C-store IQ: 2023 Purchasing Report

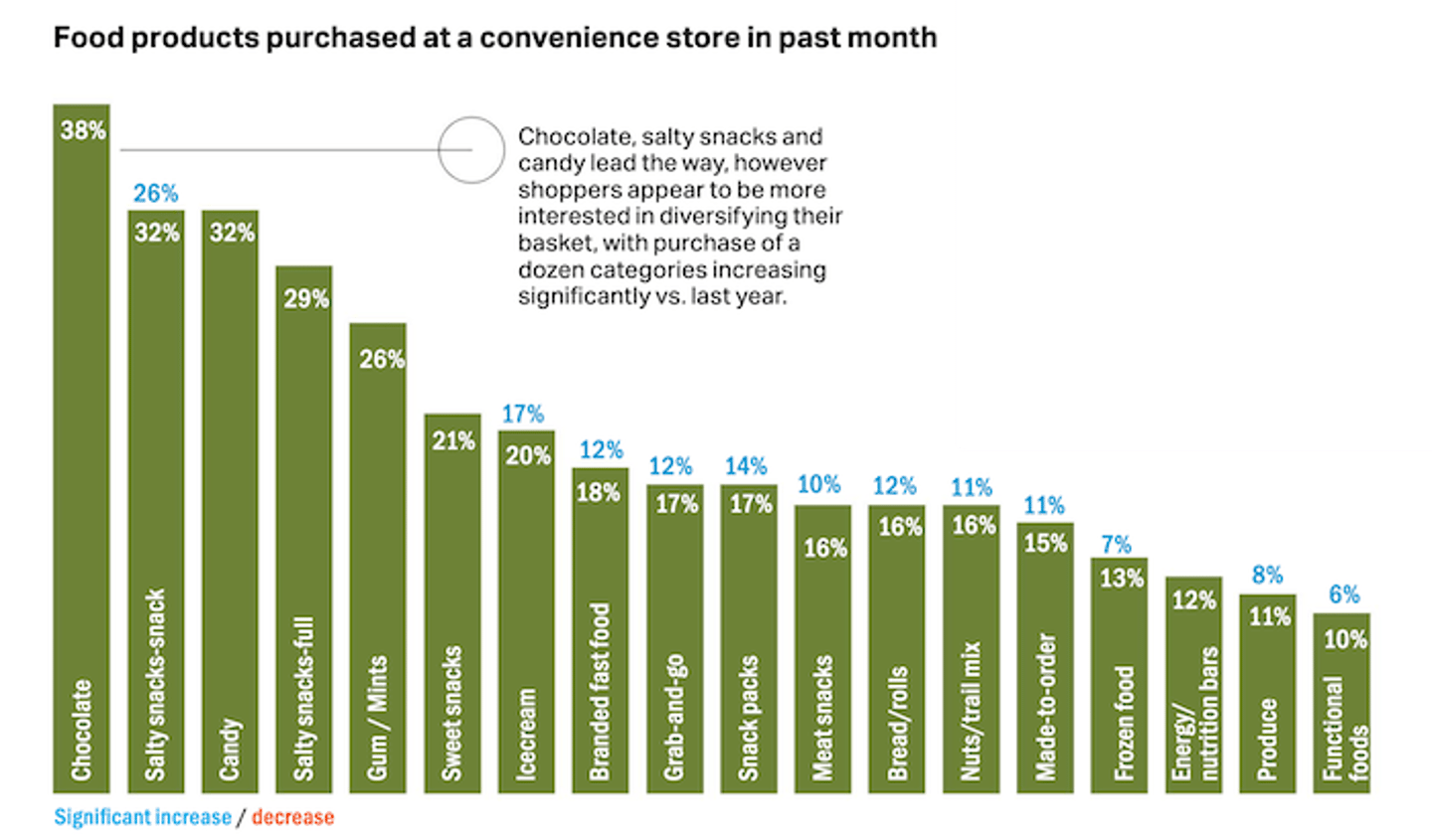

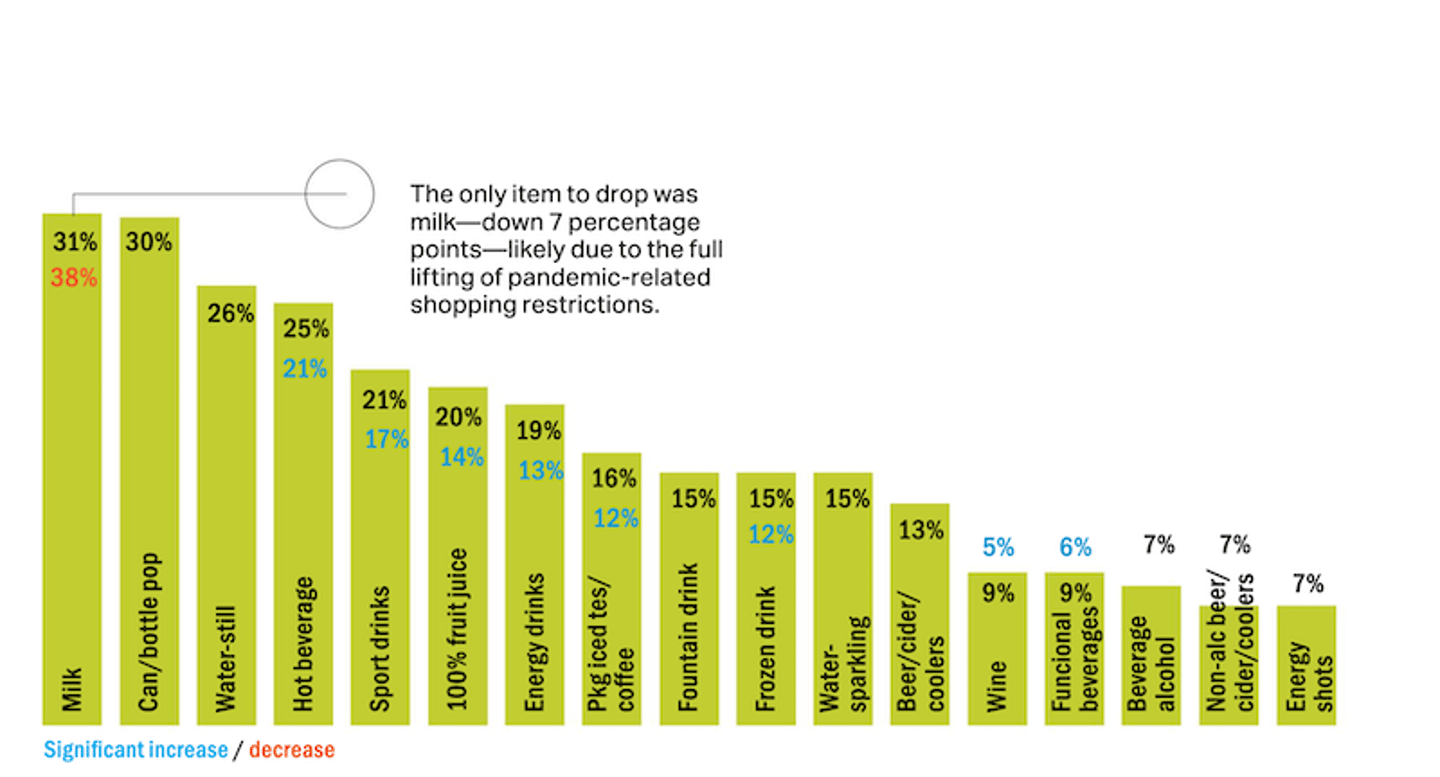

Canadian c-store shoppers appear to be diversifying their baskets, with purchase rates for 12 food and 10 beverage categories way up compared to a year ago.

