Redefining convenience for a value-focused Canada

Despite ongoing economic uncertainty, Canadian consumers show remarkable resilience. The latest NielsenIQ Consumer Outlook shows that rising costs, persistent inflation, and shifting tariffs are influencing behaviour. Yet, instead of pulling back, shoppers are re-evaluating how and where they spend.

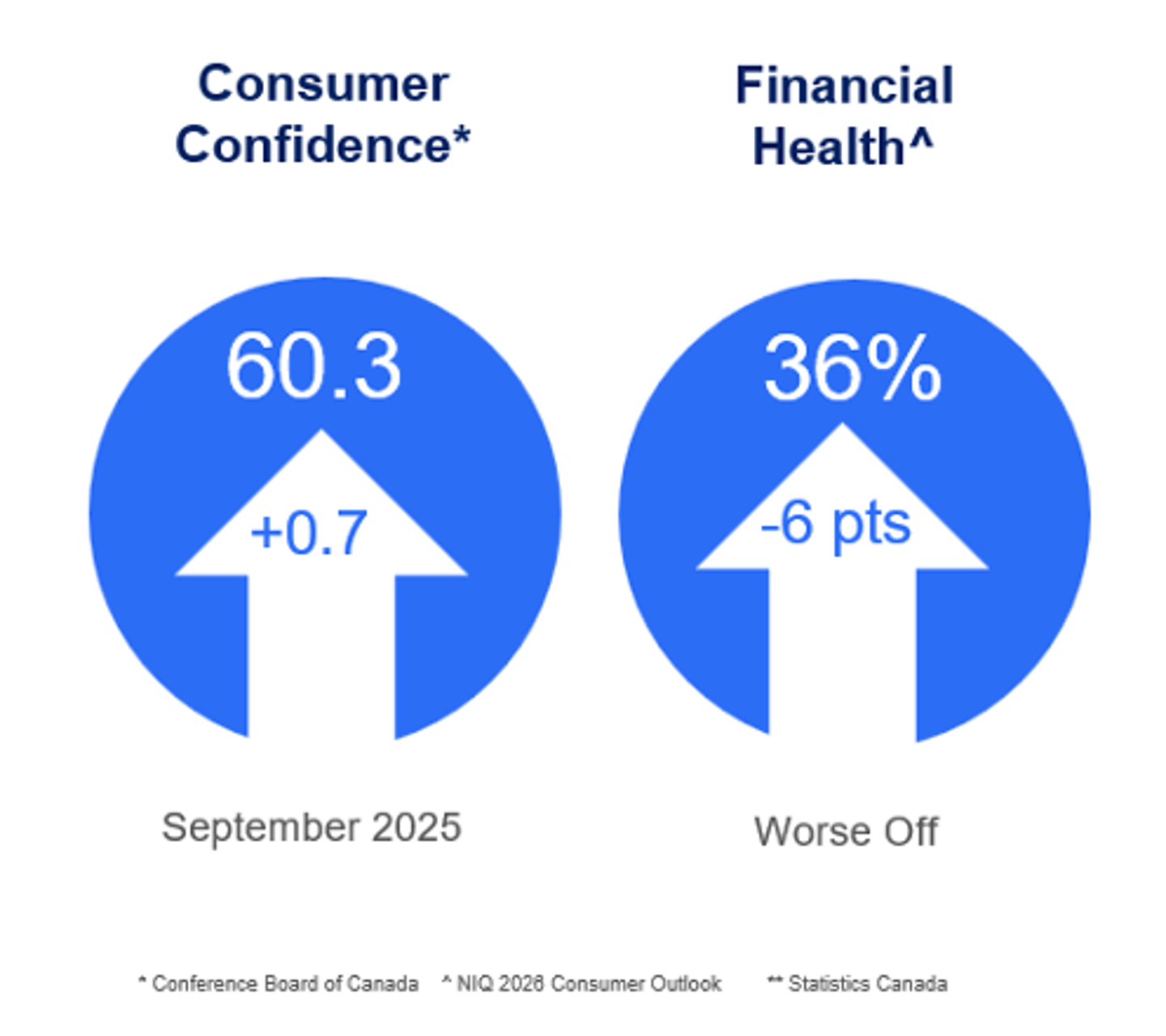

In September 2025, consumer confidence rose slightly to 60.3 points, while 36% of Canadians reported feeling financially worse off. Rather than halting spending altogether, consumers are recalibrating how and where they spend. This shift is not just about survival—it’s about strategic adaptation.

