C-store IQ: Forecourt Marketing Report

Technology has its advantages, but with 70% of c-gas shoppers saying they opt to regularly mobile pay at pump, it means less shoppers are going in-store to pay for gas, which also means a decrease in incremental or impulse spending.

Driving fuel customers in-store has long been a challenge (and opportunity) for the channel, but fortunately, retailers have at their disposal an array of valuable tools.

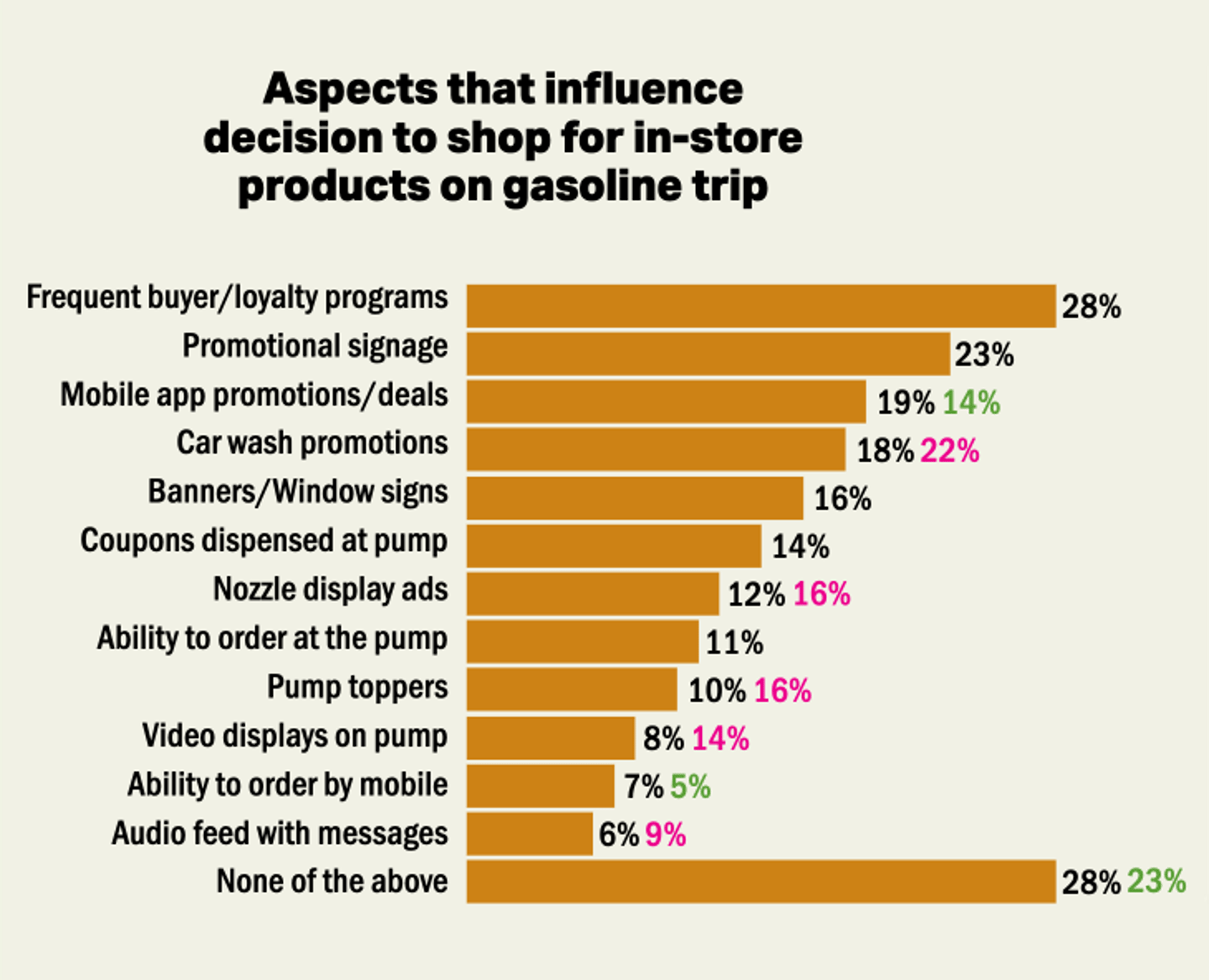

One way to influence and change shopper behaviour is via forecourt communications, from video displays to nozzle ads, audio, coupons and more.