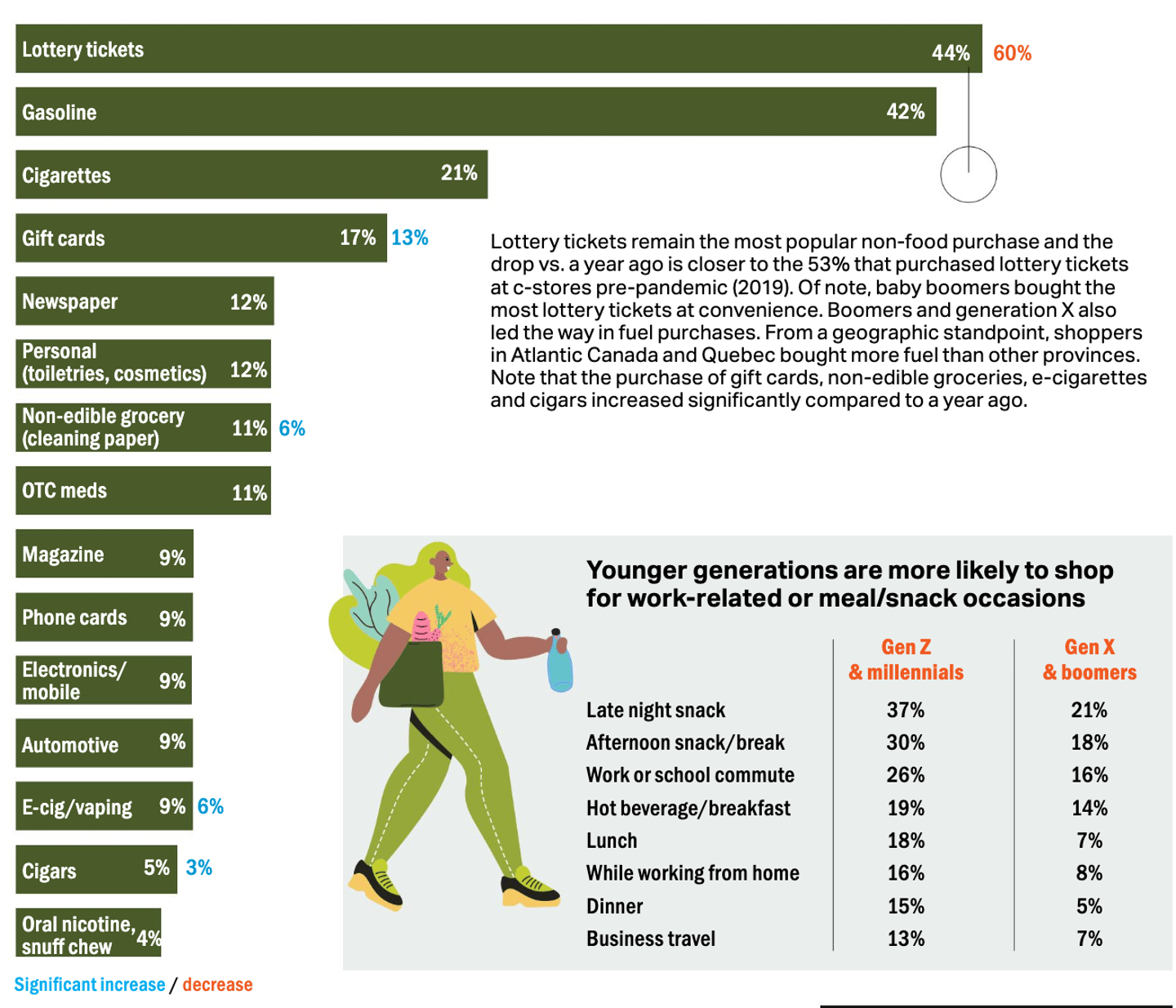

Indicators are the purchasing habits of younger consumers are playing a role in driving these changes.

While half of all shoppers (50%) visit a convenience store at least weekly, for younger generations popping into their favourite convenience store is a fundamental part of their daily routine: 46% of generation Z/millennials report daily visits to what they perceive as chain stores and 43% shop daily at independent c-stores.

Overall, visits to and spending at convenience remains strong. Shoppers spent an average of $18.06 on their most recent visit (excluding the costs of gasoline), compared to $15.46 in last year’s report and $13.56 in 2019.

What are they spending it on?

Working with the research team at EnsembleIQ, Convenience Store News Canada surveyed more than 2,000 convenience shoppers across the country to find out.

Now in its third year, the C-store IQ National Shopper Study is the only convenience and gas specific study delving into the ever evolving wants, needs, perspectives and habits of Canadian consumers.

