PHOTO GALLERY: Convenience redefined, consumer insights, competing with foodservice, beverage alcohol and more: Highlights from Day 1 of the Conference at the 2025 Convenvenience U CARWACS Show

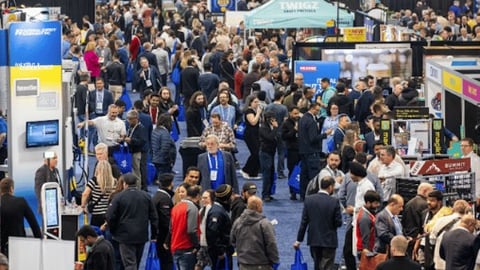

The Convenience U CARWACS Show, the country’s largest trade show and conference for the convenience, gas and car wash industry, took place earlier this week, drawing a sold-out crowd for the conference, close to 6,000 registered attendees and hundreds of exhibitors.

Over the two-day event, the trade show floor was buzzing with activity, as attendees discovered new products and services while connecting with distributors, vendors and suppliers. The newly introduced Sip Lounge was a major hit, giving attendees the opportunity to taste and learn about selections from local wineries and breweries.

Day one started with the morning’s Convenience Education Program — and beverage alcohol was a hot topic. Industry leaders, market researchers and gas and c-store executives discussed the category’s impact since its introduction in Ontario six months ago. Other topics on the agenda included foodservice, shifting shopping habits and strategies for standing out in a competitive retail environment.

The event kicked off with an energetic keynote from Doug Stephens, founder and CEO of Retail Prophet and author of the recent bestseller Resurrecting Retail: The Future of Business in a Post-Pandemic World.

Challenging traditional views of convenience, he told the audience, “It wasn’t long ago that the definition of convenience simply meant being in the right location.” Today, Stephens says, consumers find convenience in having multiple needs met from a single retailer. He pointed to a grocery store that also sells clothing and a gas station that doubles as a pharmacy, offering products like pain relievers and mouthwash.

“Convenience is no longer enough to win the day,” says Stephens, urging the industry to ask themselves: “What other value can I drive to my consumer that’s going to make that difference?”

He highlighted four areas where c-stores can unlock their purpose and heighten value: design, culture, entertainment and/or expertise. After his talk, Stephens made time to sign complimentary copies of his book, as a line of attendees eagerly waited to meet him.

Attendees were then treated to an early look at the 2025 C-store IQ National Shopper Study, with Beth Brickel, vice-president, research at Ensemble IQ (CSNC’s parent company), providing valuable context to the most noteworthy results. Now in its fifth year, the study is Canada’s only convenience and gas specific research into the evolving wants, needs and values of customers.

A question in the survey from the Convenience Industry Council of Canada found 79% of shoppers agree with the statement: “My local convenience store is vital to my needs.” Notably, those who "completely agree" increased by six percentage points, while those who "somewhat agree" rose by seven percentage points versus a year ago. “It is such a striking gain in terms of net agreement — almost four in five shoppers — highlighting the growing relevance and impact of the industry,” says Brickel.

Building on a key point from Stephens' keynote, Brickel noted that 47% of the surveyed 2,000 c-gas shoppers rated “experience” as “highly important” when choosing a store — a six-percentage-point increase from 2024. With less emphasis on rising costs, shoppers are now evaluating convenience stores more positively, particularly in areas like store presentation, product assortment and technology.

Prepared food is a key part of many store offerings today. The study revealed that 55% of shoppers purchased them at a c-store in the past month, an increase of six percentage points.

The survey shows opposition to beer and wine in c-stores has significantly decreased, driven largely by Ontario now having access. Sentiment in B.C. and the Atlantic region is trending toward greater acceptance, with 44% of those residents saying they would like to see it available.

A sponsored session with Eric Gagnon, vice president, corporate and regulatory affairs at Imperial Tobacco Canada, illustrated the revenue opportunity for getting Zonnic, the only nicotine pouch approved by Health Canada as a cessation product, back into c-stores. The Trudeau government banned its sale in the channel on Aug. 28. 2024, restricting it to behind the counter at pharmacies.

As of January 2025, Gagnon revealed that Zonnic sales in pharmacies have skyrocketed by 1,100% since the ban, while the illicit sale of pouches has also surged.

“If we were to bring back Zonnic in convenience stores, and reduced illicit by 10%, we’d be looking at least — and this is a very conservative number — $15 million in profit for the convenience and gas channel,” says Gagnon. He emphasized that Imperial Tobacco Canada will “continue to fight," alongside associations and retailers to make Zonnic available where adults purchase cigarettes most: c-stores.

CICC president and CEO Anne Kothawala discussed a campaign aimed at bringing Zonnic back to the channel during her wide-ranging fireside chat with Michelle Warren, editor and associate publisher of Convenience Store News Canada.

A poster was projected with the message, “Stop the nonsense. End the ban. Restore choice,” and featured a QR code that attendees could scan to sign a petition in support.

The two discussed a wide-range of issues impacting the convenience and gas channel, from tariffs to beverage alcohol, contraband and more. Kothawala shared insights from CICC's State of the Industry Report and emphasized the channel's resiliency in the face of change.

Back-to-back sessions showcased valuable industry research. Emma Balment, director, market strategy and understanding, Ipsos Canada, focused on foodservice in the C&G sector, revealing demand beyond afternoon and late-night snacks. Compared to December 2023, foodservice traffic in December 2024 rose 11% at breakfast, 13% mid-morning, 20% at lunch and 8% at dinner.

Gabriel Moreau, VP of NielsenIQ, shared key beverage alcohol insights for Ontario. Over the past 20 weeks, C&G stores accounted for nearly 40% of beer sales, 15.2% of wine sales and 36.1% of total spirits sales. (The tracking excludes independents.)

A lively panel closed the morning program. Moderated by Michelle Warren, it featured Thea Bourne, retail program manager at BG Fuels; Marietta Cini, Hasty Market’s vice president of operations and sales; Emily Sparrow, project lead and category manager alcohol - Ontario and Quebec, Petro-Canada, a Suncor business; and Manish Thakker, co-owner, Vani’s Convenience in Brampton, Ont.

The panelists acknowledged early challenges, but are optimistic about the category’s solid performance to date and future opportunities.

Asked what needs to happen next, Sparrow hopes to see regulations “loosened to allow this category to function like other categories,” including with “true cross category promotion.”

“Let's bring it to that next level,” she says.

Speaking of next level, thanks to the sponsors, speakers, panelists, exhibitors and attendees for making the 2025 Convenience U CARWACS Show the best yet! Your contributions provided attendees with fresh insights, valuable connections, and innovative products and solutions to help navigate the ever-evolving retail landscape. Until next year!