Milking it

C-store staple

While overall milk consumption is down, it remains a key category for Canadian c-stores. Among beverages purchased at c-stores in the past month, more than one-third (35%) of shoppers bought milk, according to the C-store IQ National Shopper Study, that’s up from 30% pre-pandemic. In fact, milk came out on top, followed by 30% purchasing can/bottled pop, 23% still bottled water, 21% hot beverages and 17% sports drinks.

I’m old enough to remember that houses in Toronto used to have a milk door. It was a small door on the outside wall, a narrow shelf in between, and an inside door with a small metal catch. Once or twice a week, the “milkman” would make his rounds, placing a couple of heavy glass bottles filled with fresh dairy inside, and collecting the empties from the previous week. When I was in elementary school, we also had vendors doing home delivery of other staples—fruit, eggs, bread, and, my favourite, wooden crates of carbonated beverages.

In the 1970s, exponential growth of supermarkets disrupted the home delivery model. Larger refrigerators that could easily accommodate plastic gallon jugs of full-fat milk became the norm. A decade later my mom switched to cartons, and then to four litre bags of 2% milk. Though the packaging changed over the years, milk was still Canada’s hydration option of choice.

Changing perspectives

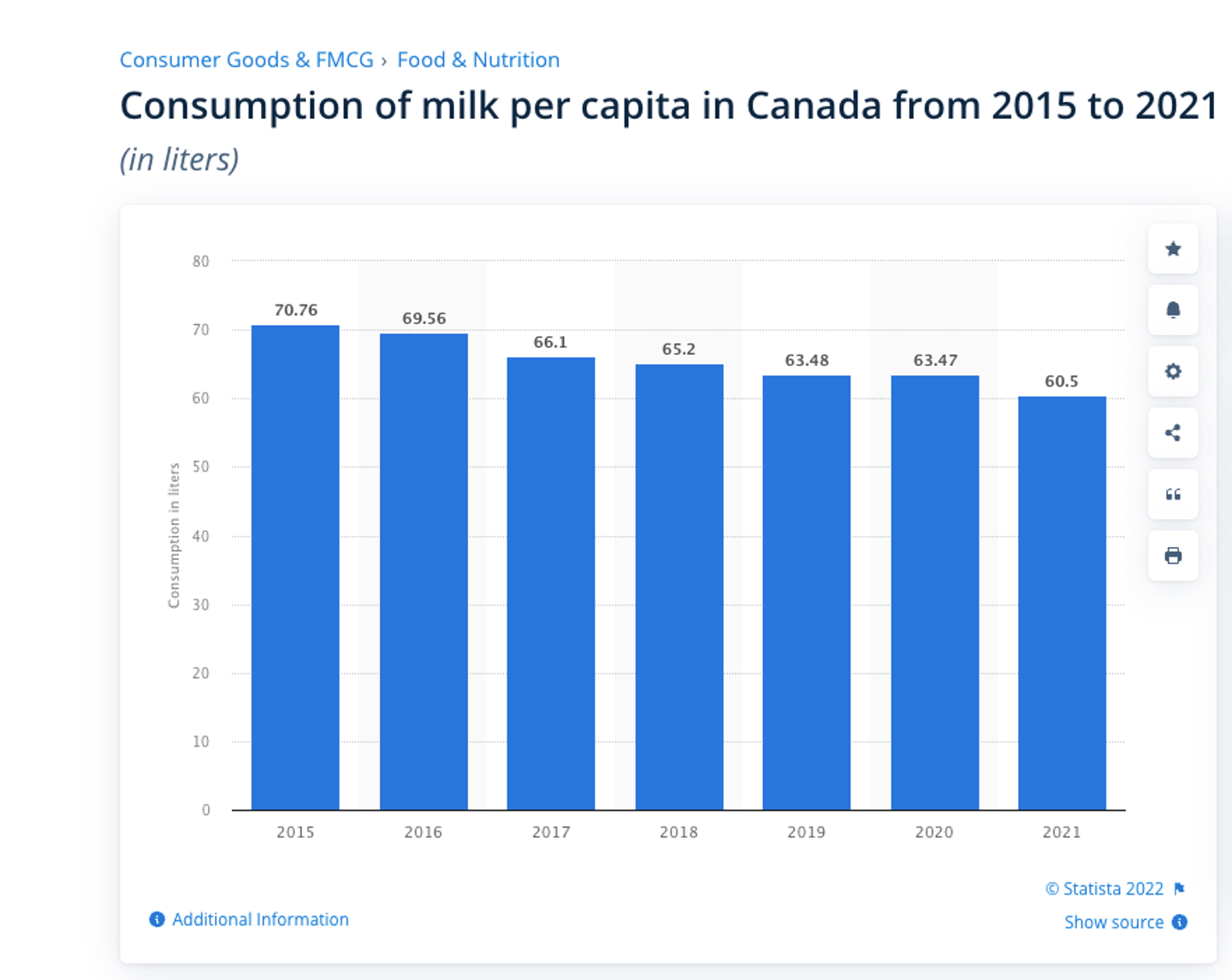

Long before bottled water, energy drinks, isotonic beverages, and RTD juices, Canadians mostly consumed whole milk. Overall annual per capita milk consumption in Canada peaked at 98 litres in 1979. However, over the last four decades, per person annual consumption has fallen by close to one-third. Of note, the rate of decline has been accelerating since 2009.

In 2021, consumption hit a new low of around 60.5 litres per capita, according to Statista: This is a decrease of more than 10 litres per capita since 2015.

It’s not just Canada where milk sales have been lagging. According to retail market tracking company IRI, U.S. milk sales have soured as well. “Dollar sales within the refrigerated milk category fell 1.5% in 2021, (and) unit sales tumbled 4.6%”.