For 2023, we doubled the number of participants to provide a more robust snapshot of Canada’s convenience landscape, with comprehensive coverage by age demographics and geographical locations.

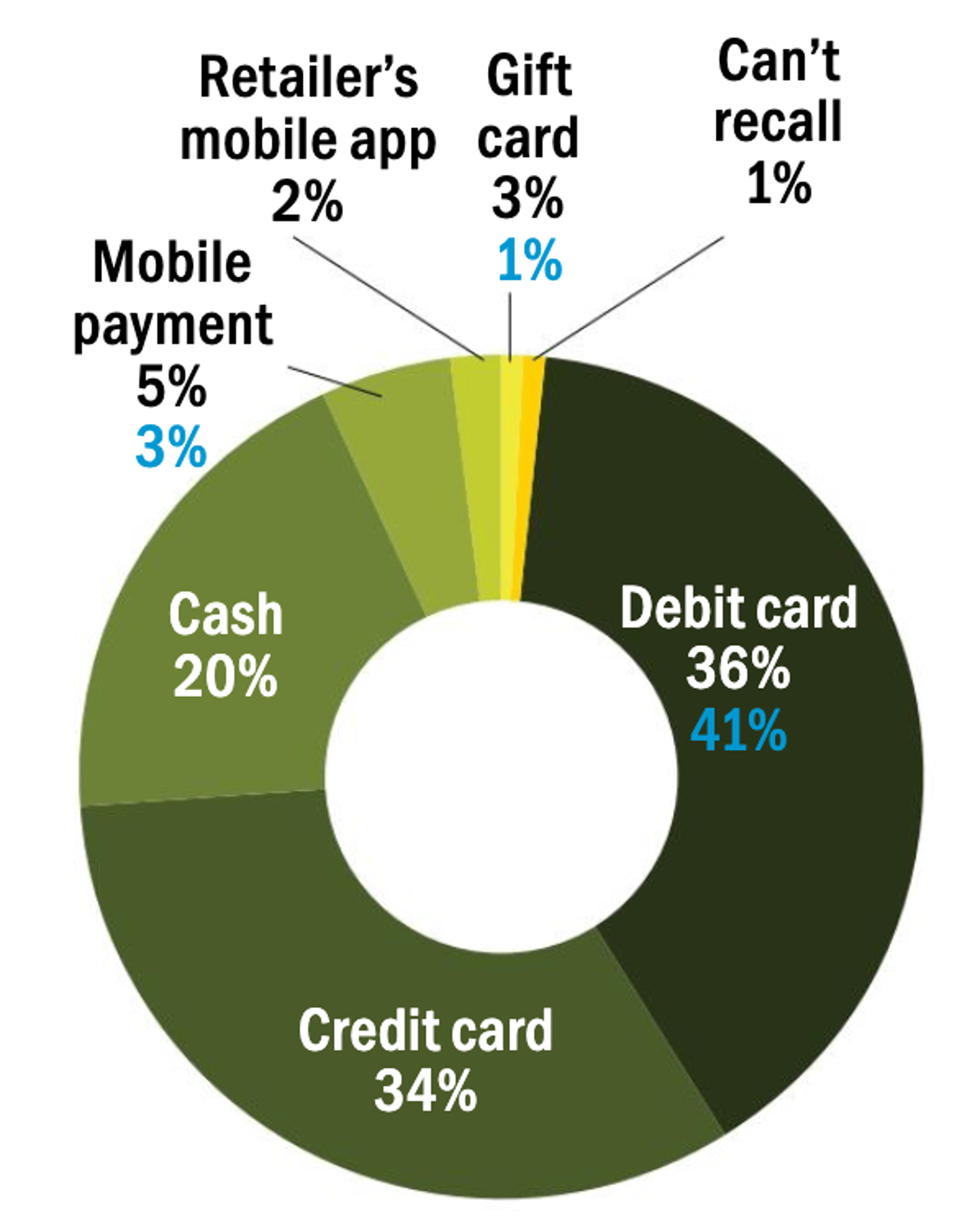

Total spend on most recent in-store visit (not including fuel) + Payment type used on most recent convenience shopping trip

Plastic’ remains the most common payment method, however mobile payments are on the rise, increasing significantly vs. a year ago. The driving force here is generation Z.

