2024 Forecourt Performance Report

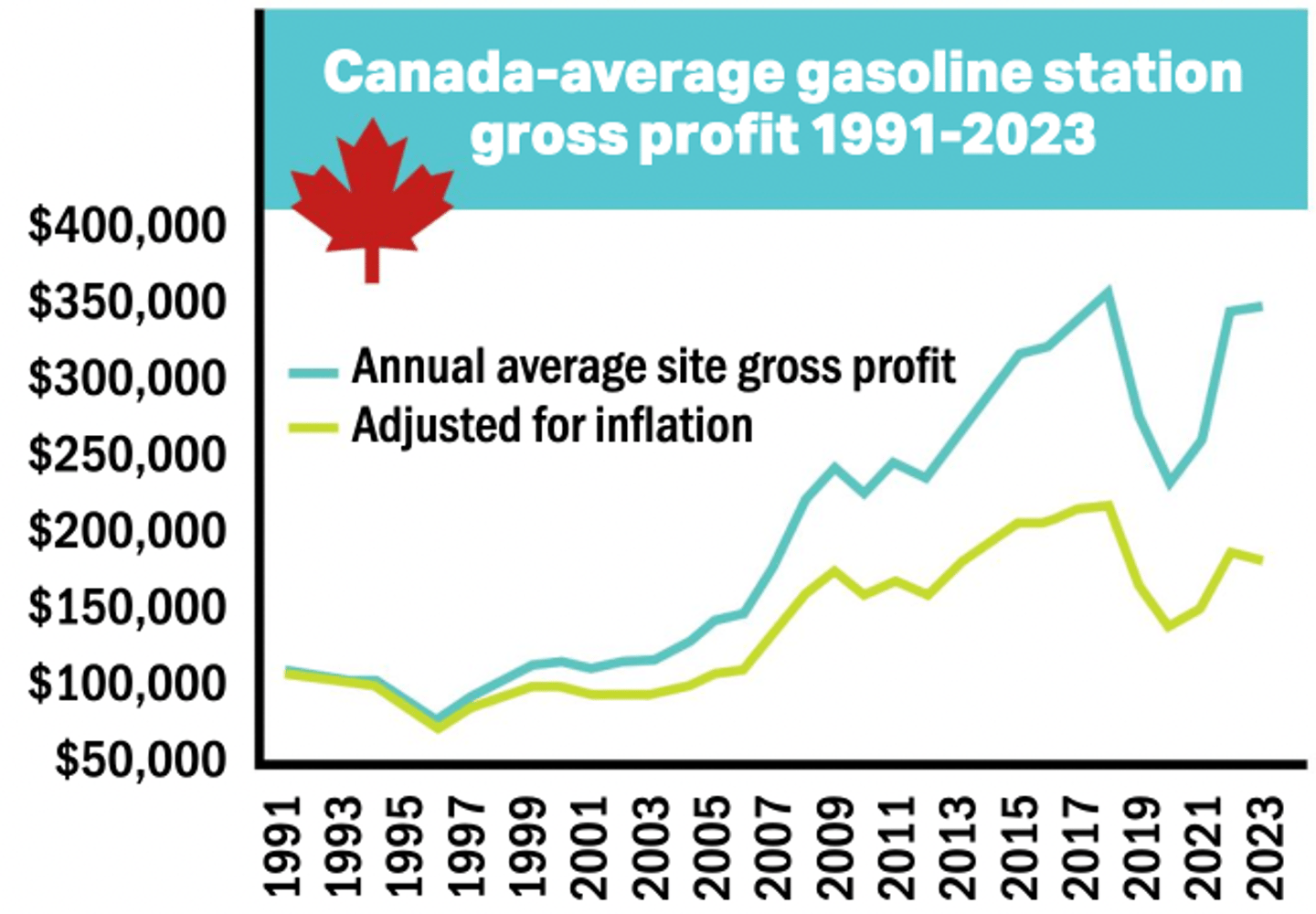

Canada’s retail gasoline station market remains remarkably resilient, even in a time of inflation, high interest rates, and a changing mobility landscape with an ever-growing number of hybrid and electric vehicles coming onto Canadian roads.

