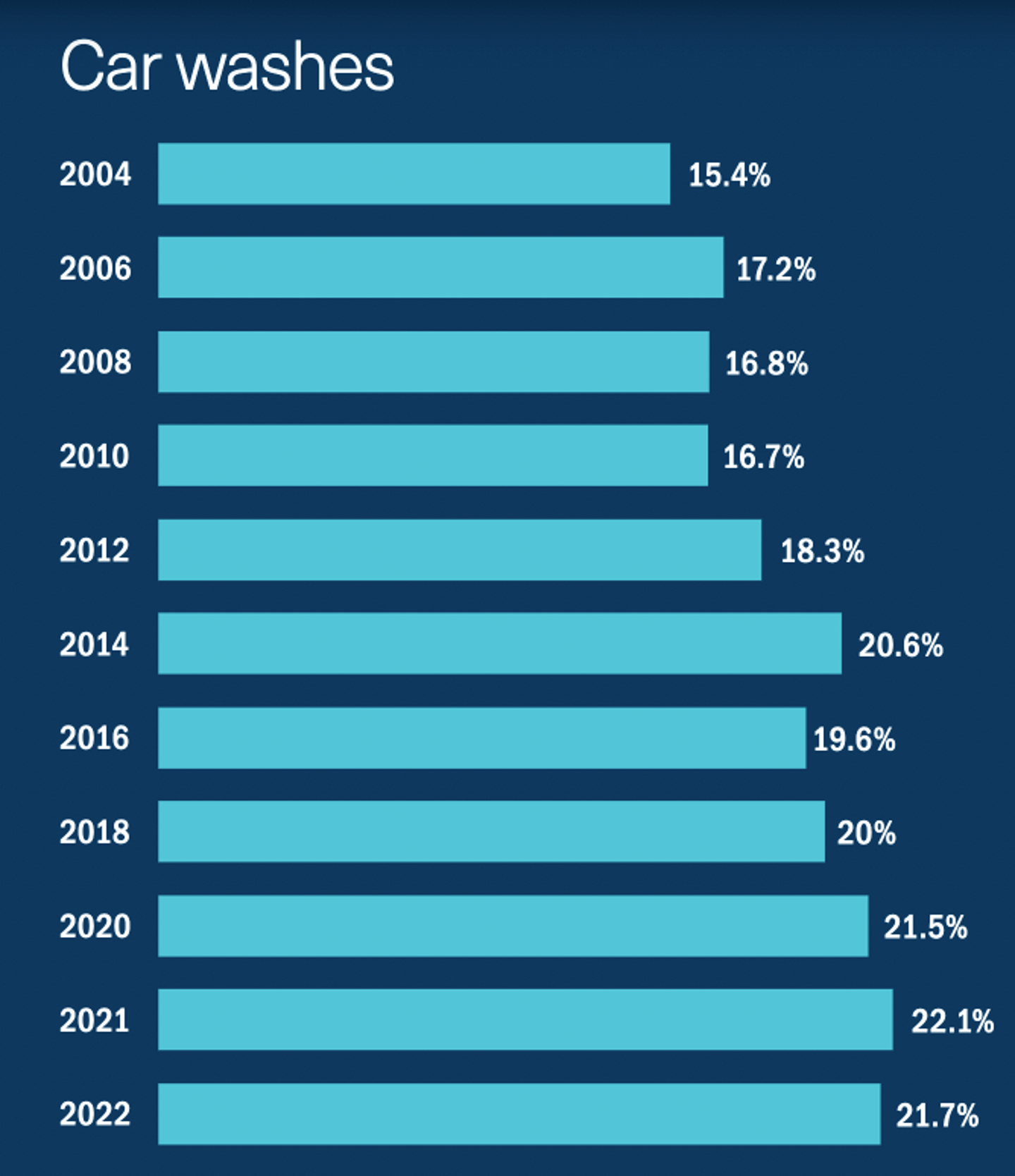

Car washes also play a key role: There are 2,373 car washes associated with the 10,090 stations reporting backcourt offerings. That’s 21.7%, down slightly from 22.1% in 2021 but way up from 15.4% in 2004. The car wash representation of the three major brands (Petro-Canada, Esso and Shell) rose to 15.5% in 2022, up from 14.6% in 2021 and 9.2% in 2004.

How important is food to the forecourt?

