People still love snacking: U.S. study

Maybe it’s stress eating caused by the economy. It could be part of the shifting work culture. It might be attributed to diets that are less centered on defined meals and more driven by personal circumstances and cravings.

At any rate, the trend toward all-day snacking has yet to slow down. What may have started with pre-pandemic on-the-go lifestyles has continued in the wake of an unconventional decade, with data bearing out Americans’ penchant for snacking.

According to information from Circana (the new name for the recently merged IRI and NPD firms), 49% of consumers eat three or more snacks per day. That’s up four percentage points from just two years ago.

Circana’s 2023 Snacking Survey also found that the noshing way of life spans demographics. The 25-34 age bracket leads the charge, with 68% eating three-plus snacks a day, followed by those age 35-44 (60%) and Gen Z consumers between 18 and 24 (58%).

"All generations are snacking three-plus snacks a day, just at varying levels,” noted Sally Lyons Wyatt, EVP of client insights at Chicago-based Circana, during a recent webinar with SNAC International.

As snacking covers a wide population ground, it also extends to occasions throughout the day. Circana’s data reveals that morning and late evening are the largest growth occasions, likely because of changed or changing work/life behaviors. According to Wyatt, younger generations are “really rocketing” morning and late-evening eating.

Other research supports the ongoing snackification of diets. Research from 210 Analytics finds that while volume is down in some categories, snack sales are defying many inflation-era trends.

“Sales of cookies, crackers and snacks are boosted by inflation, much like many areas of the store,” Anne Marie Roerink, principal of San Antonio-based 210 Analytics, tells Progressive Grocer. “However, where most areas have fallen to single-digit dollar increases, cookies, crackers and snacks are still growing by double digits in the mid-teens.”

Deirdre McFarland, SVP, marketing and communications at New York-based ad analytics firm NCSolutions, agrees that certain snack categories are holding their own. “People like their cookies. Although the unit price for cookies was up 16.34% in February 2023 compared to February 2022, the units per trip were down less than half a percentage point,” observes McFarland, adding, “This indicates that consumers might not be as concerned about the price hikes if it means keeping their pantries stocked with cookies.”

Meanwhile, to Roerink’s point, some types of snacks are performing especially well, both in terms of innovation and sales.

Feeling Salty

Perennially popular salty snacks continue to land in shoppers’ baskets. “Salty snacks are a giant seller, with $29 billion in the past year,” notes Roerink. “This was up 15.5%, as the average price per pound increased by nearly 17% over the past year.”

Reflecting the entrenchment of salty snacks, high pricing hasn’t made a big dent in consumption habits. “Potato wholesale prices are prompting very high inflation in the fresh produce department, frozen potato products, and potato chips as well,” says Roerink. “Nevertheless, pound sales are only trailing prior-year levels by 1.1%.”

Within the salty snack sector, some macro trends are evident. Plant-based and better-for-you products, for example, continue to be a hotbed of R&D activity. Recent introductions include tomato chips from Just Pure Foods and plant-based popped crisps from Pure Protein.

Flavor, including intense flavors and palate-piquing combinations, is another area of differentiation in salty snacks. Intensity is an attribute of new products like Takis Intense Nacho snacks from Grupo Bimbo-owned Barcel USA, and Sweet and Tangy BBQ Doritos from PepsiCo-owned Frito-Lay.

[Read more: "Sweets & Snacks Expo 2023 brings innovative treats to Chicago"]

During the SNAC International webinar, Wyatt pointed to the blurring of flavors evident in this stalwart category, which now features items like Skinny Pop’s Sweet Vanilla Kettle popcorn, Trix Popcorn and Bugles’ Cinnamon Toast Crunch corn chips. “We’ve seen it happen, even in salty snacks that are predominantly salty, crunchy and crispy, to now, with sweet [flavors],” she said. “It’s happening because we’ve added more to those categories, and it’s showing up in what consumers tell us they love about their favorite snacks.”

Carnivorous Cravings

What accelerated with Paleo, keto and other high-protein diets a few years ago seemingly hasn’t peaked, as meat snacks are another popular snack form.

Roerink observes: “With an average assortment of 50 different items between the front end and aisle, the average number of items per store has increased 5.9% over the past few years.”

Many of those items include meat snacks that are innovative in form and ingredients. “There are quite a few developments, from different types of protein, such as bison and elk, to the same types of claims seen in the meat department, including organic, grass-fed and regenerative agriculture,” says Roerink.

On that last point, the Chomps brand of meat snacks recently revealed that it’s working with the outcomes-based verified regenerative sourcing solution Land to Market, based in Durango, Colo., to measure its environmental impact.

“At our scale, when thinking about domestic and international sources, we want to uphold the highest standards, challenge our own supply base, and better our own understanding so we can ask the right questions,” explains Peter Maldonado, co-founder and CEO of Naples, Fla.-based Chomps.

The blurring of categories includes fusions of salty snacks and meat snacks. Earlier this year, Jack Link’s and Doritos teamed up to launch beef jerky and meat sticks featuring popular Doritos flavors, including its signature spicy coating and Flamin’ Hot profile.

The Sweet Indulgence Spectrum

Meanwhile, the overall sweet snack space is defined by parallel demand for indulgent and permissibly indulgent offerings. The scale of indulgence is largely based on consumers’ mindsets at a particular moment in time.

