2025 C-store IQ National Shopper Study: Healthy Eating Report

People across Canada continue to prioritize health and wellness, which is reflected in the choices they make when it comes to everything from movement to meals, snacks and beverages.

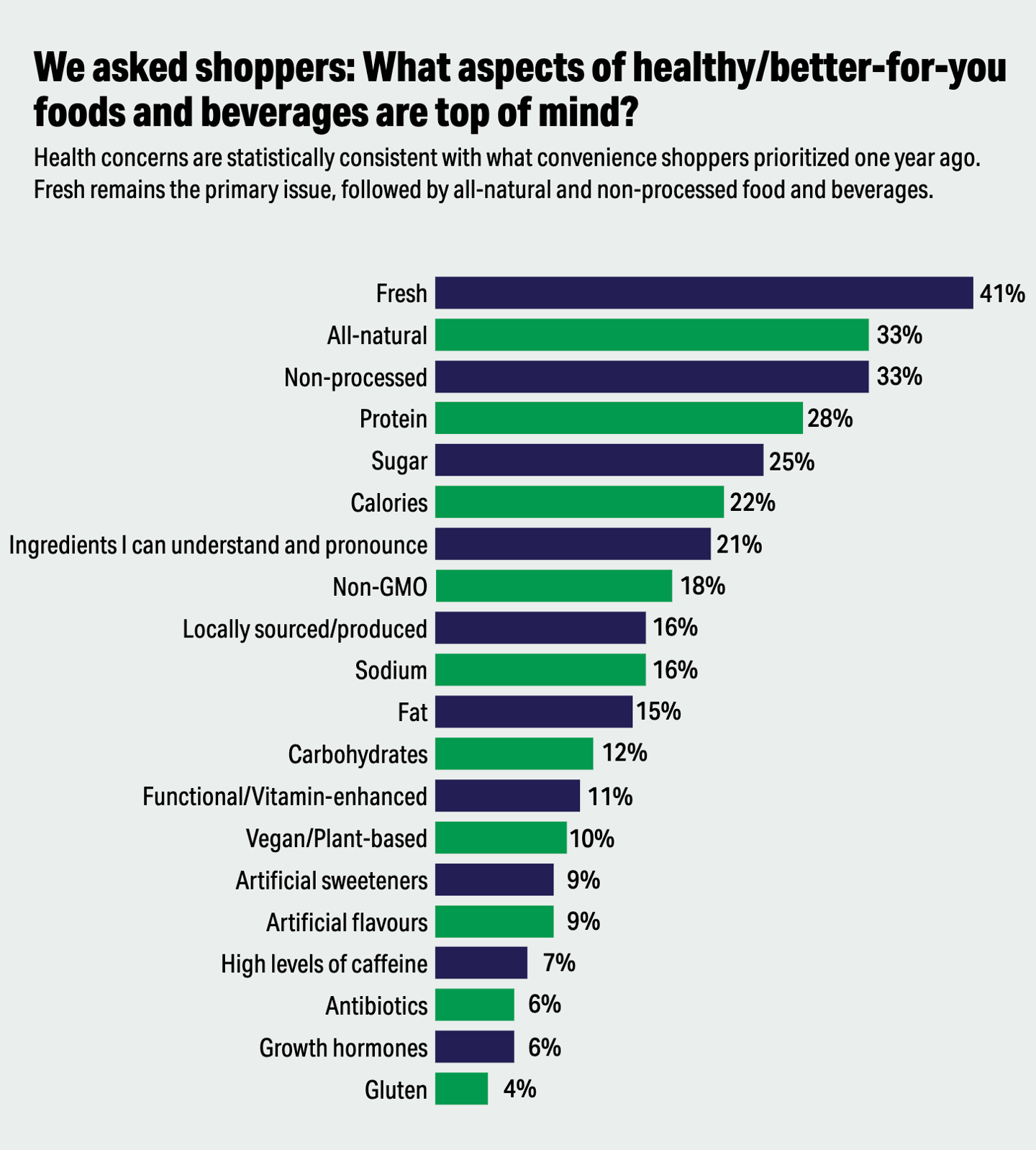

For several years now, the quest for “healthier” has shaped product innovation and categories in the food and beverage space—note the most recent rise of all things protein, spanning beyond traditional fare to include potato chips, baked goods and even water.

In turn, convenience retailers have an opportunity to meet the needs and desires of consumers by offering better-for-you (BFY) products to help their loyal shoppers make choices that suit their values and lifestyles.

Working with the research team at EnsembleIQ, Convenience Store News Canada surveyed more than 2,000 people across the country to examine their wants, needs and shopping habits at convenience.