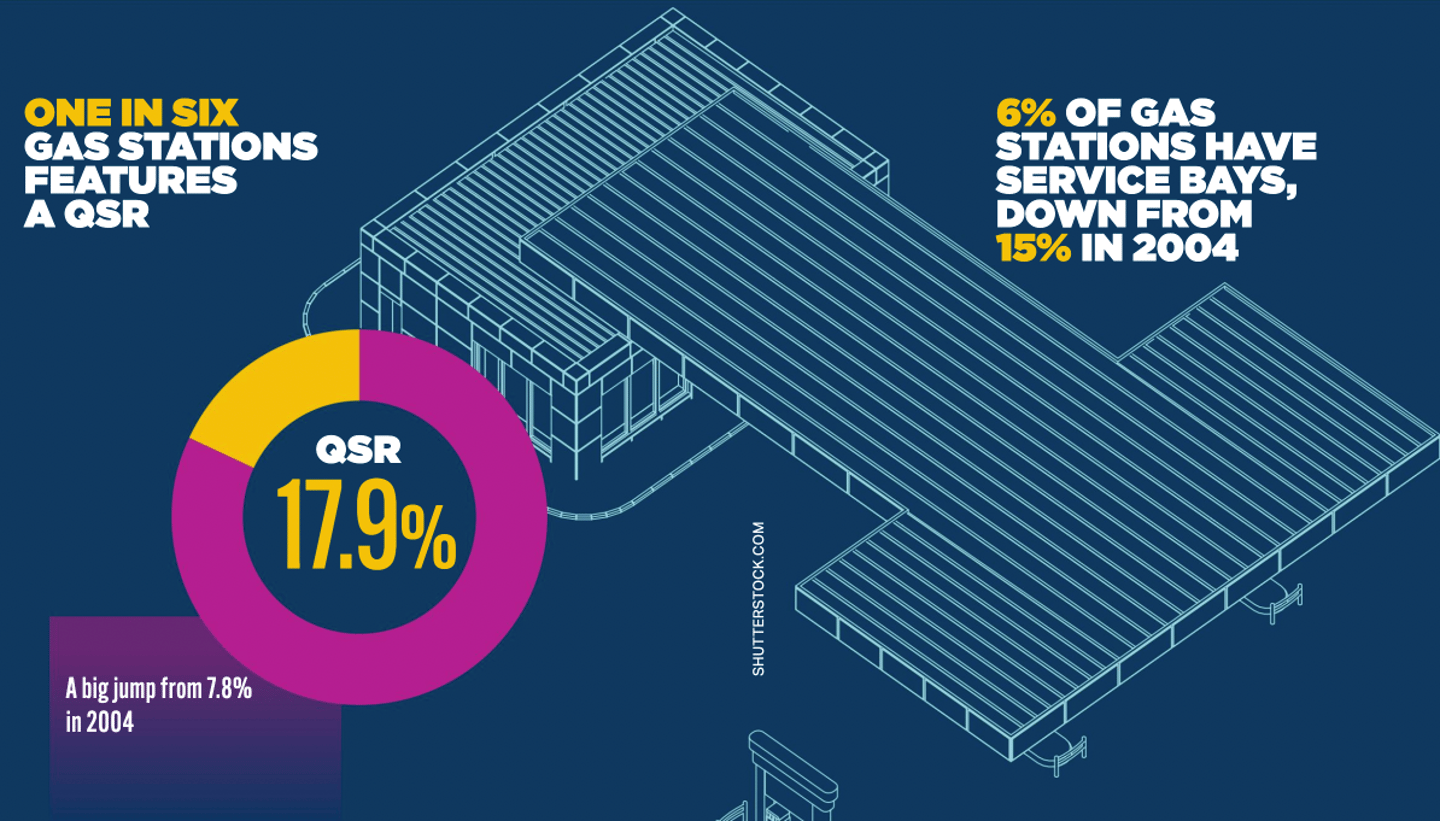

Foodservice is a rapidly growing category, with huge potential. There are 1,808 quick-serve restaurants (QSRs) associated with the 10,090 sites reporting ancillary offerings, which translates into almost 18% of sites–a significant increase from 13.3% in 2021 and 7.8% in 2004. Data shows QSRs are generally integrated into the convenience store and are typically run by third-party vendors. According to Kalibrate: “They provide increased traffic not only to the pumps but also to the store itself.”

How are electric vehicles shaping the forecourt?

Electric vehicle charging stations are now available from 22 fuel marketing companies, up from 11 in 2019 and that number continues to grow. While adding EV charging stations naturally does not add to fuel sales, according to Kalibrate: “EV or PHEV visits to gas stations may help maintain convenience stores, QSR, and car wash revenues. The adoption of electric charging stations may alter the perception of a gas station from a ‘quick stop’ to a ‘destination stop’, where consumers can enjoy amenities such as free Wi-Fi or a cafe experience while charging their vehicle.”

In an ever-changing world shaped by the evolving demands of consumers, regulators, and stakeholders, as well as global issues, the sector continues to innovate and adapt. As Kalibrate reports: “The retail gasoline industry is a vital part of the day-to-day lives of most Canadians by providing automotive fuels and related goods and services to the consumer.” Looking ahead, the forecourt is undergoing a massive transformation, embracing technology, EV, convenience and foodservice to both modify and solidify its role in the Canadian retail landscape.

The 2023 Forecourt Performance Report was originally published in the July/August 2023 issue of OCTANE.

Inquiries about the data contained in this report can be directed to Suzanne Gray at [email protected] or 226-270-8964.