Zero sugar replacing diet in the beverage aisle

Almost 70 years ago, the manager of a sanitarium for chronic disease in New York City had the idea of creating a sugar-free soft drink for both his patients and the general public. No-calorie drinks had been around since the 1920s. However, he had the vision of commercializing a new beverage, appealing to weight-conscious women as a target market, and offering a selection of flavours—no-cal ginger ale, root beer, black cherry, lime cola, chocolate and more.

Within a year, sales had risen above US$5M. By the end of the decade, multiple competitors had entered the market. Royal Cola launched Diet Rite, which was marketed to diabetics. The name was a play on the word “dietetic” and (initially) it was available only in drug stores.

The first no-cal beverage developed by Coca-Cola in 1963 was called Tab—as in ‘keep tabs on your weight’—because Coca-Cola didn’t want to draw consumer attention to the high sugar content of its core product. In fact, the Diet Coke brand didn’t launch until 1982. PepsiCo followed the same approach. Diet Pepsi started out as Patio Diet Cola, for about a year, until Diet Pepsi hit shelves in 1964. Diet 7Up started as Sugar Free 7Up. It took nearly 20 years for the biggest players to be convinced that “diet” wasn’t a fad, and that the market size and growth of the segment justified connecting diet formulations back to their flagship brands.

Signs of the times

Beverage Marketing Corporation (BMC) provides management consulting, research, and advisory services to the global beverage, food and consumer packaged goods (CPG) industries. Among its products is a comprehensive North American beverage database.

