Consumers have a growing taste for plant-based confection

By the numbers

The Global Vegan Chocolate Confectionery Market size is expected to reach $1 billion by 2027, rising at a market growth of 12.3% CAGR during the forecast period, according to data from Research and Markets.

Interest in vegan candy is up 30% since January 2020, according to research from Tastewise. In foodservice, vegan chocolate menu mentions have increased 1,000% since January 2020

People love sweets. You might even say that we’re addicted to sweet treats. We also, undeniably, love to gamble. Conservative estimates taken from licensed sportsbooks in the U.S. suggest that north of $100 billion was wagered legally during the 2021 NFL season. Bets on Super Bowl LVI alone, from tens of millions of people, represented close to $10B.

One of the most popular bets is the coin toss. Bets are placed on which team will win, heads or tails, and whether the team that wins the coin toss will then go on to become Super Bowl champs.

The phrase, ‘It’s a coin toss’, implies that two outcomes have an equal probability of happening. We know that, mathematically, chance then decides if one thing or the opposite will occur. In business, few have an appetite for being at the mercy of such odds. Before investing, we rather seek assurances that a result is both likely and sustainable. Those are key elements in the evolution of markets. Sustainability as a goal, has itself become a market driver.

For more than a century, the surety of success in confections has been a predictable reliance on impulse purchases by consumers. On my first trip to London in the 1980s, I took note of the many wall-mounted vending machines on subterranean Tube platforms, selling a limited selection of chocolate bars. My last trip in 2020 before COVID was to Santiago, Chile. The modern and highly efficient subway system in Santiago is littered with vending machines selling a wide variety of candies, snacks and chocolate confections.

At first glance, the model doesn’t appear to have changed much in my lifetime. But there are indications that consumers are looking for more. In 2013, Lindt introduced a line of premium, indulgent products under the banner ‘Hello’. Thomas Linemayr, then-CEO and president, Lindt USA, explained, "We are excited about… the opportunity to engage millennials, a virtually untapped group in the premium chocolate space." In 2021, Lindt expanded the Hello line to include vegan offerings and recently launched in Canada and the U.K. three new vegan bars made with oat milk.

Trickle or flood

According to global insights and research provider Euromonitor, confectionery SKUs that call-out vegan represented less than 2% of the category SKU count in 2020. Fair Trade SKUs, globally, were approximately 1% of the total SKU count. However, Euromonitor further reported that Canada significantly over-indexed in both of these segments.

The Ipsos FIVE Consumption Tracking Study monitors labels of importance, reflecting defined Canadian consumer needs. While vegan confectionery is still small, strong development among younger consumer cohorts denotes that future growth is likely, particularly as the focus on plant-based continues to rise in importance. Digging deeper into the motivations underpinning these purchases, Ipsos research points to the prioritization of ethics, health, all-natural and nurturing.

Consumer demands

Ontario-based manufacturer, Waterbridge Confectionery often hears this question from consumers: “Are your wine gums suitable for vegetarians?” Until recently, the answer was no.

It’s widely known that the traditional gelatin used as the binding agent in wine gums and other confection gummies is animal-based, but that is changing.

Waterbridge listened to customers and worked with food scientists to replace gelatin with modified potato and tapioca starch. Use of beeswax precludes classifying the product as vegan. However, they are suitable for vegetarians and contain no animal by-products.

As established companies shift their ways, many new confection players are differentiating themselves from the outset with plant-based offerings. For instance, Yumy Candy is a health-conscious low-sugar plant-based confectionery company based in Vancouver. Its portfolio of healthier gelatine-free candies just got picked up by The Hudson Group, one North America’s largest travel retail chains operating more than 1,000 stores across the U.S. and Canada.

“While vegan claims were once predominantly used as secondary or tertiary claims in combination with other ‘free-from’, organic or health positionings, they are now coming to the fore as a primary focus,” according to research from Innova Market Insights.

Case in point: Dare’s Real Fruit Gummies put their “certified plant based” differentiator front and centre, as emphasized in a recent cheeky ad campaign: “Zero animals harmed. But we beat the pulp out of fruit.”