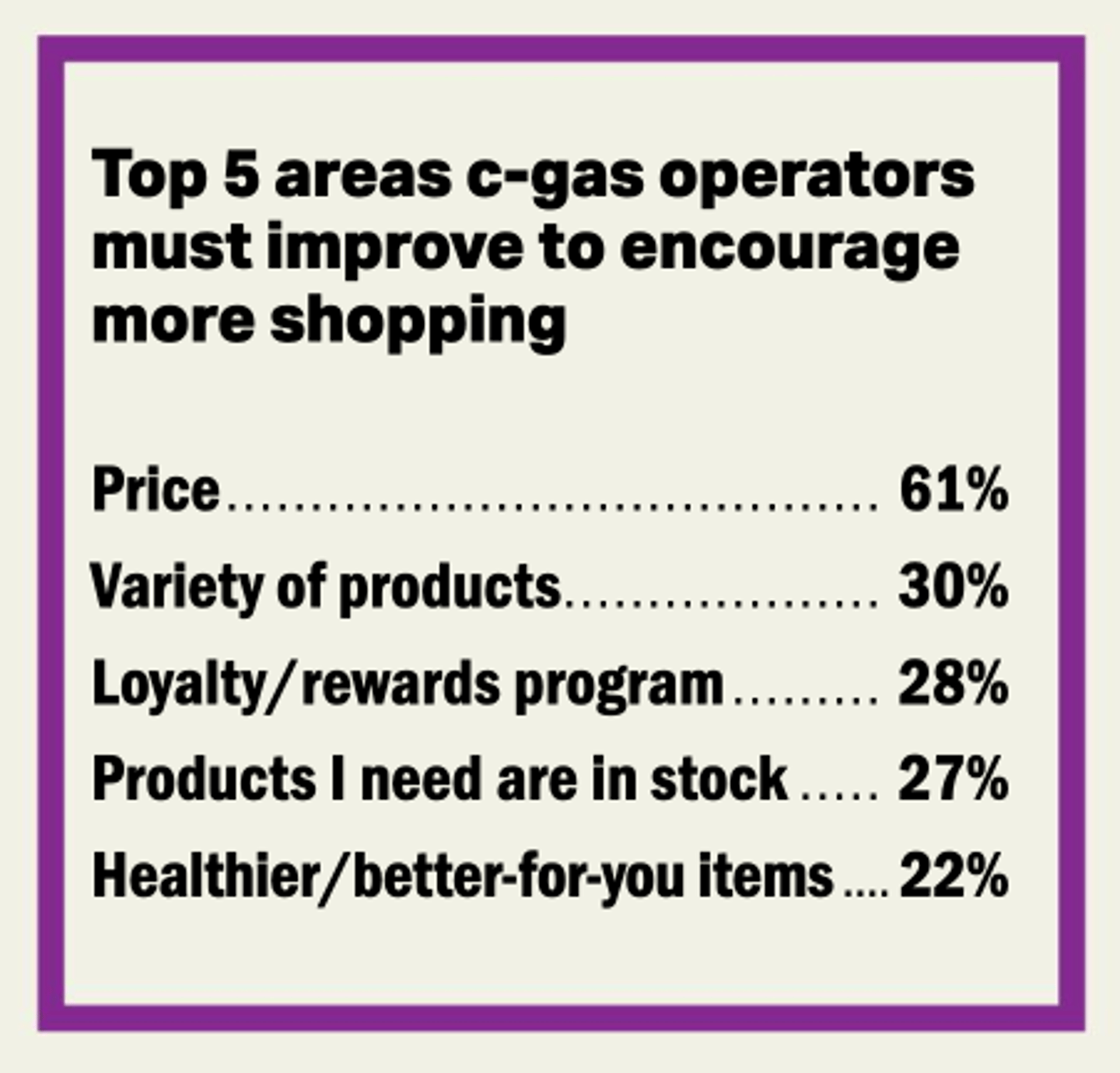

In 2024, we know that the way to c-gas shoppers’ hearts is through their wallets: 68% of shoppers say price is number one in terms of a positive shopping experience at convenience (that’s up 8 percentage points from last year), according to the 2024 C-store IQ National Shopper Study.

In addition, 45% of shoppers tell us price and value remain the most important factor when purchasing prepared foods, with economic pressures making this even more significant.