[Read more: "Mondelēz's SnackFutures Hub selects startups for new CoLab class"]

On the better-for-you edge of the sweet snack business, brands that have traditionally built their name on health, wellness, or natural and organic profiles are adding items geared toward consumers seeking indulgent rewards. The Chobani brand of yogurt, for instance, recently unveiled a new limited-time Flip Confetti Birthday Cake flavor and a dessert-inspired Zero Sugar Boston Cream Pie variety.

In this arena, too, plant-based sweets are providing a new layer to the segment. The Hershey Co., for example, recently rolled out Reese’s Plant Based Peanut Butter Cups and Hershey’s Plant Based Extra Creamy with Almonds and Sea Salt candy bar, while Unilever’s Magnum ice cream brand has expanded its options with a line of nondairy bars made with vegan chocolate.

Sweet snacks designed for consumers with specific health needs are also indicative of today’s mindful snacking habits. One case in point is the new Mightylicious cookie that provides a decadent taste yet is 100% free of gluten, wheat, rye, barley and rBST. Another example is a PB&J snack from Bobo’s, available in grape and strawberry jam flavors and marketed as gluten- and soy-free, vegan, and certified kosher.

Bite-sized treats also straddle the indulgence line. Products like Enstrom Almond Toffee Petites and chocolate-covered mascarpone truffles from Schuman Cheese are billed as rich and satisfying, but they come in smaller portions.

[Read more: "Canadians worried that inflation will impact their holiday shopping this year: Numerator survey"]

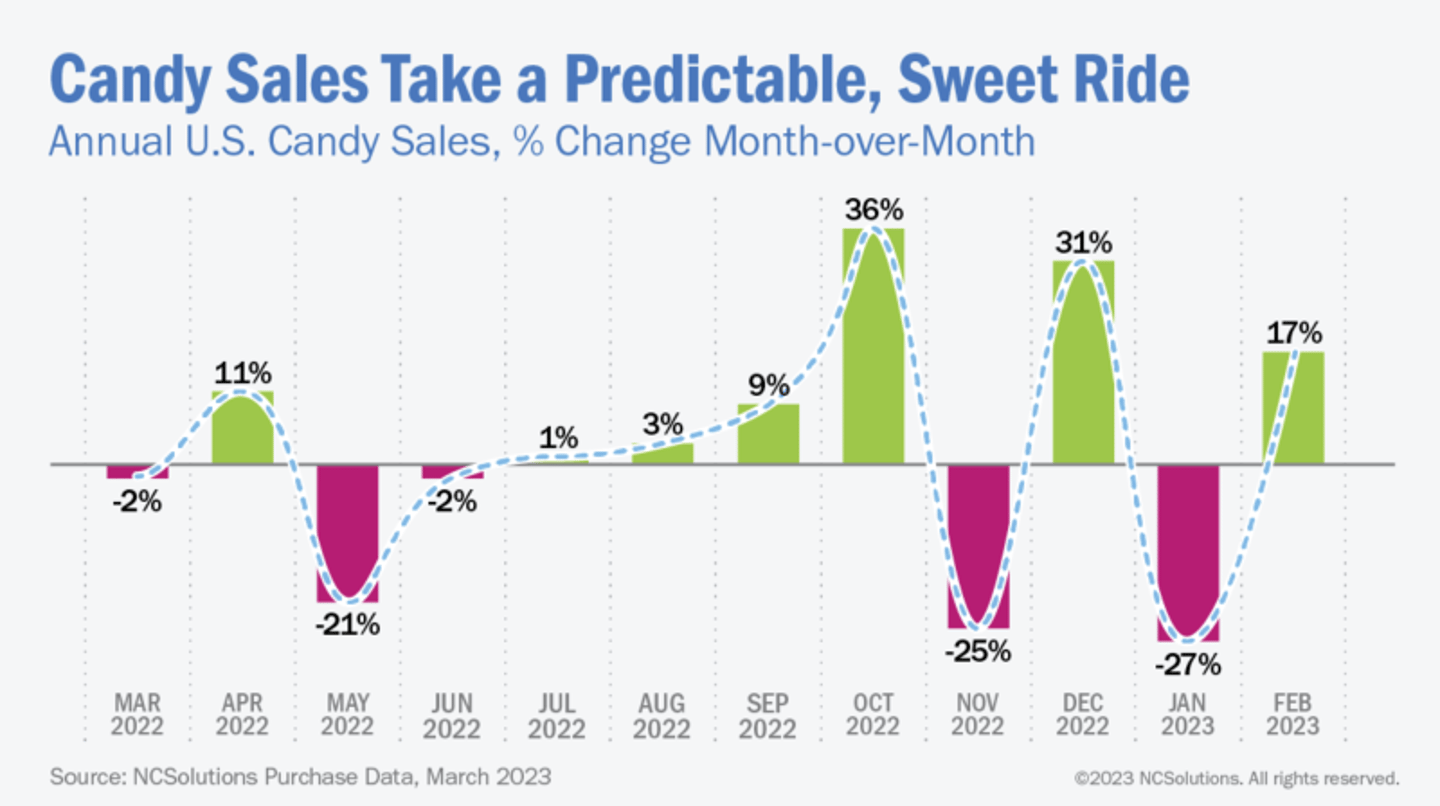

When it comes to the consumption of confections, people are still noshing on candy even as consumption of sweet treats spikes at Halloween, the holidays and Valentine’s Day and tends to level off in the summer, according to NCSoutions. The firm’s research also shows that chocolate remains a fan favorite, purchased 15% more often than other types of candy.