Plant-based goes mainstream

Pat Brown could well be the Steve Jobs of protein alternatives.

Under Jobs, Apple's mission statement was “to make a contribution to the world by making tools for the mind that advance humankind.”

Like Jobs, Pat Brown is a man on a mission. Brown’s company, Impossible Foods, is working “to completely replace animals in the food system by 2035.”

This is worth paying attention to. The impacts of the market shift to protein alternatives are not theoretical and they will significantly affect the convenience sector in 2020 and beyond. They’re also happening in real time.

Unique data from Tastewise, a food and beverage insights and trend tracking company, confirms the explosive growth of plant-based meat. Its AI technology harnesses billions of data points from social media, recipe websites and restaurant menus, to provide an early read on consumer interests and motivations. In 2019, Beyond Meat experienced a +225% growth on menus and +95% growth in social media mentions.

What’s on the menu?

In Canada, many leading foodservice providers are adding plant-based proteins to the menu.

A&W Canada created a splash when it introduced the Beyond Meat burger in 2018, and followed with a Beyond Meat Sausage & Egger in 2019. A&W reported record same-store sales in quarters three and four in 2018, corresponding with the launch. In the second quarter of 2019, A&W same-store sales were up +10.3%, compared with +6.6% in the same quarter in 2018.

Several other QSR chains got the message and started down the plant-based path. Burger King embraced the Impossible Burger and the Impossible Sausage debuted in its Impossible Croissan’wich in January. Subway, Quesda, Mucho Burrito, and Tim Hortons all introduced Beyond Meat items to their menus (despite positive consumer response, Tim Hortons announced a pullback in September 2019, only offering its Beyond Sausage sandwiches and burgers on menus at restaurants in B.C. and Ontario).

As convenience stores embrace foodservices as a means to attract busy consumers and grow sales, plant-based proteins are key. In August of 2019, 7-Eleven Canada introduced The Beyond Sausage and Roasted Veggie Pizza in select locations. At the end of 2019, Sheetz, a large U.S. chain of restaurants and convenience stores across the mid-Atlantic, announced the introduction of Beyond Meat plant-based burgers at all 597 store locations.

With companies like Nestlé—the world’s largest food company—recently adding pea protein-based Sweet Earth sausages to its growing range of meat substitutes in an effort to secure a position in the booming market for plant-based foods, all indicators are this is the tipping point.

Size of prize

Foodservice operators are well advised to differentiate their offering to capture the expanding slice of consumers, who, for health and//or ethical reasons, are drawn to premium plant-based meat alternatives.

Data shows per capita meat consumption is declining, particularly when it comes to beef and pork. Conversely, a Dalhousie University study recently reported that vegetarians and vegans now account for nearly 10% of Canada’s population; that’s more than 2.3 million vegetarians and 850,000 vegans. People under the age of 35 are driving this trend and they are willing to spend more for food that satisfies their tastes.

According to the Ipsos Canada, strict vegan/vegetarians spent close to $500M at foodservice in 2018, with an average eater cheque of $11.01 versus the industry average of $8.75. Flexitarians (those who have a primarily vegetarian diet but occasionally eat meat or fish) though harder to quantify, could account for at least another $5B annual foodservice sales.

According to the Ipsos FIVE & Foodservice Monitor:

- Alternative proteins are growing at a faster pace at foodservice than meat proteins

- Vegan burgers are the fastest growing burger type in foodservice (up 15%)

- Protein inclusion at lunch on the rise, with alternative proteins now on par with meat proteins.

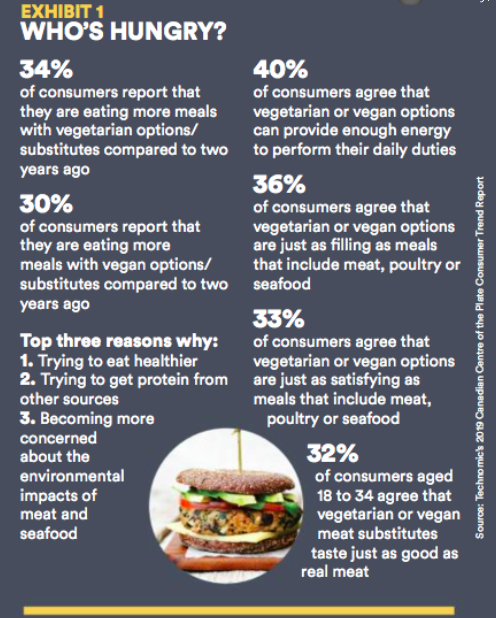

What’s behind this consumer behaviour? Technomic’s 2019 Canadian Centre of the Plate Consumer Trend Report details that consumer satisfaction with meat-alternatives is growing and objections are fading (Exhibit 1). In other words, companies like Impossible Foods and Beyond Meat are raising the bar with great-tasting beef and pork alternatives.

The outlook for chicken and seafood

Next up for disruption? Chicken and seafood.

Sunfed Chicken-Free-Chicken, a New Zealand start-up food manufacturer, claims to have developed a product with the taste and feel of poultry, as well as double the protein of chicken and triple the iron of beef. It is free of gluten, soy, cholesterol, trans fats, preservatives, diary, GMO, palm oils, antibiotics and hormones. It also features a relatively clean label—water, pea protein, rice bran oil, pea fibre, pumpkin, natural yeast extract and maize starch. Sunfed’s products are currently available through two large chain supermarkets, but a broader distribution is only a matter of time.

Swiss-based Planted makes its “chicken” with just four ingredients—pea protein, pea fibres, sunflower oil, and water. It’s founders focused on plant-based chicken because of the high and growing global demand for chicken (it’s the only meat where consumption is actually on the rise). The company was motivated to mitigate several negatives associated with real poultry, including the consumption of antibiotic resistant bacteria by those eating it and the environmental impact of greenhouse gas emissions involved in production.

Given the depletion of ocean resources generally, growing global demand for shrimp and seafood, as well as environmental and sustainability concerns associated with farmed aquaculture, plant-based seafood is a logical area of opportunity. (Canadians have a big appetite for shrimp and import about $700 million in shrimp every year, with the majority of it coming from India, Vietnam, China and Thailand.)

California-based New Wave Foods, the latest player in plant protein, is about to take a bite out of this demand with its “Shellfish, evolved” seaweed-based vegan shrimp products. Industry giant Tyson Foods, which continues its expansion into convenience stores with a variety of foodservice offerings, sees the potential here, having recently purchased a minority stake in the company.

Doing the impossible

When Steve Jobs held a press conference to introduce the iPhone in 2007, he said: “Every once in a while, a revolutionary product comes along that changes everything.”

The breakthrough for the iPhone was to make smartphones more user friendly. As Jobs explained at the time, “We’re going to use the best pointing device in the world. We’re going to use a pointing device that we’re all born with—born with ten of them. We’re going to use our fingers.”

The challenge that the new wave of plant-based protein companies are embracing is equally simple and impossibly complex—offer protein alternatives that fully replicate the experience of eating beef, pork, chicken and shrimp.

Jobs understood that user experience rules the day. Now, with protein analogues well on their way to seamlessly mimicking the taste and mouthfeel of traditional protein, we may be on the cusp of a sea-change disruption in the protein that we eat.

Is 2035 a realistic timeframe to be fully switched off animal protein? Single lens reflex digital cameras with an image sensor first hit the market in 1991: By the end of 2009, Kodak announced that it would cease selling its iconic Kodachrome color film product. To paraphrase Mark Twain, change comes slowly, at first, and then all at once.