The future of ATMs in convenience stores

The industry has heard for years now that cash will become obsolete. It begs the question: how long will there be a need for cash machines in c-stores?

This summer, Toronto-based Perativ Holdings, a leading provider of more than 7,000 non-bank ATMs nationwide under the brand Access Cash, filed for bankruptcy protection. The company cited a pandemic-accelerated decline in consumer use of paper money for the need to restructure.

But experts don’t see this as the beginning of the end for cash machines in Canada.

According to figures posted by the Canadian Bankers Association last year, there are nearly 70,000 cash machines nationwide. About 18,500 – or just over 25% of them – are bank-owned. The remaining 50,000 or so are privately owned. (The Canadian government opened up the ATM market to independent players in 1996.)

In addition to Perativ, private operators include NCR Atleos (under the brand Cardtronics), Saskatoon-based Evolution Cash Technologies, Edmonton-based Jack Cash and Calgary-based Olympia ATM.

Perativ didn’t respond to requests for comment. However, sources expect the company to survive, citing court documents that indicate Sandton Capital Partners in New York, Perativ’s largest creditor, has agreed to take over the business.

There is no denying visits to machines are collectively down versus pre-pandemic.

“Cash is no longer king,” says Jeff Brownlee, VP, comms and stakeholder relations at the Convenience Industry Council of Canada. “The use of ATMs as a major traffic driver is decreasing, and started during the pandemic when there was a huge move away from cash and to digital payments.”

“In our channel alone, we saw a 55% increase in credit card usage 2021/2022, and it still continues to increase, especially given the economic environment,” he underscores.

Nevertheless, Brownlee says customers have come to expect ATMs in c-stores.

“The big opportunity for convenience stores during the pandemic was when other retail businesses only accepted credit card and debit cards, some c-stores still accepted cash. And so, it has become expected from customers that a store have an ATM,” he adds. “Even if they don’t use it as much as in the past, they do rely on it at times and become frustrated if it is down for servicing when they need to withdraw money.”

Interestingly, the value of ATM transactions has in fact increased by 21% over the past five years, according to the Canadian Payment Methods and Trends Report 2023. However, that is not in lockstep with increased use.

“We’ve seen a decline in the volume of ATM transactions year after year throughout the past decade,” says Stephen Yun, senior analyst, market insights at Payments Canada.

In addition to using credit cards, he says mobile wallets like from Apple have also grown in popularity with shoppers.

“More Canadians are increasingly comfortable using digital payments on a daily basis and embracing digital payment innovations that make their payment experiences easier,” Yun says.

Still, the increase in transaction value underscores that ATMs are still very relevant to a population of Canadians.

In fact, Payments Canada’s recent Payment Behaviour Tracking Survey found 37% of Canadians use cash for making day-to-day payments as well as hold onto it in case of emergencies. “Some Canadians are withdrawing more cash each time, including higher denomination notes ($50), partly driven by Canadians’ precautionary motives,” explains Yun.

ATMs are also likely to have a strong user base in small communities.

“Canadians who are frequent cash users tend to be older [and] live in rural areas,” he says. “In rural areas, there are fewer bank branch locations with ATMs and they're more spread apart geographically which makes ATM access less convenient for cash users. So, there would likely be a greater demand for white-label ATMs in c-stores or grocery stores located in rural areas compared to urban areas.”

Jim Wilson, president of Calgary-based Olympia ATM, which has a network of over 800 ATMs across Canada, says cash machines still offer a lot of benefits. They generate extra revenue for c-stores via a nominal service charge to the customer per transaction and provide a value-add service to customers especially in rural areas.

Plus, “the fact that once they take out some cash, most customers typically also buy something in the store” is also a revenue-generator, points out Wilson.

“Although we have some c-stores getting dozens of transactions per day depending on the location, even a c-store seeing about three or four transactions per day will pocket about $50 per month just from fees,” says Wilson, who says the advantage of white-label providers is that they’re smaller businesses than banks and provide immediate customer service from the top.

However, Brownlee says he is hearing from some members making the switch in their stores to bank-owned ATMs.

“One of Canada’s top c-store retailers said that their bank-branded ATMs generated over 3.5 million transactions a year. They were originally white label, but converted, and as a result the number of transactions went up,” he says.