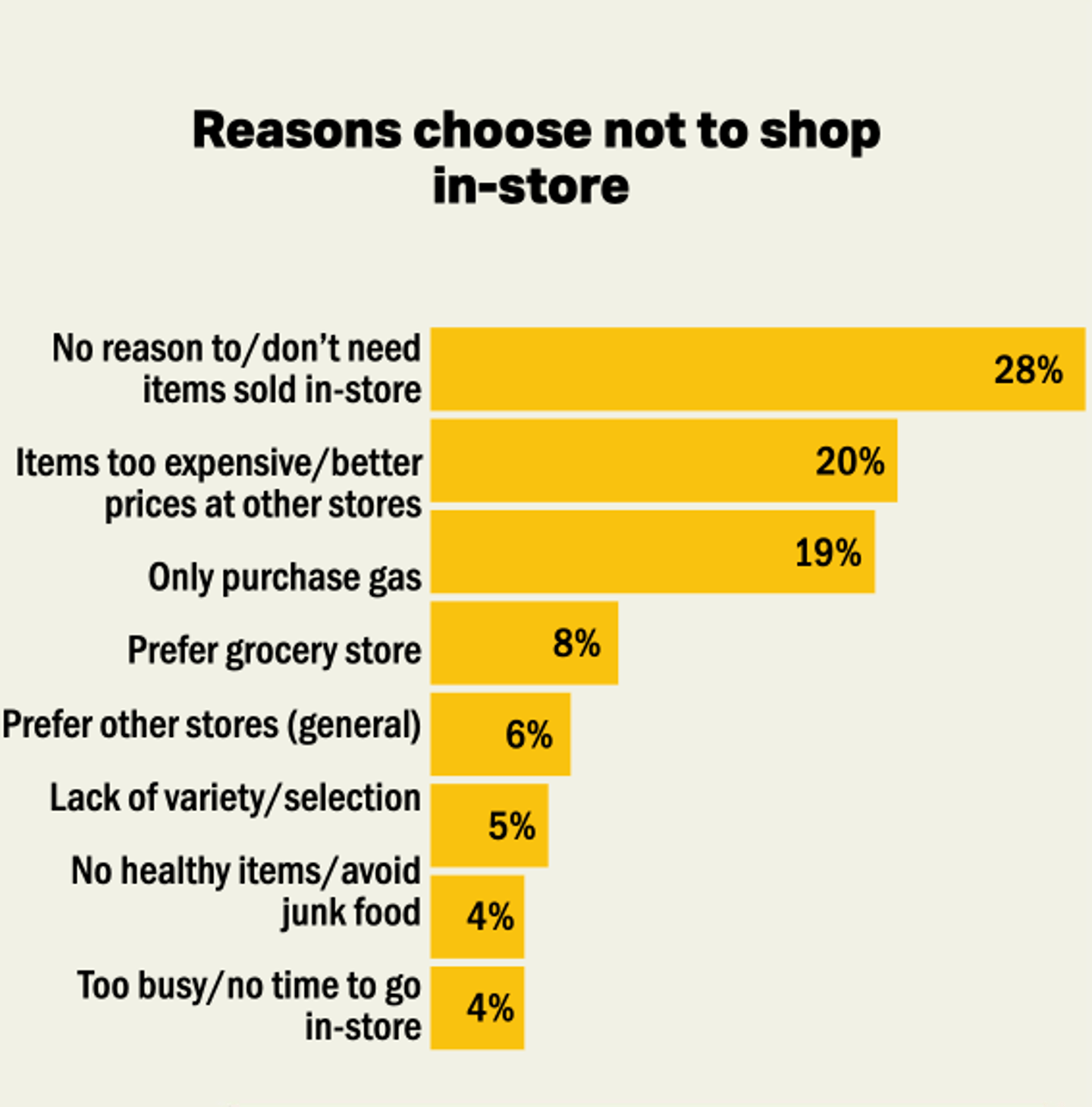

In turn, 20% of shoppers say the reason they rarely or never go in-store is because “items are too expensive/better prices at other stores.”

Using forecourt marketing to communicate value through pricing and promotions is a sure-fire bet for driving shoppers from the forecourt to the backcourt.

In addition, more than a quarter of all shoppers say they have been influenced by a loyalty program prompt to shop in-store when making a fuel stop. In fact, uptake of mobile app promotions increased significantly vs. last year.

With nearly half (46%) of shoppers visiting a c-gas operation to purchase gas, a significant increase over last year (likely due to new post-pandemic routines), incentivizing customers in-store is key for boosting the bottom line.