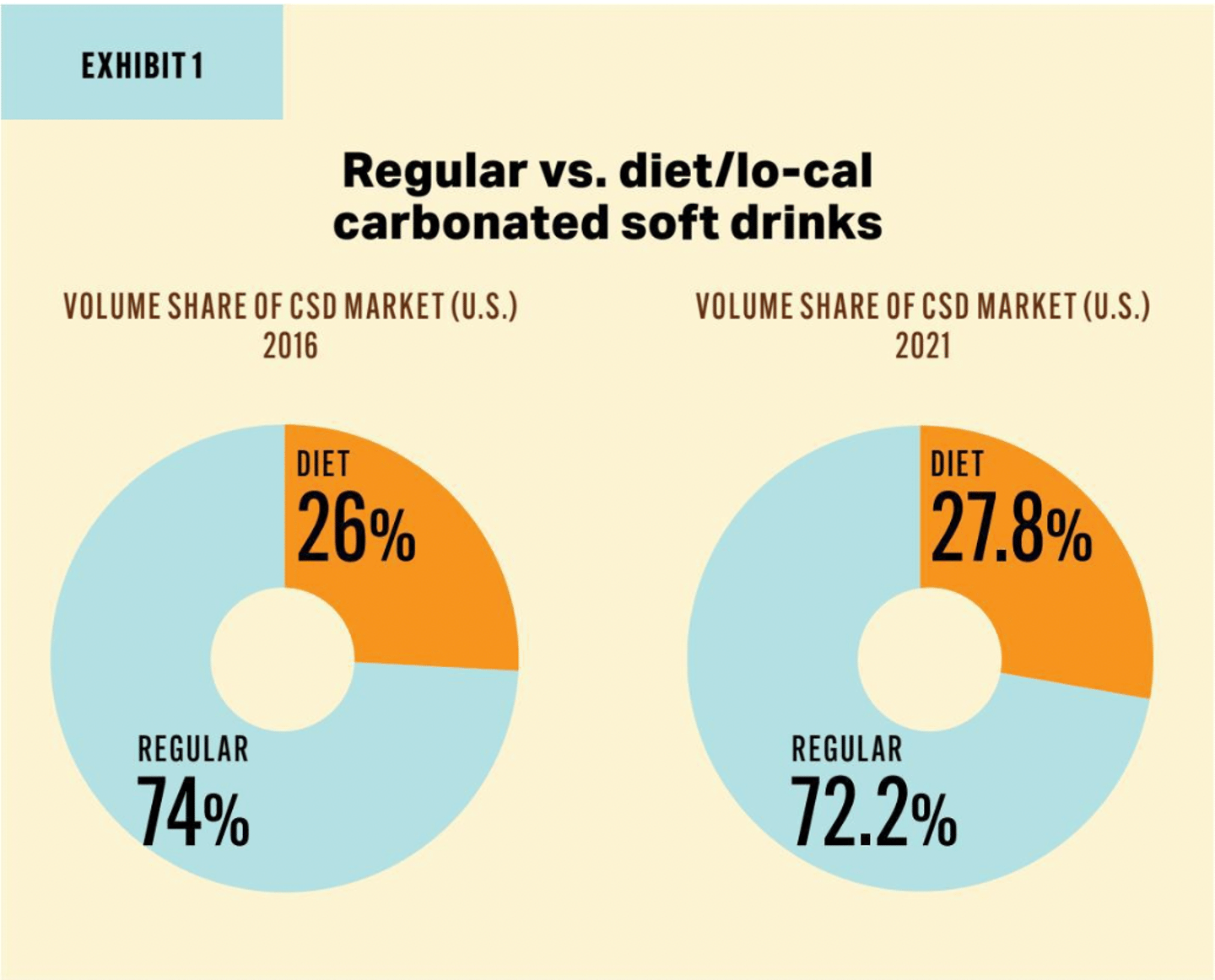

According to BMC tracking, volume sales of “diet” or lower calorie carbonated soft drinks (CSDs) have been rising relative to “regular” CSDs. In the U.S. market, regular CSDs lost nearly half a share point a year between 2015 and 2021 (Exhibit 1). To put it in financial terms, that’s a loss of more than US$250M per year in each of the last five years.

Shrinking diet

The shift has not gone unnoticed: 70 years on, the beverage aisle is again undergoing a major makeover as manufacturers compete for a piece of a growing segment. The “zero sugar” tag is replacing “diet” for many familiar soft drink brands like Canada Dry, Schweppes ginger ale, 7Up, A&W and Sunkist, to name a few. There are a few holdovers, for now—Diet Dr. Pepper, Diet Pepsi, Diet Coke—based on their large and loyal customer bases. While formulations remain largely unchanged, the names and packaging of low/no calorie carbonated soft drinks are being updated.

Greg Lyons, chief marketing officer at PepsiCo Beverages North America, recently explained the motivation for this approach: “Younger people just don't like the word ‘diet’… No Gen Z wants to be on a diet these days." The shift to zero beverages avoids negatives associated with the term diet. Zero seems to connote a halo of healthfulness, in terms of sugar and calories. It’s also a more gender-neutral term—diet tends to be less relatable for younger males.

Zero sugar conversion is getting traction with consumers. According to Derek Hopkins, president of cold beverages at Keurig Dr Pepper (KDP), “Zero sugar launches alone were responsible for one percentage point of market-share gains for the company.”

Meanwhile, an updated Coca-Cola Zero was launched in the U.S. in summer 2021 and enjoyed “accelerated growth,” according to CEO James Quincey. Coke reports that “23% of (these) Coke Zero Sugar consumers are new.”