For convenience stores, these shifts reflect many of the same forces shaping the broader FMCG landscape, but with added implications for quick-trip missions and immediate consumption. The c-store channel sits at a unique intersection of need-state shopping, local availability, and real-time decision-making, making it particularly sensitive to changes in price perception and national-origin sentiment.

Rising prices fuel inflation fatigue

Inflation remains a key pressure point for Canadians. In September, prices for essentials such as meat (+6.8%), baby care (+6.3%), and dry groceries (+4.5%) continued to climb. Dramatic increases in commodities such as coffee (+33.2%) and cocoa (+22.9%) signal that elevated costs will continue into 2026, mirroring trends seen across grocery and mass retail. Because many of these commodities directly connect to top-selling c-store categories, retailers often feel pricing volatility quickly and visibly at the shelf.

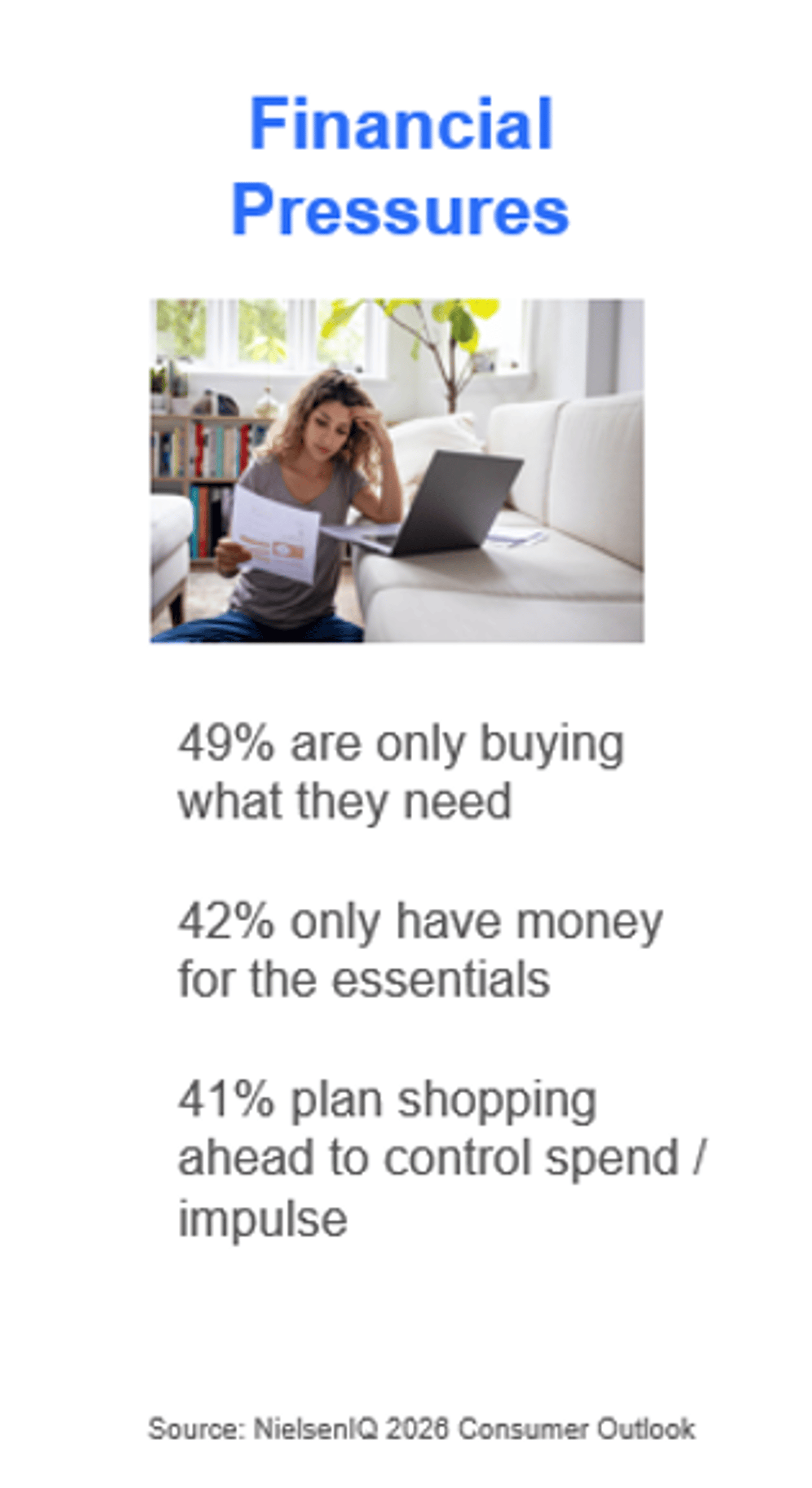

Consumers are changing their habits in response to inflation fatigue. Nearly half of Canadians (49%) now stock up when items go on sale, and 42% say their budgets only cover essentials. For a channel traditionally driven by impulse, this shift toward planned, value-oriented shopping is significant. Promotions, bundle deals, and loyalty programs are becoming increasingly important as discretionary trips soften.

C-stores that clearly communicate value across all channels are better positioned to maintain traffic in an environment where every purchase is more closely measured. Operators also report that mission-based trips—from morning coffee runs to last-minute top-ups—must now deliver a clearer value signal to keep shoppers coming back.