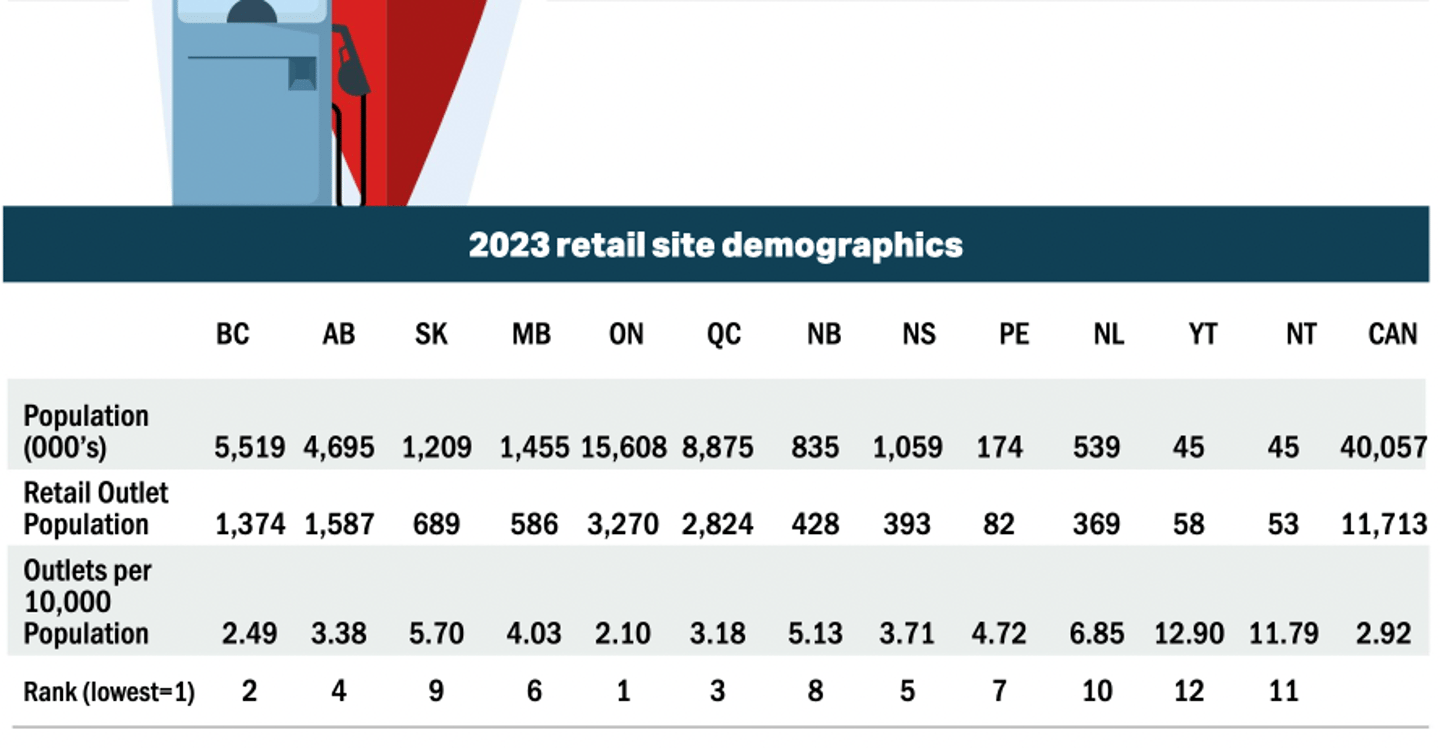

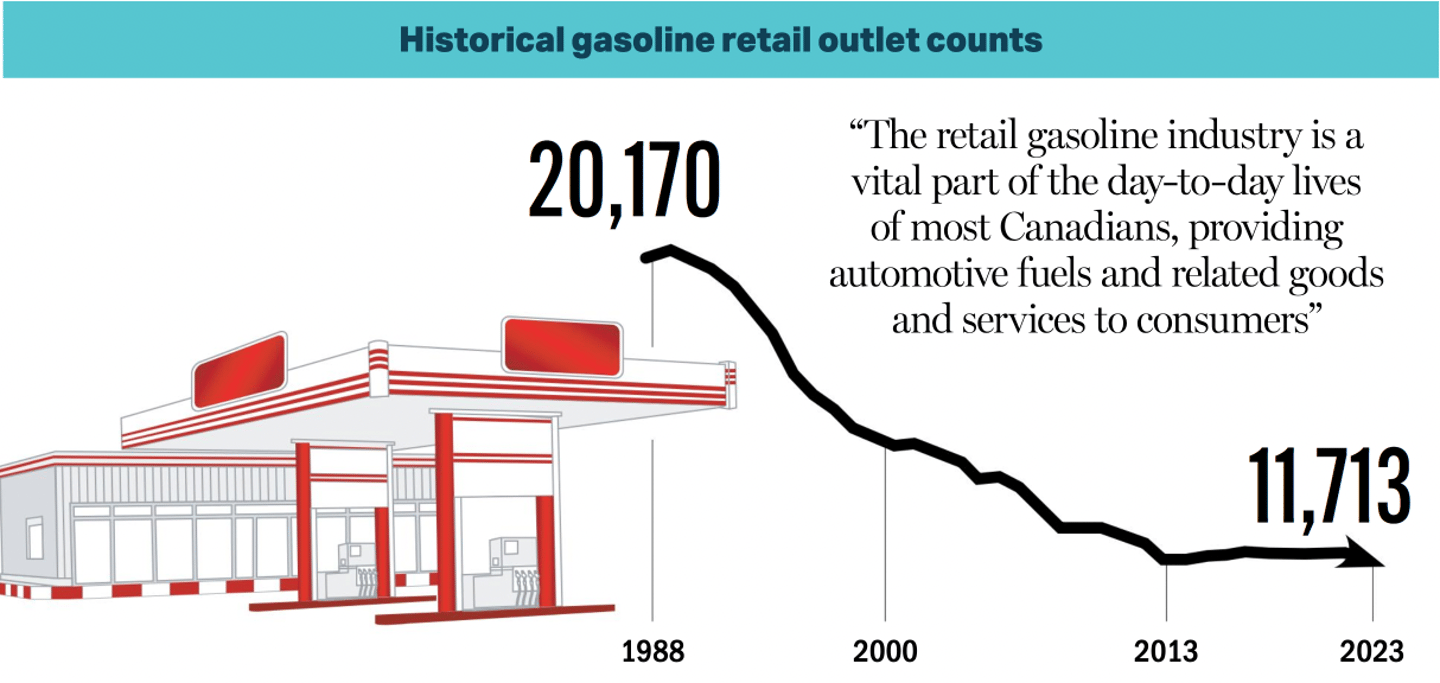

There were 11,713 retail gasoline stations across Canada at the end of December 2023, down 1.5% (180 sites) from 11,893 at the end of December 2022, according to the newest 2023 National Retail Petroleum Site Census, published by Kalibrate Canada, Inc., a leading data, analytics and consulting services firm that provides services for the retail petroleum and convenience channels.

While a marginal drop, the number of sites have remained remarkably stable, staying close to 12,000 sites since 2008.

The report launched in 2004 and this year marks two decades of valuable comparable data, which provides the retail fuel and convenience channel with the information needed to understand consumer behaviour, maximize site potential and make key decisions about the future of their businesses.

OCTANE has taken the time to look at the numbers and findings of this year’s over 30-pages in-depth study and market analysis to present several highlights to our readers.