Food products purchased at a convenience store in past month

Beverage products purchased at a convenience store in past month

Non-food products purchased at a convenience store in past month

Purchase frequency of items at c-store today vs last year

As was the pattern in 2022, at least one-fourth of shoppers report ‘more’ purchases of HBC, edible and non-edible grocery, other tobacco and prepared food. Further evidence of a return to normalcy, hot and dispensed beverages are being purchased ‘more’ by a significantly larger share of shoppers compared to last year.

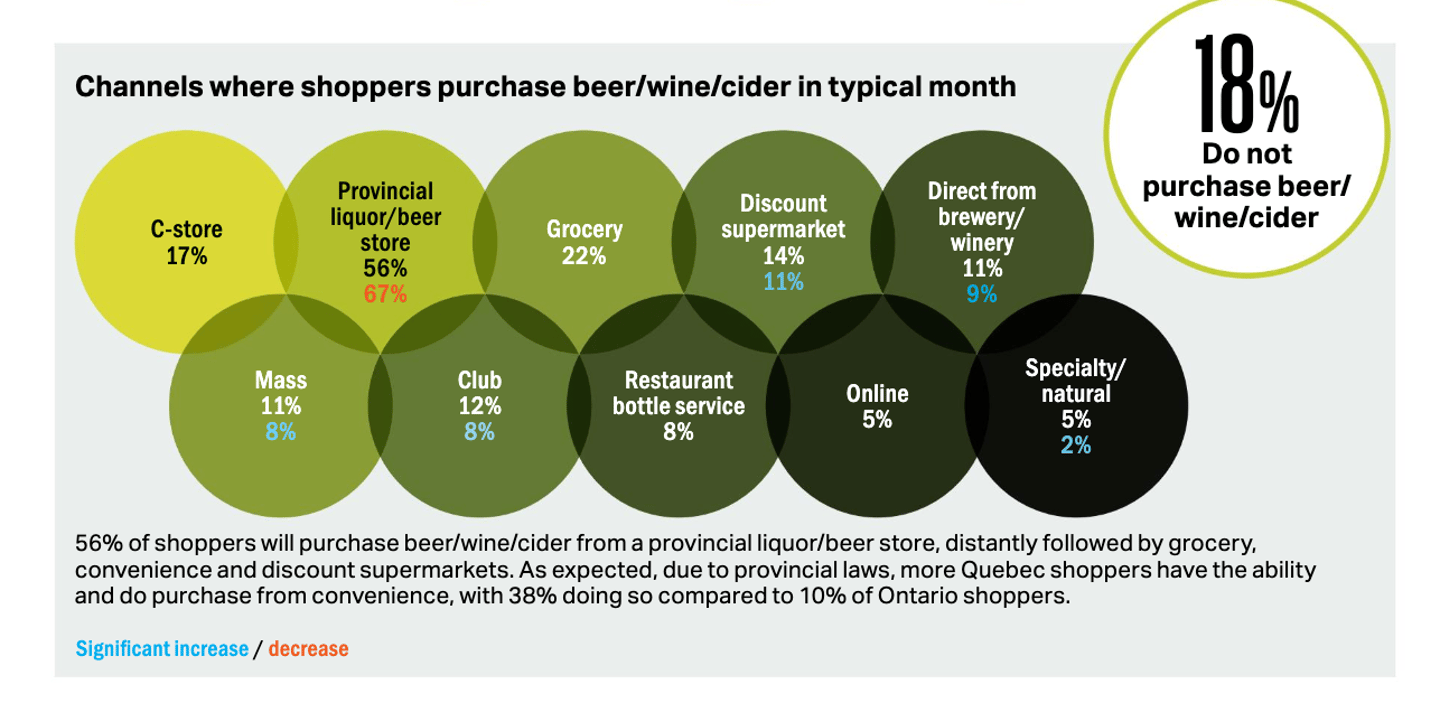

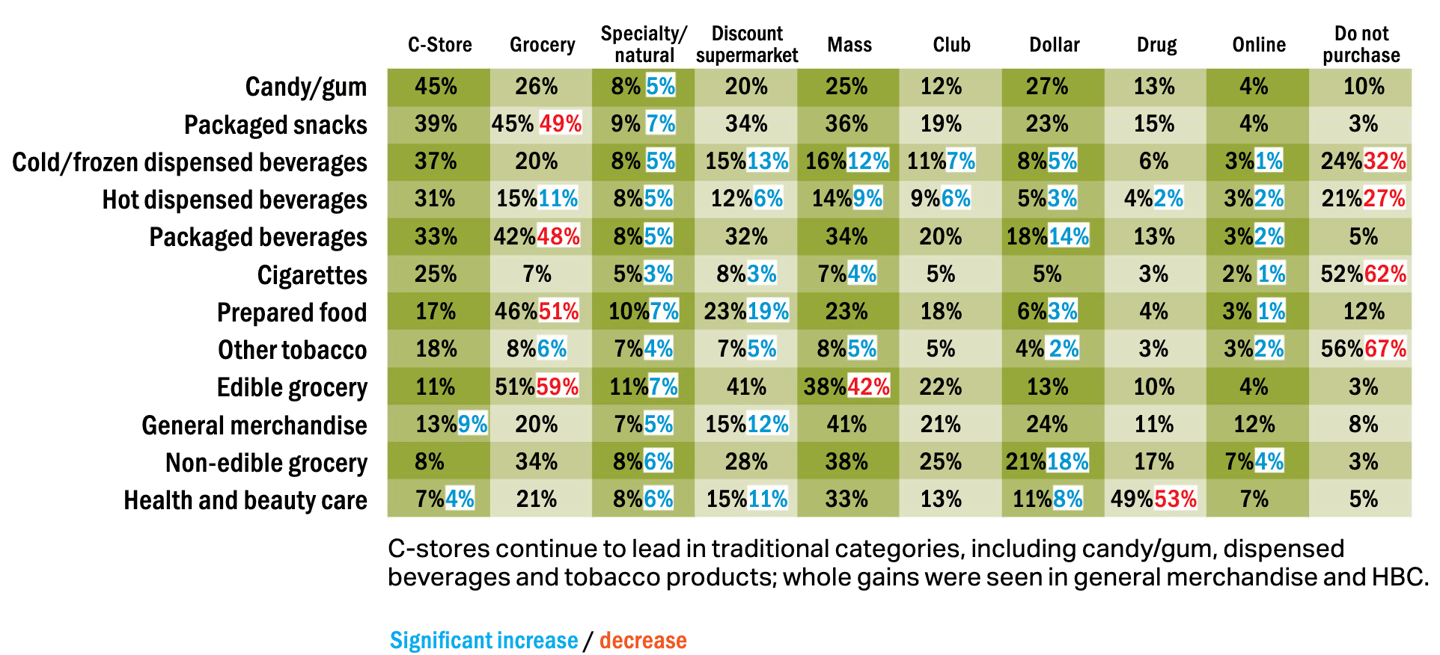

Channels where shoppers purchase items in a typical month

Reasons for shopping at c-stores more today vs. before the pandemic

Longer hours and changes to routine remain the lead reasons for shopping more at c-stores, however, both decreased significantly vs. a year ago. Another sign of pandemic recovery is consumers are shopping more for foodservice items. Of note, 24% of males say they are “shopping convenience stores more for foodservice items,” compared to 13% of females. In addition, 24% of generation Z say they are relying on c-stores more because they “feel shopping at a convenience store is safe” and “my preferred convenience store offers contactless payment options.”

Preferred one-stop-shop for essentials

We asked: “If you had to choose one store to stop at to purchase milk, bread and snacks, where would you go?” Given the scenario, most shoppers would opt for a grocery store, however, compared to one year ago, dollar stores increased significantly and are now equal to drug stores in preference. However, males and generation Z say they are more likely to choose c-stores for their one-stop-shopping experience.

The survey was fielded from December 7, 2022 – January 10, 2023 and responses were gathered from 2,008 people, who were required to be 18+, reside in Canada and shop at convenience stores at least once a month. Quotas were imposed to ensure measurable base sizes for age generations and provinces or territories.