As value drives behaviour, buy Canadian sentiment slows

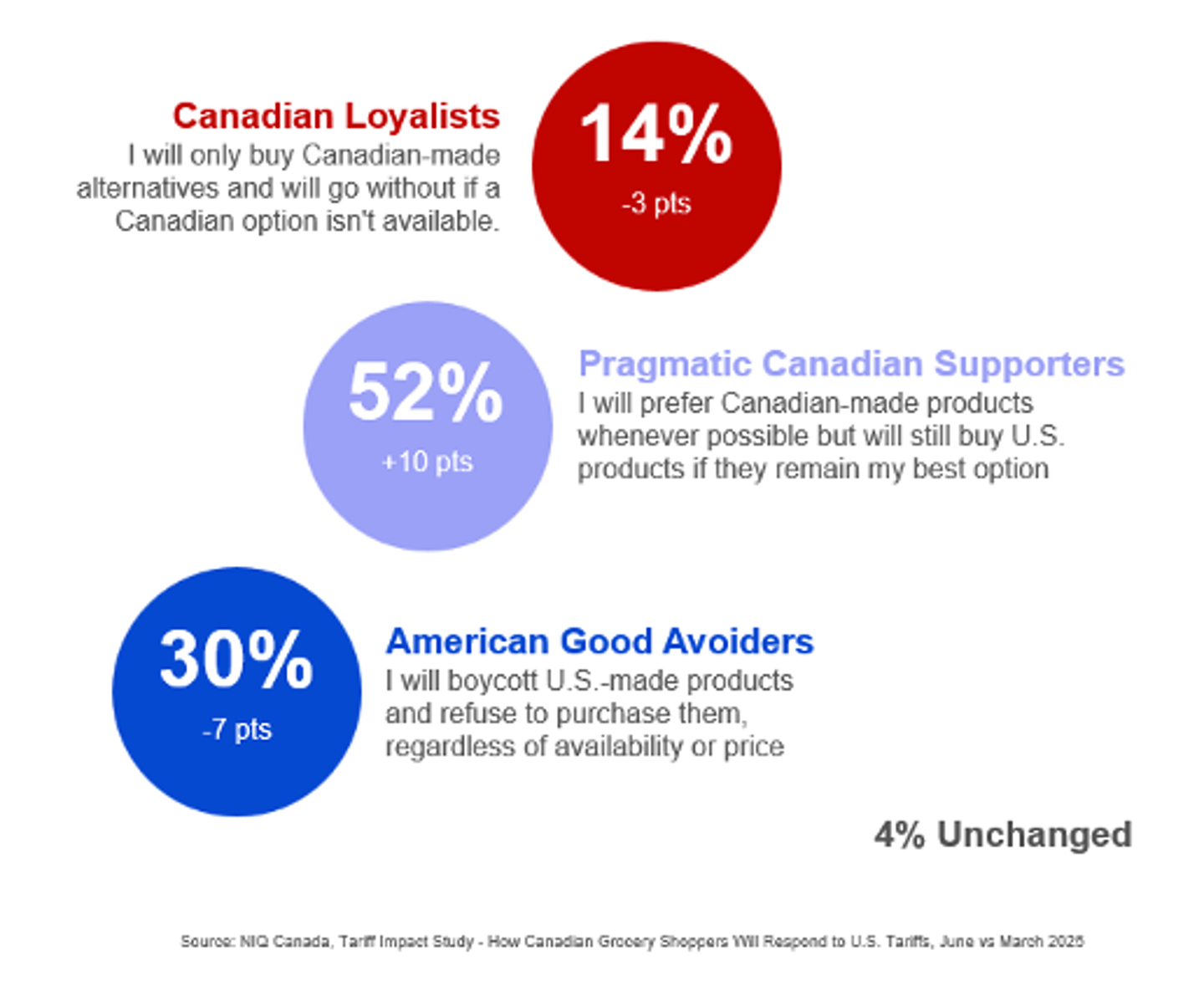

Support for homegrown products remains strong, but it is evolving. In mid-2025, 14% of Canadians identified as "Canadian Loyalists," which was down three points from earlier in the year. Thirty percent of Canadians report avoiding US brands. This sentiment has dropped by 7 points, reflecting a preference for Canadian-made goods when affordable, but not at the expense of price pressure.

Despite this moderation, Canadian-made goods continue to outperform imports. Year-to-date, domestic products are up 5.3%, while U.S. products are down 7.9%. In several impulse-driven categories commonly found in c-stores—snacks, beverages, ready-to-eat items—local manufacturers continue to win share thanks to regional relevance, product innovation, and perceived freshness.

For c-stores, where basket sizes are small and trip missions are narrow, price gaps can influence whether shoppers pick up a Canadian-made snack or opt for a lower-priced import. The decision happens in seconds, which makes signage, placement, and promotion especially important. Some operators are even testing micro-local assortments, such as spotlighting regional coffee roasters, local jerky producers, or community-based snack brands, to reinforce relevance without major assortment complexity.

Smaller brands and private label gain ground

Smaller manufacturers and private label brands continue to gain traction across the FMCG landscape. Brands ranked 101 and beyond account for 38% of absolute dollar gains and are outpacing the top 100 manufacturers in both dollar and tonnage growth.

These emerging players resonate with consumers because they go beyond price. Smaller brands emphasize authenticity, innovation, and community roots—qualities that resonate with today’s value-conscious but experience-driven shopper. This shift also reflects a broader evolution in strategy. As conventional loyalty erodes, retailers are leaning into differentiation to retain shoppers. Assortment is no longer just about breadth—it’s about relevance.

For c-store retailers, stocking select local or smaller-scale brands alongside national names allows stores to appeal to both pride and practicality. This approach also enables them to respond quickly to trends, bringing in new flavours, formats, and local partnerships without the long lead times associated with larger manufacturers.

Value of convenience expands beyond proximity