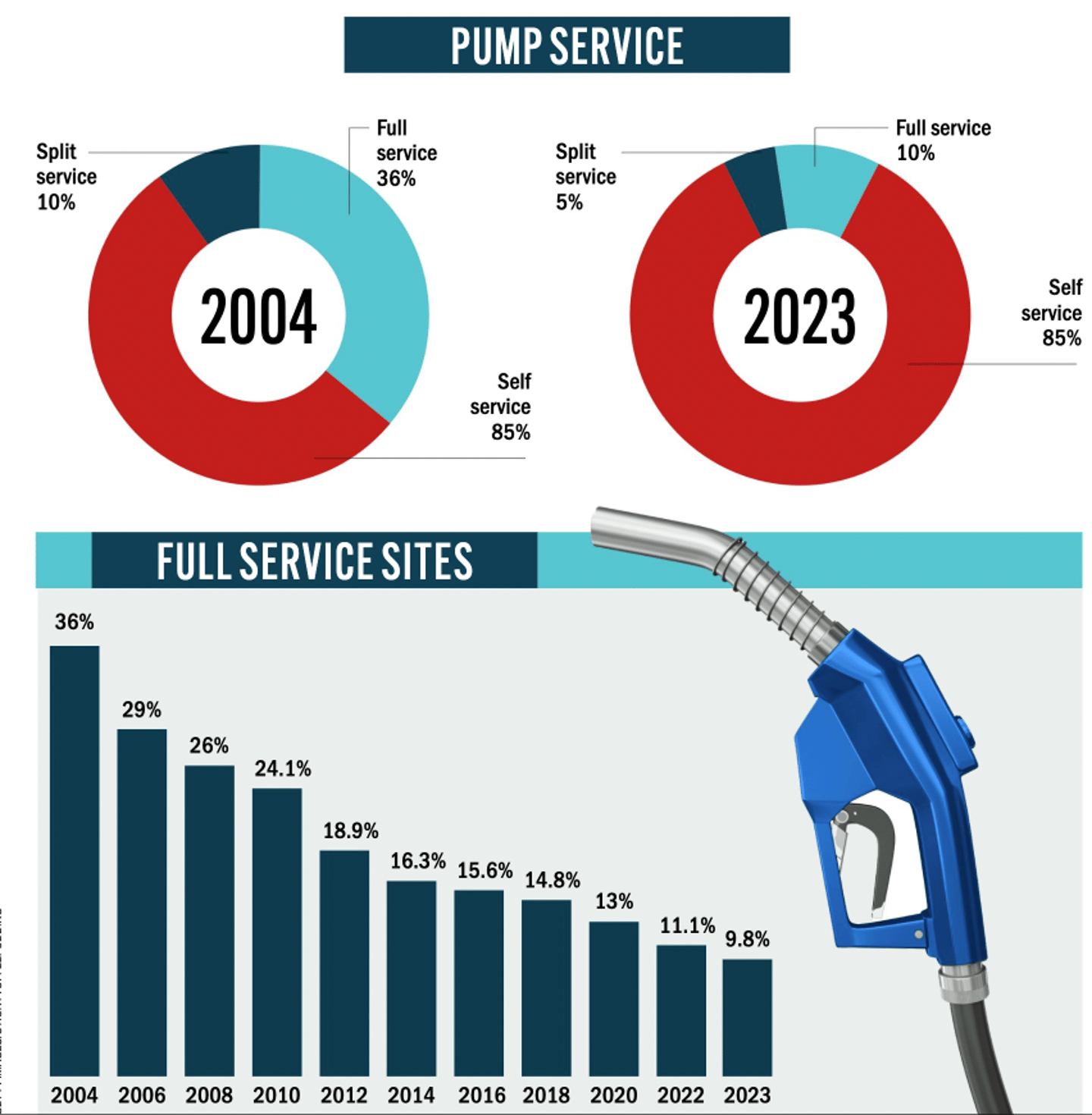

The gas station and its pumps

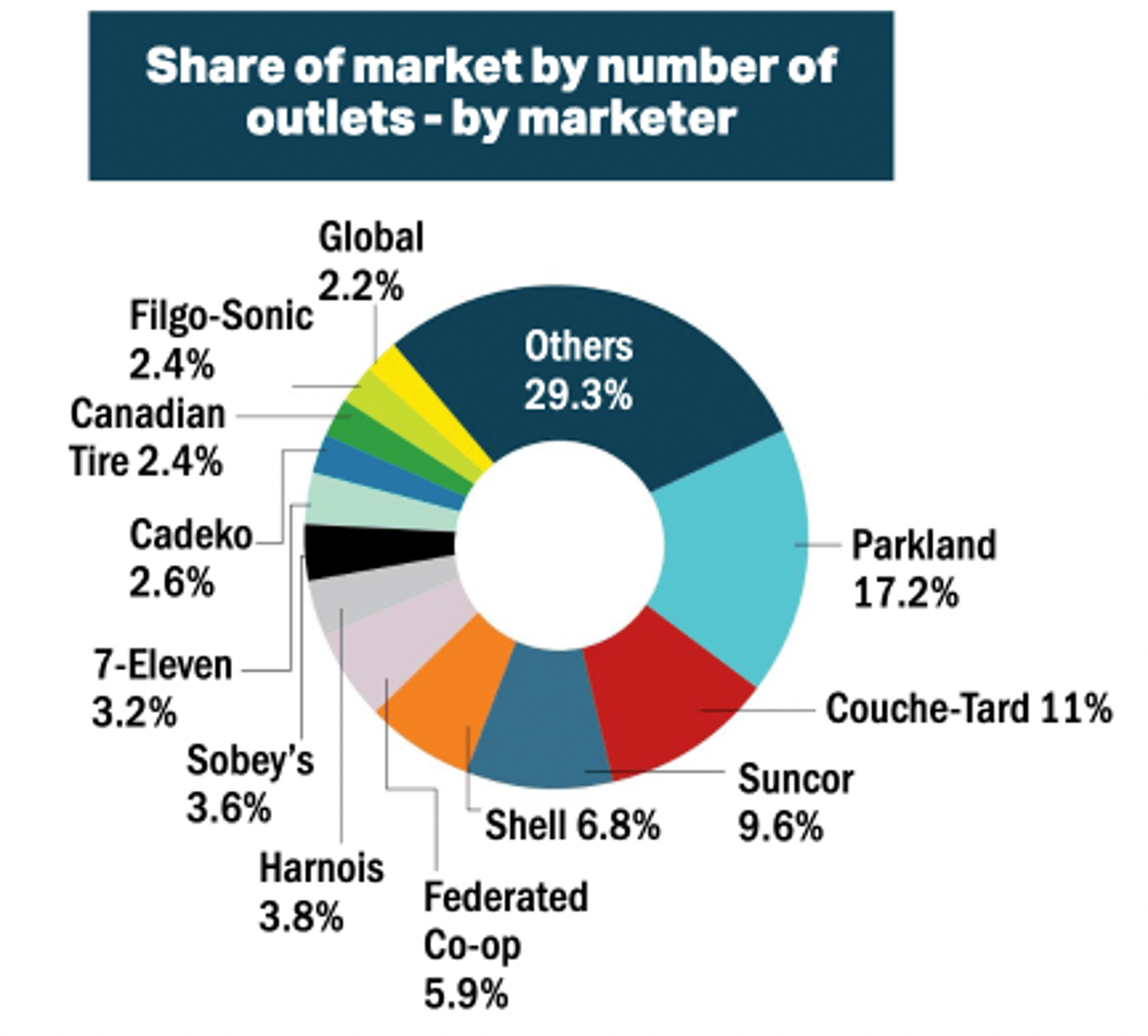

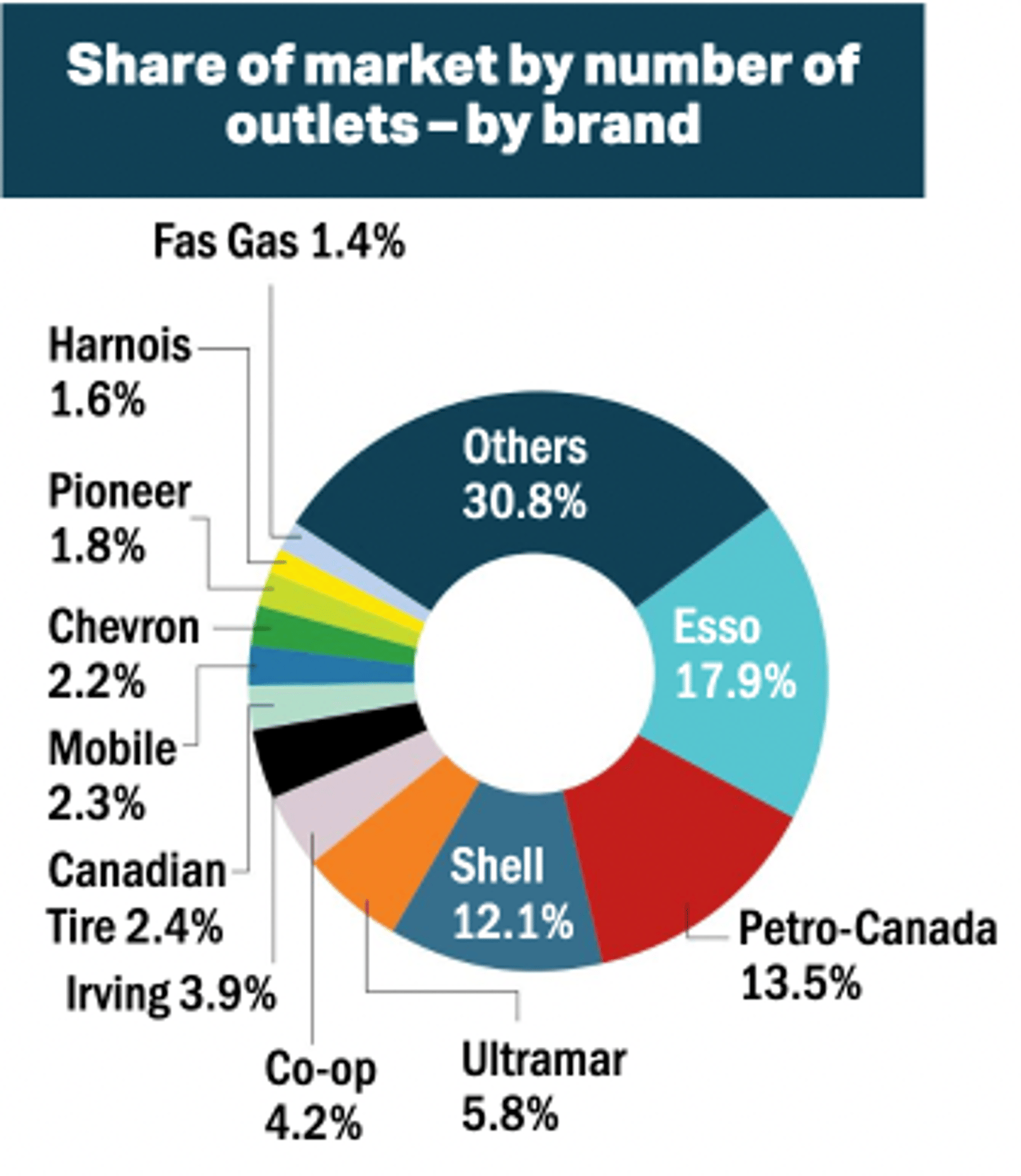

One of the most interesting findings in this year’s study is the number of distinct fuel brands operating in Canada and supplying gasoline to drivers. There are 97 fuel brands across Canada, the most common being Esso-branded gas station operations. The study finds some 2,100 sites with the Esso banner, or 18%. As well, there are some 66 companies in Canada that market gasoline, the most prominent being Parkland Fuel Corporation, having some 2,000 sites in their fuel network, or some 17% of all sites.

The top three brands in Canada are Esso, Petro-Canada and Shell, which combined have some 5,108 stations or 44 % of all sites.

“In addition, although most traditional fuel marketers use one of their own brands in their network, these marketers are increasingly using a branded supply agreement with another brand owner (often using a refiner’s brand such as Shell or Esso) to benefit from the established brand’s brand recognition, proprietary fuel additives, marketing support, and loyalty programs,” according to Kalibrate Canada. “In 2023, 42% of sites used such an arrangement, up from 6% in 2004, our first survey year.”