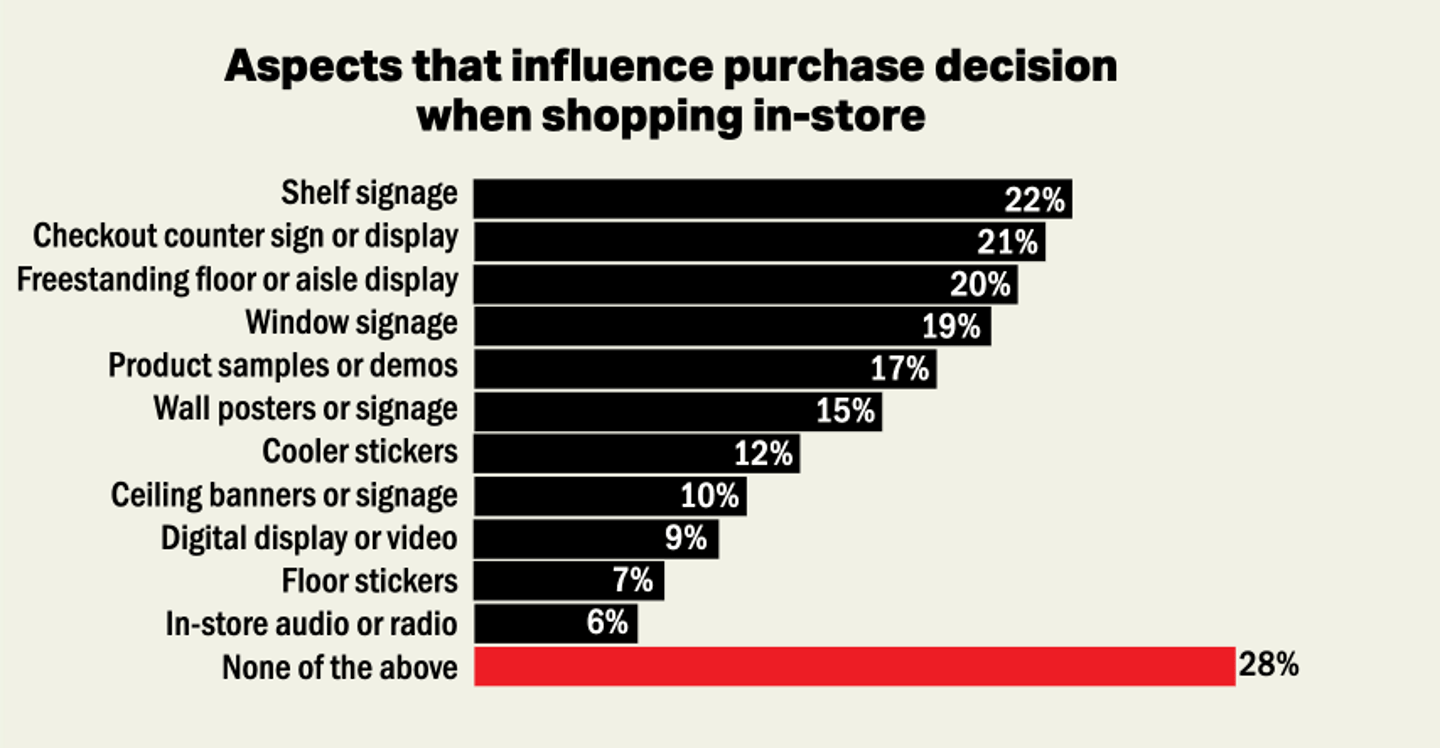

Once in-store, shoppers say that shelf signage, checkout counter signage and freestanding floor/aisle displays are the most effective at impacting purchase decisions.

Again, pricing and promotions are key to motivating value-driven customers to part with their hard-earned dollars. octane

Digging deeper into the C-store IQ data reveals younger shoppers (millennials and generation Z) are more open to and influenced by forecourt communications than older shoppers (generation X and boomers).

• Video displays on pump: 10% vs. 5%

• Nozzle display ads: 14% vs. 10%

• Audio music feed: 9% vs. 2%

• Coupons dispensed at pump: 16% vs. 11%

• Mobile app promotions 22% vs. 14%

• Ability to order at pump 13% vs. 8%

• Ability to order by mobile 11% vs. 3%

Another reason shoppers tell us they “rarely or never go in-store” is because there are “no healthy items/avoiding junk food.” Forecourt communication tools offer another opportunity to break such misconceptions and showcase better-for-you options.