Not just for vegans

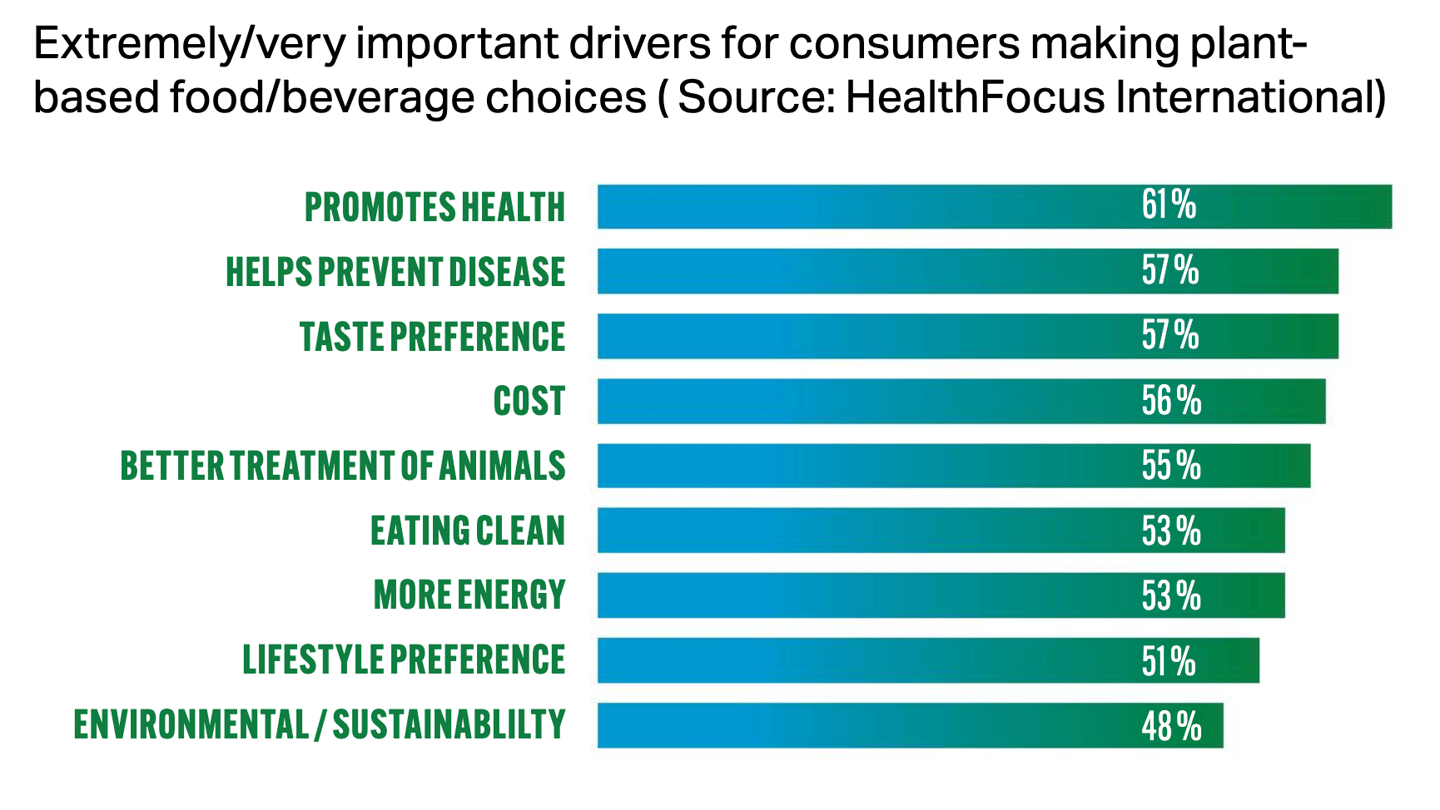

This is in keeping with the widespread shift of animal-free products further into the mainstream, with numerous global consumer surveys showing people are interested in plant-based foods across different categories. It not only appeals to vegan or vegetarian consumers, but also a much broader audience of so-called flexitarians.

Consumers are embracing plant-based snacking for a number of reasons and companies are paying attention.

In 2020, 67% of all new products with ‘plant-based’ claims were launched outside of the usual dairy and meat alternatives sectors, with confectionery being a primary focus, according to Innova.

A growing number of milk-free and gelatin-free chocolate confectionery products are hitting store shelves, some being new twists on old favourites. In 2021, Nestlé launched KitKat V, what it calls “a great-tasting, no-compromise vegan version of KitKat.”

Alexander von Maillot, head of confectionery at Nestlé, said at the time: " One of the most common requests we see on social media is for a vegan KitKat, so we're delighted to be able to make that wish come true. This is for everyone who wants a little more plant-based in their life when they treat themselves!"

While total confectionery launches rose at a CAGR of less than 2% from 2016 to 2020, those with vegan claims increased at 17% CAGR. “More dynamic still were confectionery launches under the simpler ‘plant-based’ banner, with introductions more than doubling in 2020 alone,” according to Innova.

On the back of the successful 2019 launch of a vegan version of its Galaxy bar, in 20021 Mars gave two more of its most iconic chocolate bars—Bounty and Topic—a vegan makeover. The products were both gluten-free, but vegan got top billing.

Don’t leave it to chance

Flipping a coin on plant-based confection is not an option. Suppliers are already getting on board, and consumers are voting with their purchasing power. The only question that remains for distributors and c-store operators is how far/fast you want to move to make room for and promote this burgeoning sub-category of confectionary products.