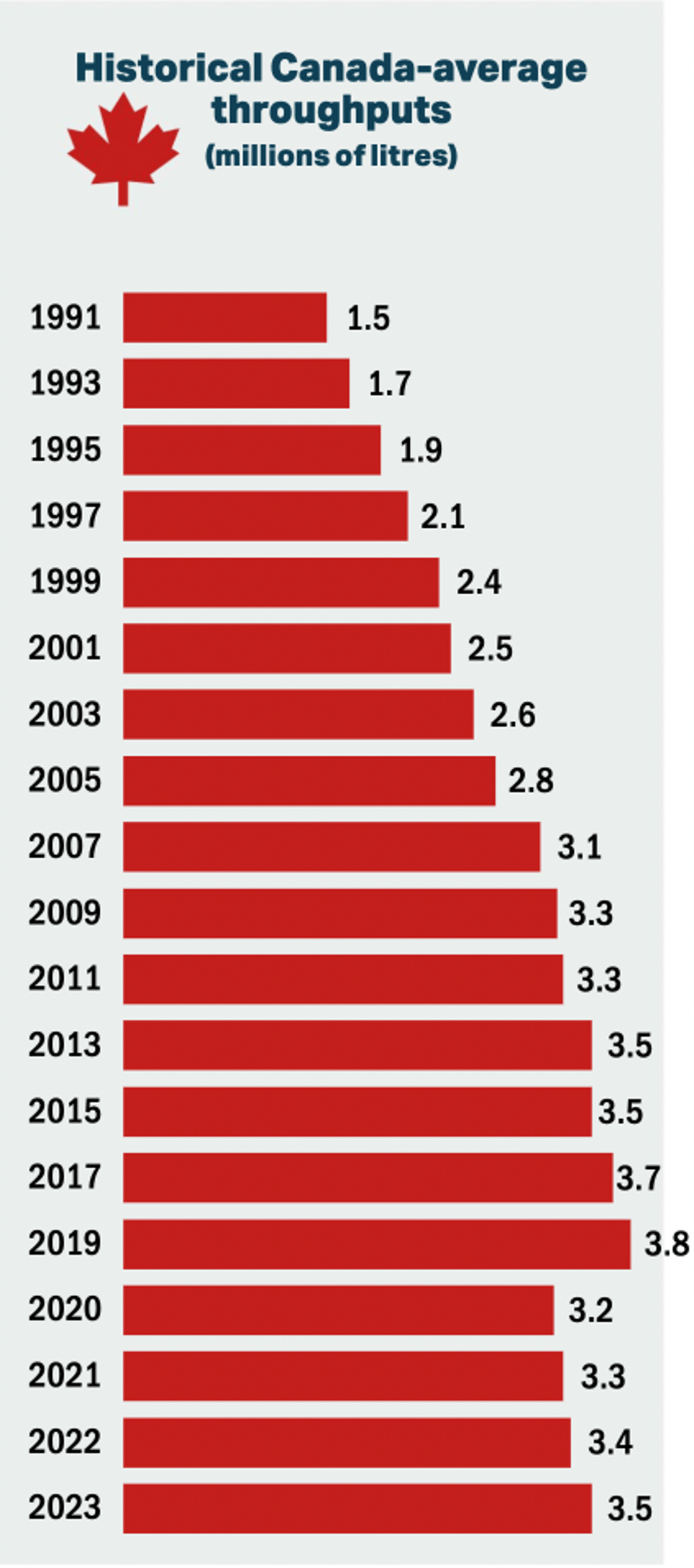

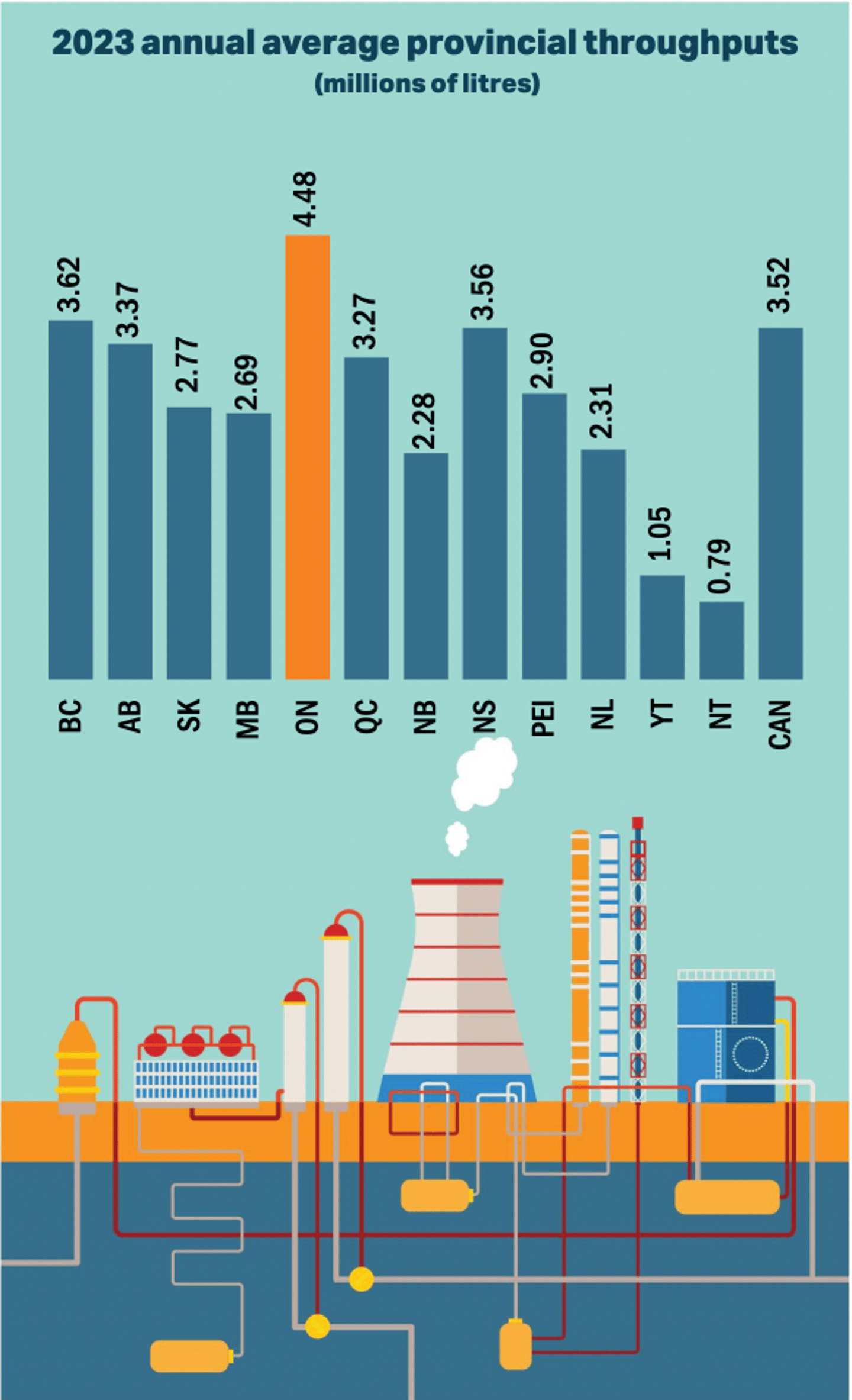

One interesting finding is that the average fuel volumes at the sites, while having improved from last year, remains below the peak throughputs recorded in 2019.

“After steadily climbing since tracking in the early 1990s, the average site throughput declined significantly in 2020 due to pandemic-related travel restrictions,” according to the study. “Increased vehicle fuel efficiency, work-from-home habits, and electric vehicle penetration may limit future growth of average site throughputs, further emphasizing the use of ancillary offerings, loyalty programs, and competitive fuel pricing to increase profitability at Canadian gasoline stations.”