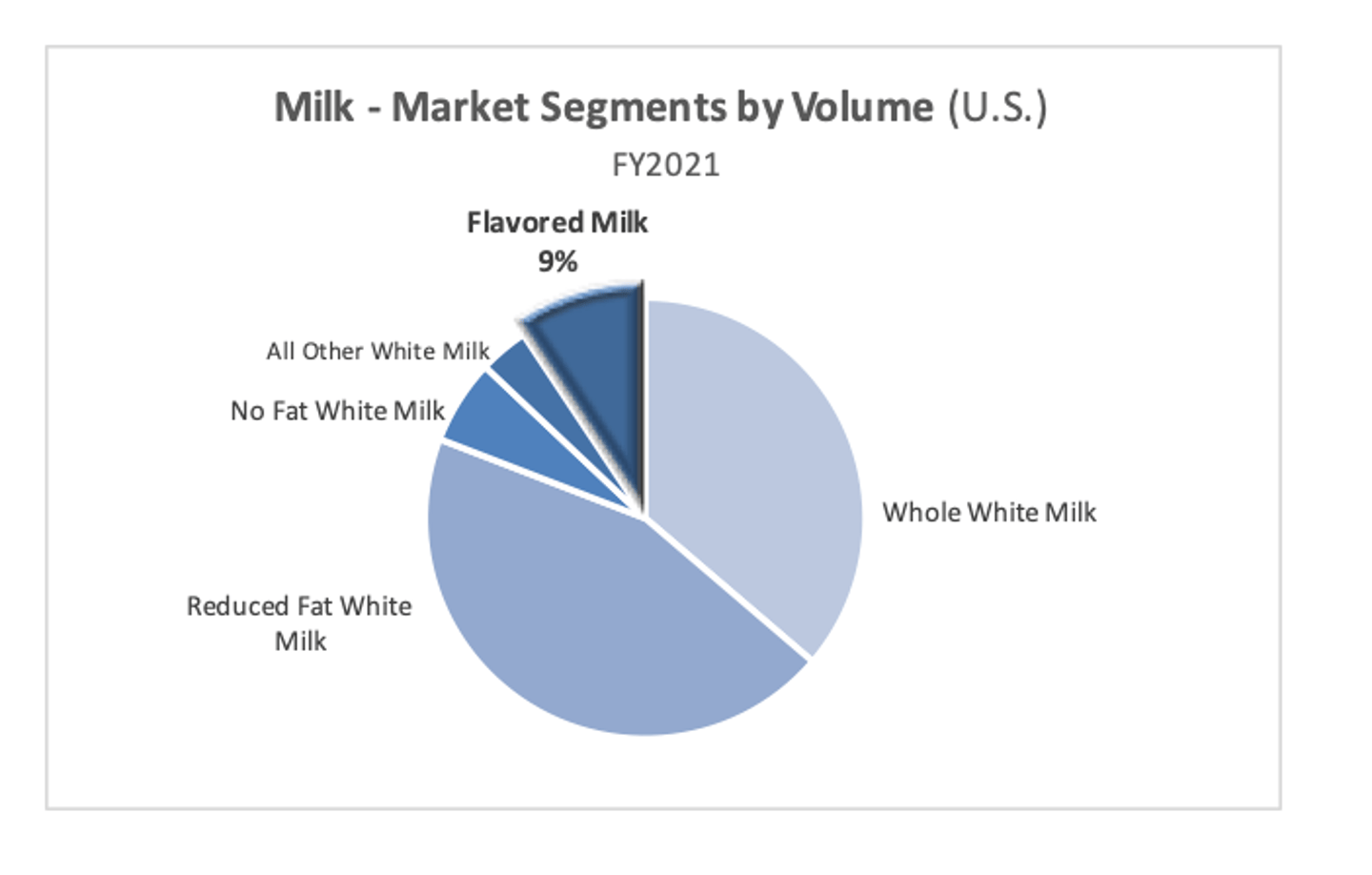

Beverage Marketing Corp. a leading management consulting and research company to the global beverage industry, tracks the U.S. retail milk market . Whole white and reduced-fat white milk represent more than two-thirds of the market in the U.S.

Looking beyond white milk reveals a different facet of the market. While the milk market may be down overall, in 2021, flavoured milk recorded a 5.1% dollar sales gain, while unit sales rose 2.1%. The two smaller segments actually showed positive growth—"flavoured” and “other” (including plant-based).

The future of milk

One notable exception to the baseline milk trend is Fairlife, a Chicago-based company owned and distributed by Coca-Cola, with a Canadian manufacturing facility in Peterborough, Ont. Fairlife’s proprietary ultrafiltration process is used to affect reductions in sugar and lactose, while increasing protein and essential nutrients. Fairlife, and other innovative manufacturers, are gaining where conventional competitors are bleeding share. Fairlife is responding to shifts in consumer preferences with enhanced dairy products that offer high protein, lower sugar, more essential nutrients, and appealing flavours.

Data sources like Technomic’s proprietary Ignite Menu Database (tracking chain and c-store menus across Canada) confirm the growing popularity of plant-based alternatives. For the year ending Q1-2022, plant-based milks (like oat milk and coconut milk) grew double-digits overall. Just like other plant-based categories, this growth reflects both rapid consumer adoption, and the fact that the base market share for these products is still very low.