It isn’t just that in the current economic climate, customers want to avoid private ATMs because customers often get charged higher withdrawal fees than a bank machine. “As fraud continues to grow, there is often less trust with while-label machines versus bank-branded,” notes Brownlee.

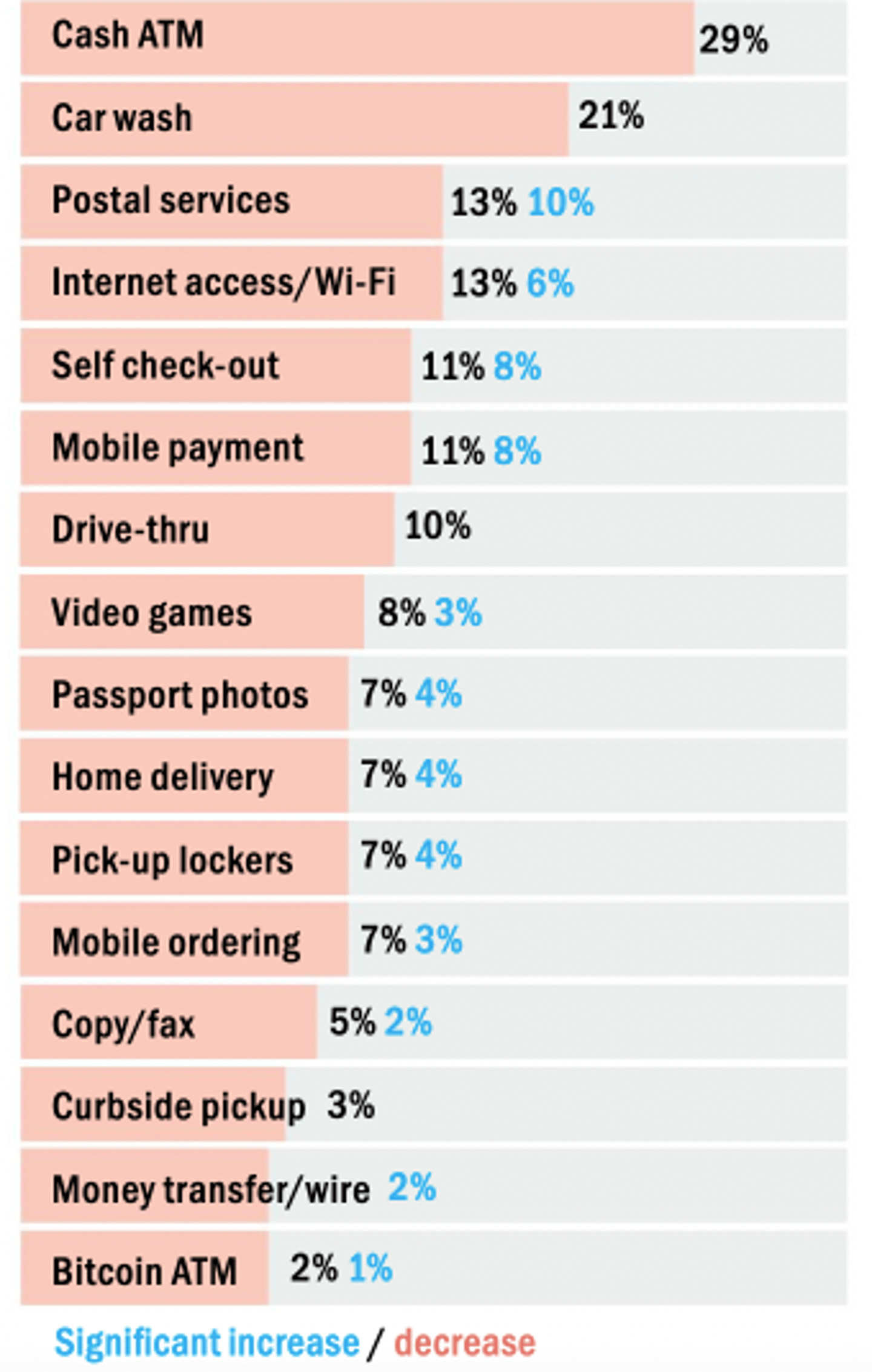

According to data from the 2023 C-store IQ National Shopper study, 88% of shoppers regularly use at least on expanded service at convenience stores, with cash ATMs coming out on top.