The rise of the convenience store

This is where the convenience side of the equation comes into play. While retail gas operations make money from the sale of gasoline, the gross margin on the gasoline is not enough to cover the costs of operating a retail gas operation. So, c-stores are a way to tap into additional sales and boost profits from Canadians using the pumps.

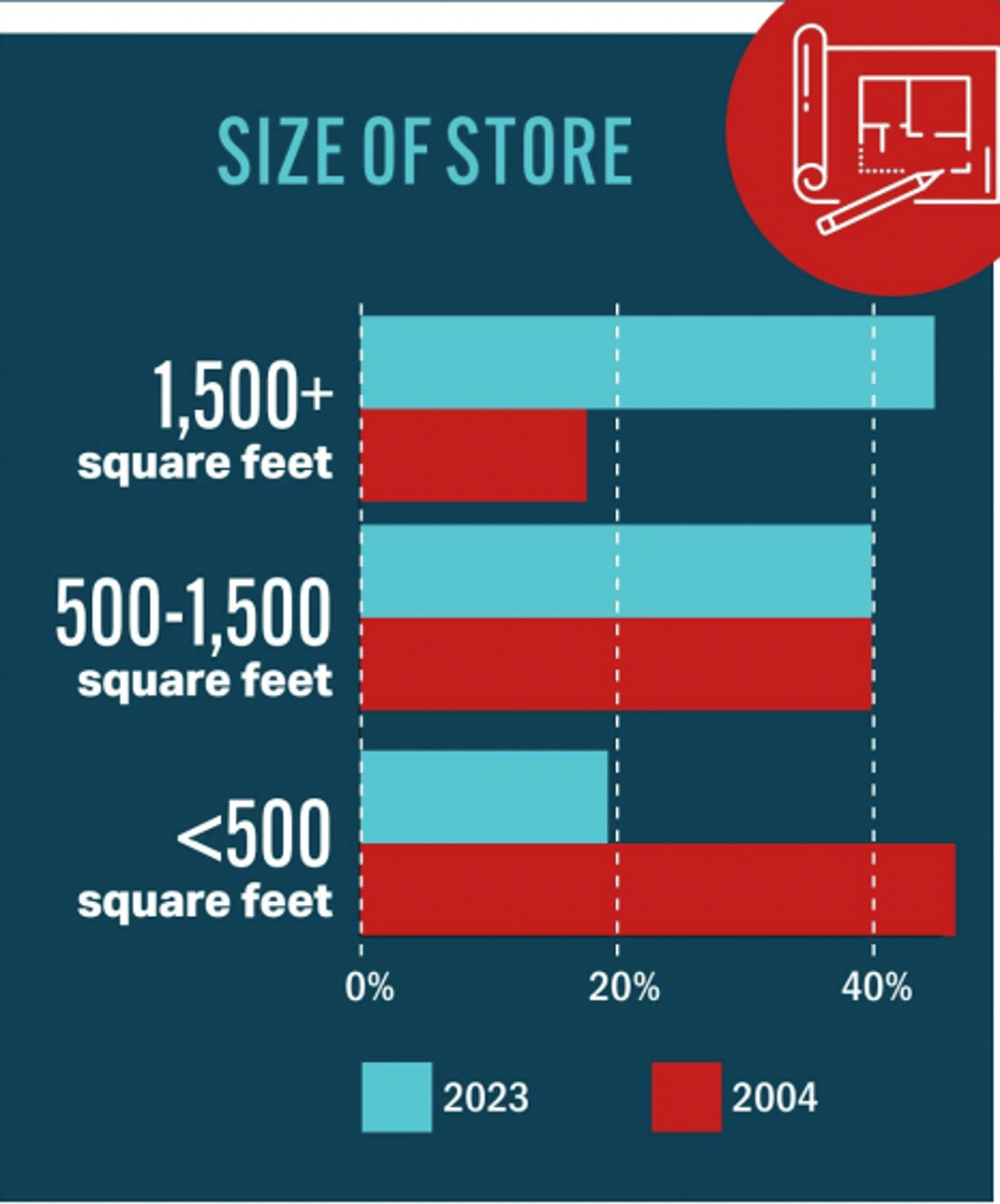

According to Kalibrate Canada’s research, 82% of Canadian retail gas operations had a convenience store as part of their business, with that store being over 500 sq.-ft. and the most common being 1,500 sq.-ft.

“This marks a significant shift from 2004, our first survey year, when 45% of sites had a convenience smaller than 500 sq.-ft. Fuel retailers increasingly depend on foot traffic from convenience stores to drive fuel sales.”