The c-store industry has long been defined by immediacy. However, today’s shoppers associate it with saved time, reduced friction, and seamless digital experiences. NIQ data shows that online FMCG sales now exceed 10% of total spend, with penetration up by five points in two years. That share is expected to reach 15% by 2030.

For c-stores, this means integrating physical and digital touchpoints. Mobile pre-ordering, targeted loyalty offers, and apps that highlight gas prices or nearby promotions strengthen the value proposition. Some retailers are even experimenting with "scan and swap" tools, aligning digital engagement with the Buy Canadian movement.

The strongest opportunity lies in aligning convenience with broader definitions of value: ease, affordability, and relevance. As more Canadians pair grocery stock-up trips with quick convenience missions, retailers that simplify decision-making will have an advantage.

A resilient channel with room to grow

Heading into 2026, the convenience sector remains well-positioned to support Canadians’ evolving shopping preferences. The path forward requires adaptation, not nostalgia. Inflation, tariffs, and shifting consumer expectations will continue to influence behaviour. Retailers that anticipate what value means to their customers — at both the shelf and basket level — will be best positioned to earn repeat visits. Next year, we expect continued focus on affordability, more deliberate c-store trip planning, and stronger interest in local products that balance price with community connection.

For c-store retailers, understanding that mindset is key to operating with agility and maintaining relevance in their daily routines. Those who can combine convenience, value, and thoughtful local assortment will be best positioned for growth in the year ahead.

Mike Ljubicic is managing director at NielsenIQ (NIQ), where he leads the company’s business operations across the Canadian market. Mike has spent his entire career in the fast-moving consumer goods (FMCG) and retail industries, beginning with early experience working in grocery stores. At NIQ, Mike is responsible for driving market execution for new initiatives and acquisitions, while aligning the Canadian business with NIQ’s broader innovation strategy across omni-panel, technology, and ecommerce. With tremendous experience across all verticals, Mike is dedicated to helping clients succeed in a rapidly evolving CPG and retail ecosystem through championing strategic initiatives, spearheading new revenue-generating opportunities, and leading successful teams.