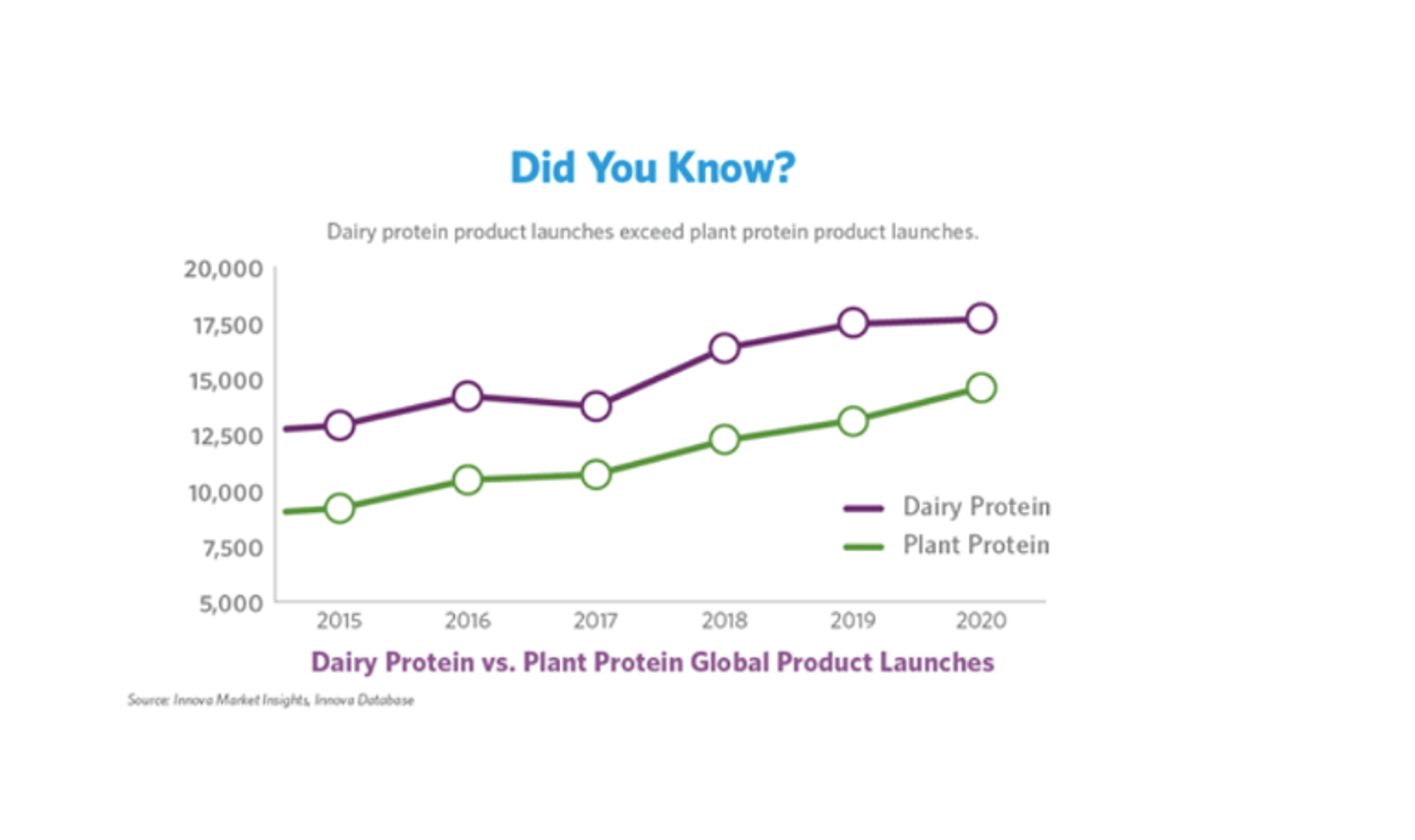

The dairy sector is not sitting idly by, but instead launching an array of flavoured products (often designed for those with a sweet tooth—think your favourite chocolate bar turned into a beverage), as well as BFY options. According to Innova’s Market Insights global new product database, global milk protein product launches are still outpacing new plant protein product launches: “Aggregated dairy protein product introductions outpaced plant proteins in 2020 by over 3,000 products…maintaining a consistent lead held for the past decade.”

By giving consumers new on-trend choices, suppliers are targeting the larger opportunity by pursuing share within an established market, namely, milk consumers.

Dairy re-imagined

Change often happens gradually, until an inflection point is reached. Canadian consumption of yogurt was virtually non-existent prior to 1960. By 1980, modest inroads had been made. However, consumer consumption of yogurt increased sharply between 2007 to 2016, rising by nearly 50%, at the same time that purchases of milk were declining. Greek yogurt startup Chobani booked more than $1-billion in retail sales in the U.S. in less than a decade.

In terms of your overall c-store beverage offerings, it’s another reminder that the demand for authentic dairy has long legs. Dairy, in whatever form it takes, still ticks a lot of boxes for a whole lot of consumers, and it’s important to find a place in your coolers for the right milk-based beverages.

Originally published in the September/October 2022 issue of Convenience Store News Canada.