Ancillary offerings boost sales

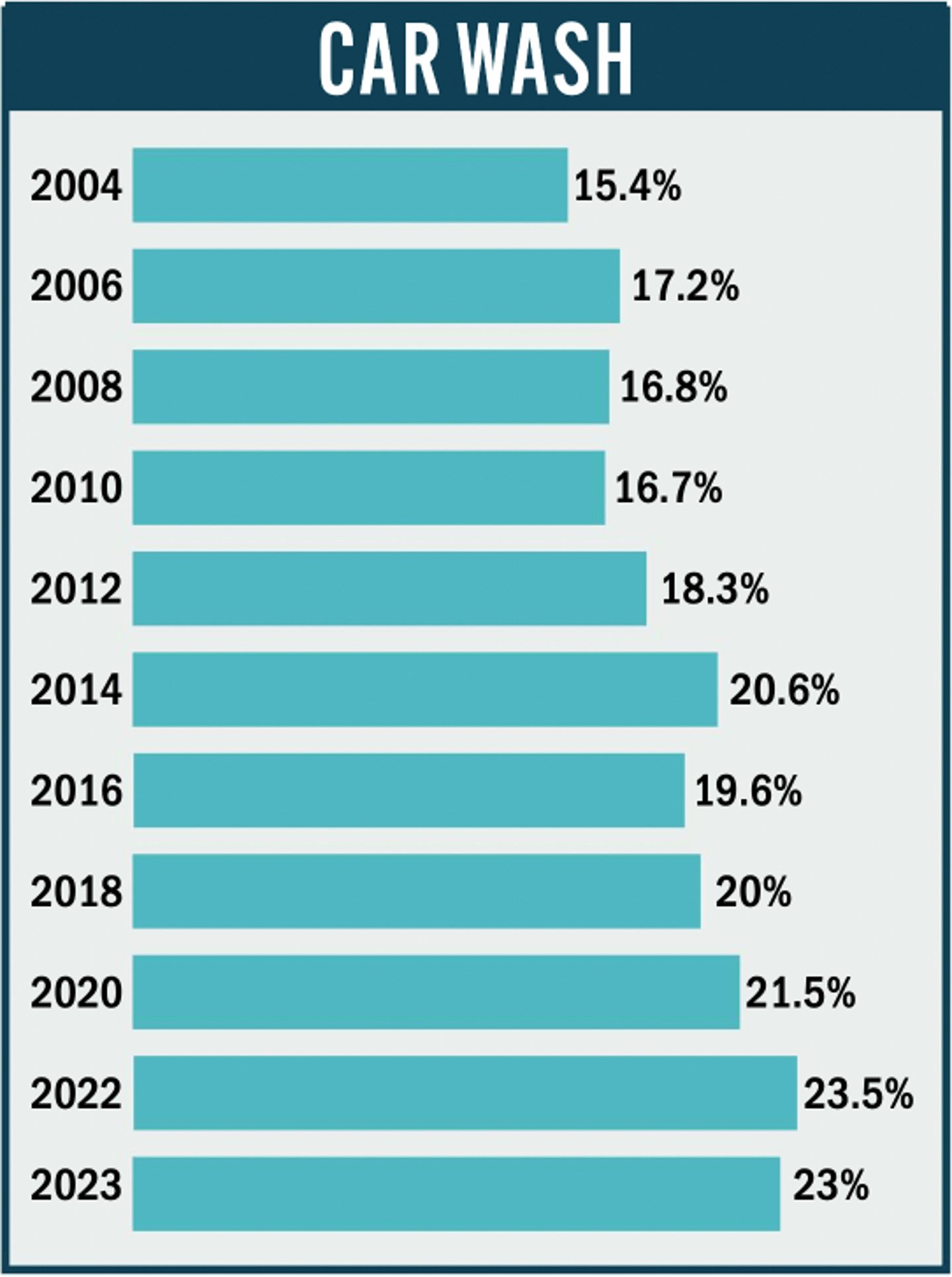

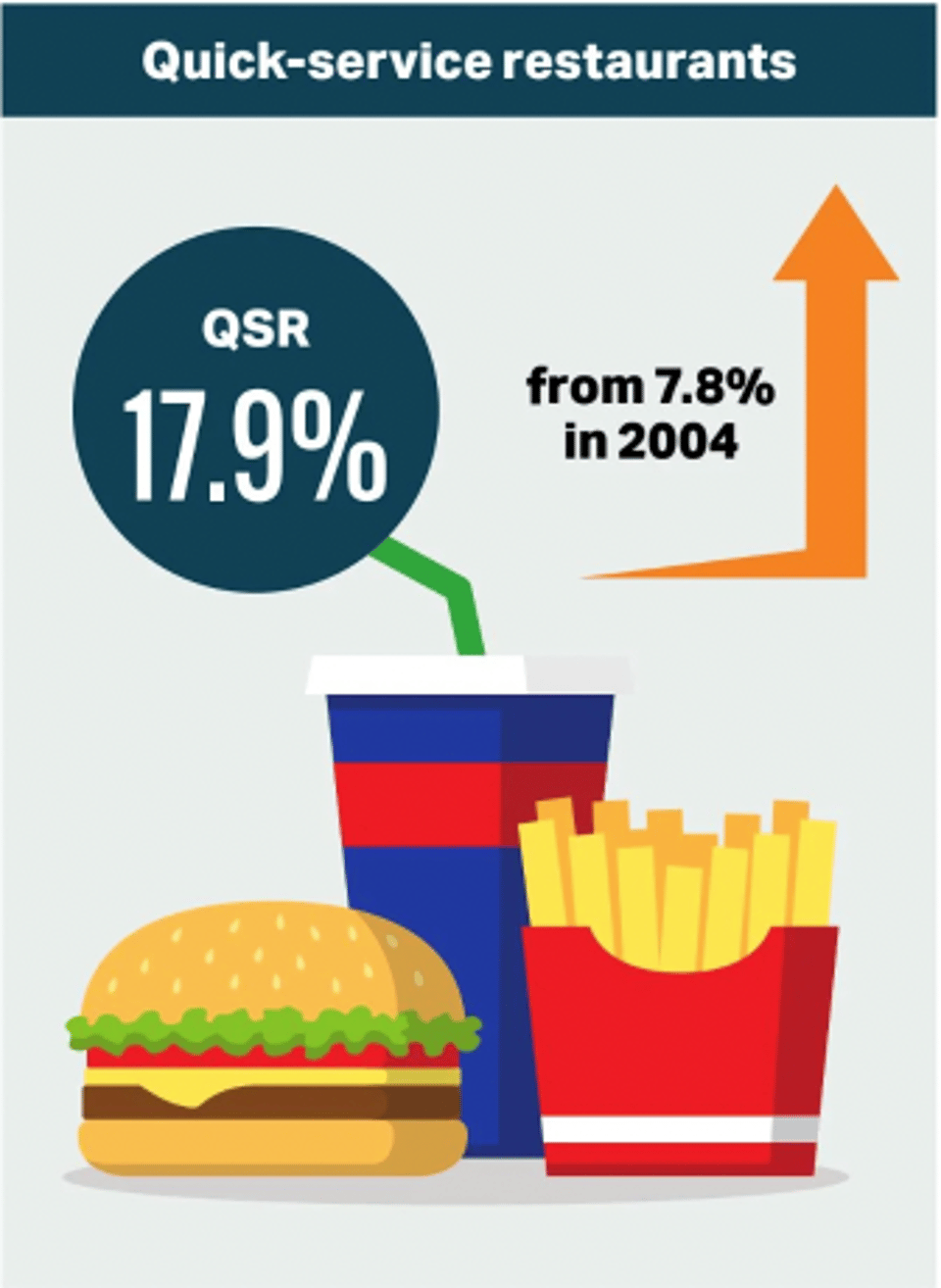

Car wash operations and quick-serve restaurants are becoming more common as well, offering another revenue and profit stream. While not every retail gas operation in Canada currently has a car wash, or a QSR, more are investing in both.

There are 2,268 car washes and 1,764 quick-serve restaurants associated with the 9,868 stations reporting ancillary offerings: That’s a car wash at roughly one out of every four sites and a quick-serve restaurant at nearly every one in six gasoline stations.

Compared to just a decade earlier, there are now about 600 more car washes and almost 900 more QSRs: These numbers are expected to increase over the coming years.