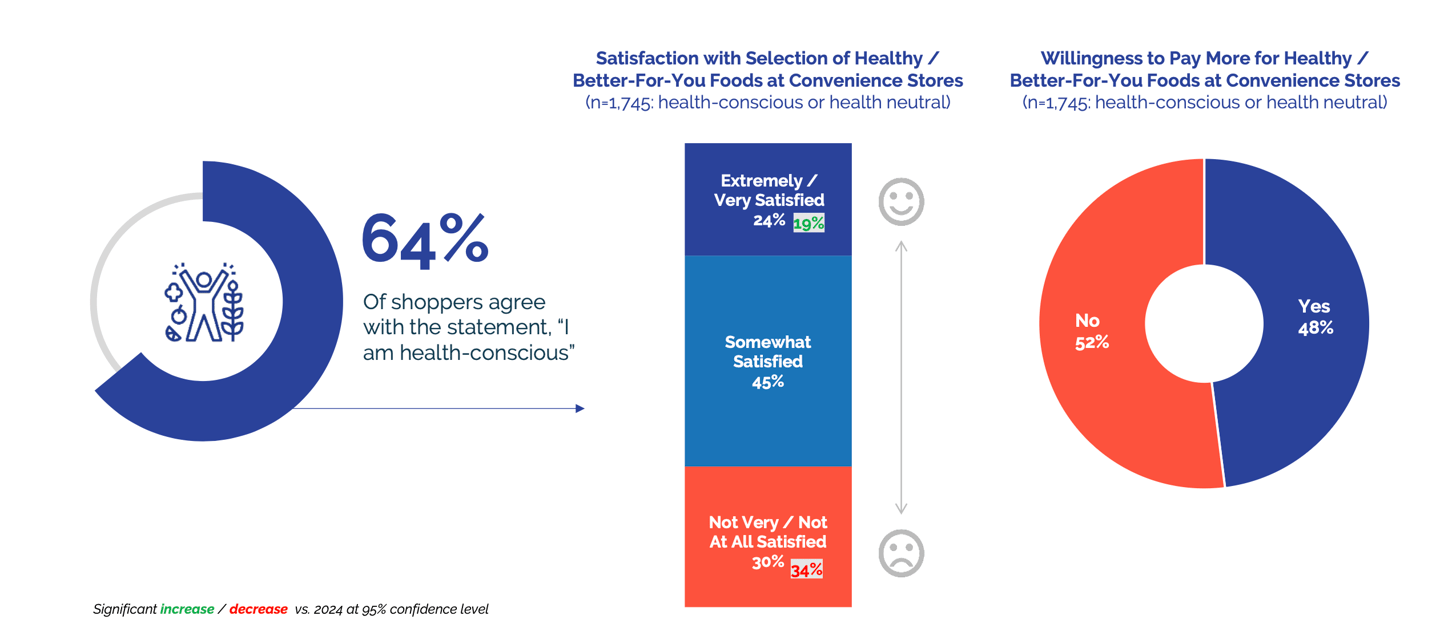

The data shows an increasing number (64%) of convenience shoppers consider themselves health-conscious, according to the 2025 C-store IQ National Shopper Study—that’s up three percentage points from 2024.

Digging a little deeper, we found differing opinions by age demographics, with 74% of boomers considering themselves to be health-conscious, compared to 65% of generation X, 60% of millennials and 57% of gen Z.

By region, shoppers in Quebec (81%) are the most health-conscious, compared to 63% in Atlantic Canada, 57% in Ontario, 55% in Alberta and (this came as a surprise) 54% in British Columbia.

Convenience retailers are moving in the right direction, satisfying shoppers’ oft-contrasting cravings for indulgence and health, with a growing number of BFY offerings (in addition to indulgent staples).

Indeed, our research shows that shoppers’ overall satisfaction with the selection of healthy foods at convenience is on the upswing, with the number of people reporting they are “extremely or very satisfied” up six percentage points to 24%, compared to 19% in 2024. Note that gen Z (33%) and millennials (31%) are more likely to be satisfied compared to gen X (19%) and boomers (14%).

Beyond satisfying consumer cravings, why does this matter? Despite larger economic and budgeting concerns, nearly half (48%) of shoppers say they are willing to pay more for healthy and BFY items. Note, this is slightly higher than 2024 (46%), but still lower than 2023 (52%).

Again, we dug into demographic differences to find gen Z (57%) and millennials (55%) more likely to be willing to pay more, compared to gen X (41%) and boomers (36%).

While the terms healthier and BFY remain up for interpretation (often in the eye of the beholder/consumer), what’s not up for debate is that this movement will continue to grow, presenting an opportunity for retailers (and manufacturers) to satisfy consumer cravings on all fronts.