C-store IQ: Gasoline Report

Price and location power gas sales

What do people consider important when they are making a gasoline buying decision? We found out in the C-store IQ National Shopper Study from Convenience Store News Canada and OCTANE. The findings offered an in-depth examination of the convenience channel and were revealing.

C-Store IQ is the first convenience and gas specific study that delves into the wants, needs, perspectives and habits of Canadian consumers. We surveyed more than 1,000 convenience shoppers across the country to bring our readers and our partners the insights and data necessary to better understand customers and achieve business success.

With average visits to gas stations running 4.67 times a month, our study found that price and location were and continue to be the two biggest drivers when it comes to gasoline purchase decisions. When it comes to preferences younger generation shoppers visit c-stores much more often and would rather visit a c-store than purchase gas from a gas-only retailer when compared to older generations. This indicates a desire to make the most of weekly gas purchase trips either to buy daily staples or a quick meal.

Millennials (6.8 X a month) report a much higher average number of gasoline ‘trips’ over a monthly period compared to Gen X (4.51 X a month) and baby boomers (3.65 X a month). And, while male to female gas purchase decisions showed an even split in c-store gas purchase decisions, more males (54%) than females (42%) were interested in buying fuel from gas-only retail sites.

We found that 47% of respondents were dedicated to gas-only sites. In turn, 34% bought fuel solely at c-store, 16% looked to warehouse clubs such as Costco and 12% looked to grocery and supermarket sites with gas for their fuel buys. Here, millennials (17%) were most likely to buy gas from a grocery/supermarket than older boomer (9%) generation shoppers.

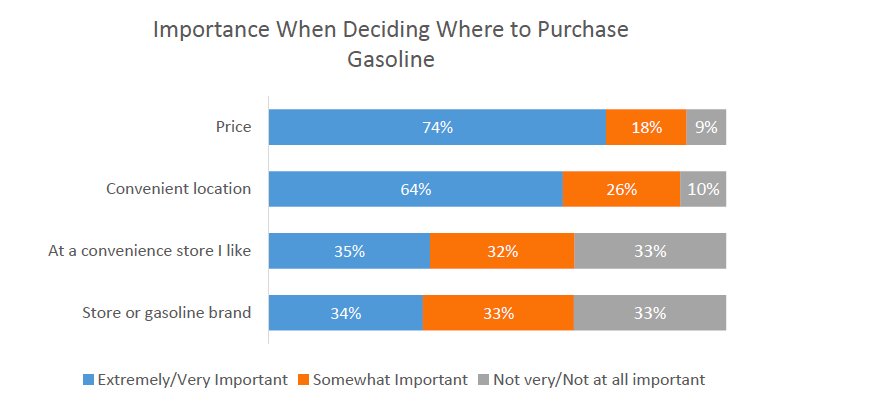

Price (74%) and location (64% ) continue to be the most important factors for shoppers when deciding where to purchase gasoline. Store appeal (34%) and store/gasoline brand (35%) were found to be much less influential. A convenient location is of higher importance to females (68%) compared to males (59%). Millennials (39%) rate store appeal as more important compared to boomers (31%).

The bottom line is that a convenient location with additional services and a competitive price is the formula for gas sale success. Convenience, service and price bring in customers. What operators do to maximize this opportunity determines the overall business viability.