Competing with loyalty programs

Another driver of sales are loyalty programs. A well-managed loyalty program can incentivize customers to make repeat purchases to earn rewards, translating into a steady stream of revenue. Additionally, loyal customers are more likely to spend more on each transaction and try out new products, especially on the convenience store side of the business.

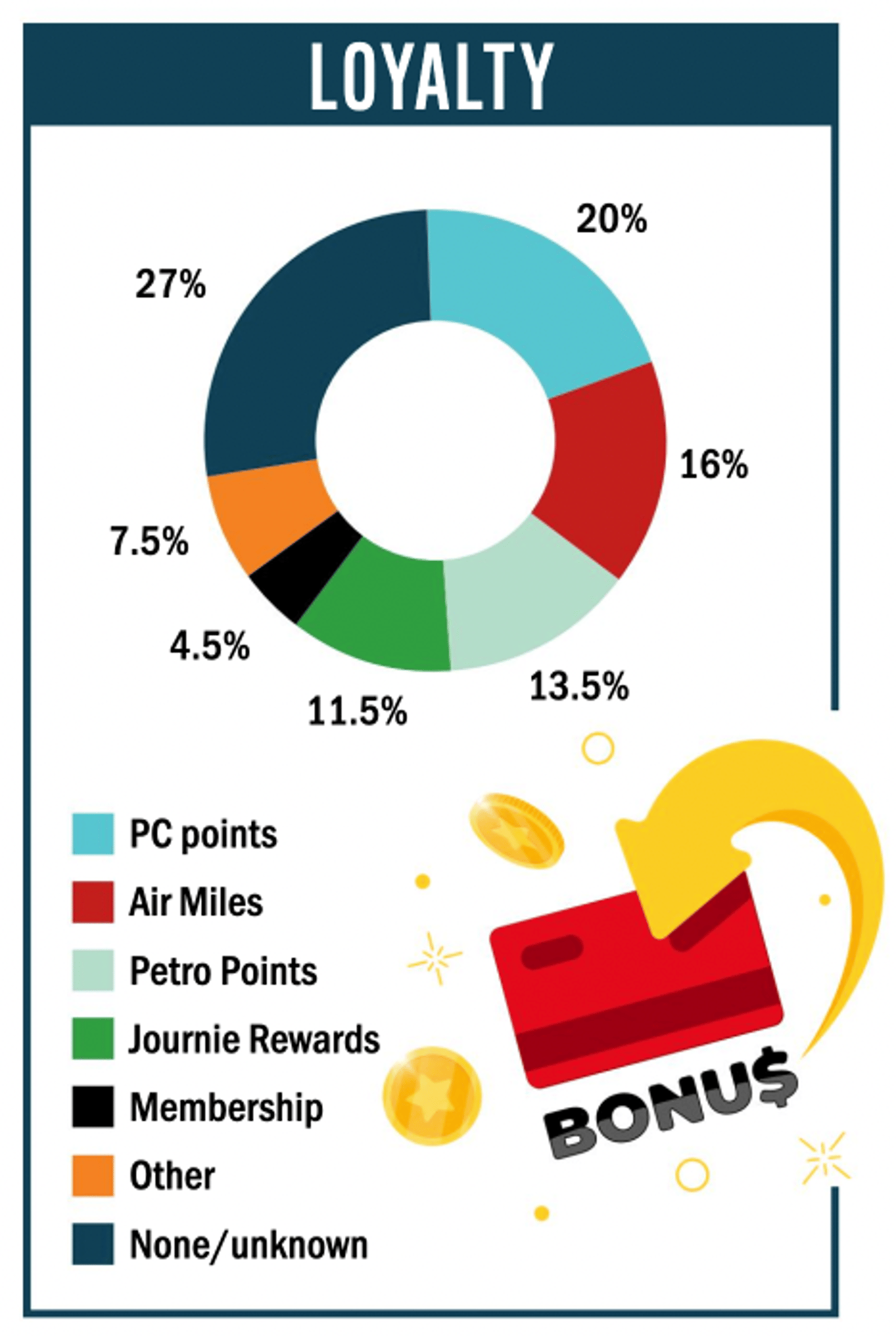

For the first time, the Kalibrate Canada study looked at loyalty program and finds 73% of gas stations provided a loyalty program, with four loyalty programs making up most loyalty programs available: PC Points, Air Miles, Petro Points, and Journie Rewards, which were available at more than 60% of sites.

“Not only does the average gasoline station compete for fuel market share by enticing customers to their gasoline stations by offering a competitive price or by providing ancillary offerings such as a convenience store, a food offering, or a carwash, but many fuel marketers compete for market share using loyalty programs.”

The charging revolution and challenge

While inflation and stubbornly high interest rates have slowed Canadian’s spending in many areas, electric vehicles sales continue to remain strong.

According to Statistics Canada, new vehicle registrations for battery, hybrid and plug-in electric cars rose to 320,237 in 2023 from 94,500 in 2019. Even if one were to remove hybrid electric vehicles—as they still have an internal combustion engine—there were still 184,578 new EV registrations in 2023, compared to 56,000 in 2019.

This has made many gas station operators look at installing EV charging stations. The study finds 517 gas stations with charging stations for electric vehicles available, a steady increase since 2019, the first year the study looked at EV charging. The number of fuel marketing companies providing electric vehicle charging stations within their fuel network has also increased to 27 fuel marketing companies, up from 11 in 2019. Quebec has the most charging stations, at 231 locations, while the territories in the north have no charging stations presently at gas stations.

“As a result, we can expect to see more electric charging stations added at gas stations in the coming years,” the study adds. “However, it should be noted that although the number of electric vehicles sold last year increased by 61,000 vehicles from 2022, for every BEV or PHEV sold, seven gasoline vehicles were sold in 2023. Therefore, we can expect that even with an increased market penetration of electric vehicles, the need for Canadian gas stations will remain solid for many years.”

As Kalibrate Canada rightly notes, adding electric charging stations will naturally not add to fuel sales. However, with increasing EV or PHEV visits to gas stations to use their onsite charging stations, this can help maintain c-store, QSR, foodservice and car wash revenues.

“The adoption of electric charging stations may alter the perception of a gas station from a ‘quick stop’ to a ‘destination stop,’ where consumers can enjoy amenities such as free wi-fi or a café experience while charging their vehicle.”

Inquiries about the data or to purchase the report, please reach out to Suzanne Gray at [email protected] or 226-270-8964.