Water water everywhere

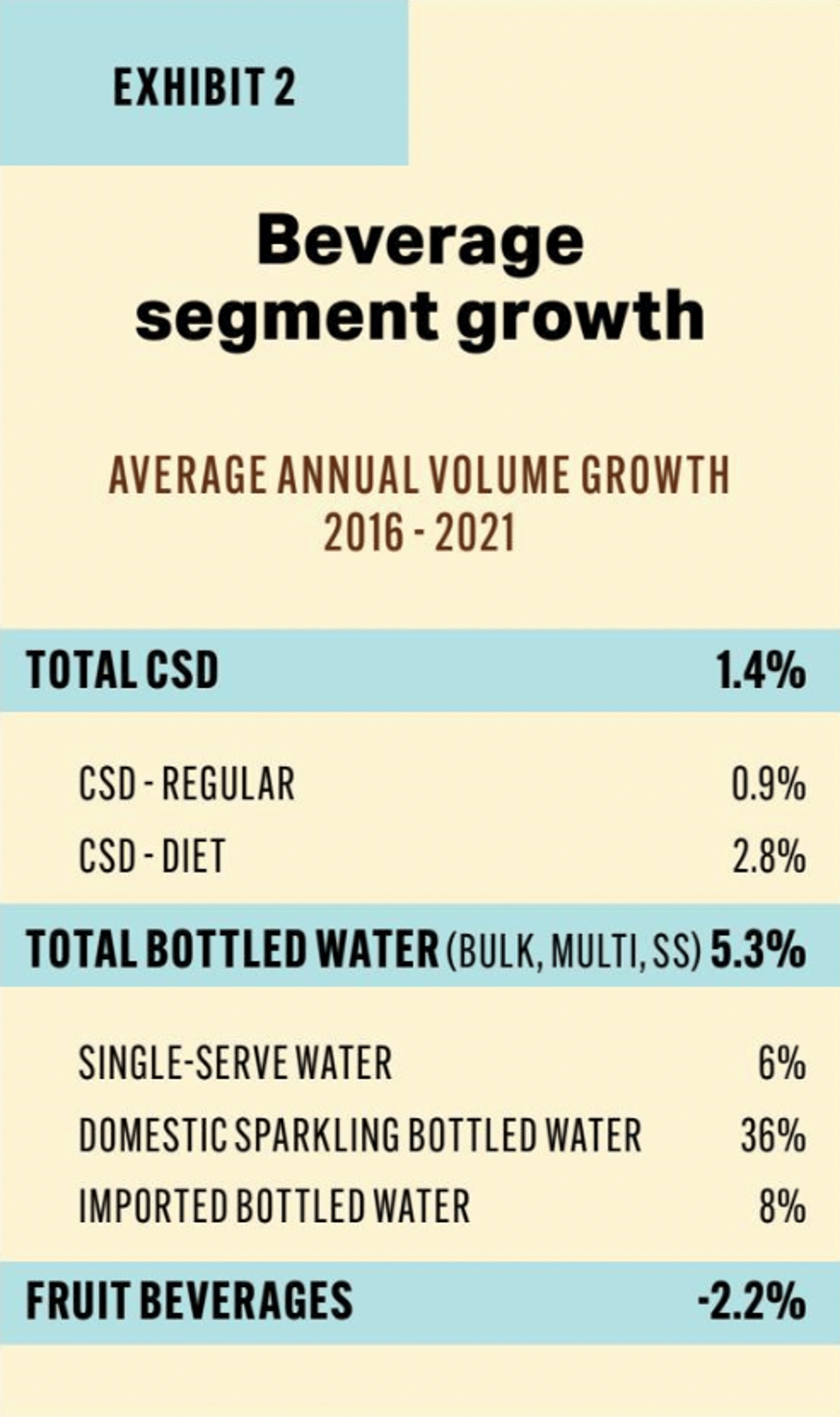

Changing the name and packaging may goose sales in the near term. However, the bigger threat for the cola conglomerates is consumer migration to other forms of hydration, like sparkling and flat water (Exhibit 2). Retail growth rates for water products offering no calories, no sugar, no preservatives, and no additives have far surpassed the volume growth of CSDs. Recognizing the shift, Coca-Cola and Pepsi have become players in the water market. In 2017, Coca-Cola purchased popular Mexican sparkling water brand Topo-Chico for $220 million, to expand its portfolio of flavoured sparkling water brands, including Aha and Fresca, and flat-water brands VitaminWater, Dasani, and SmartWater. PepsiCo Canada owns or licenses a broad range of water brands, including Bubly flavoured sparkling water, and non-carbonated brands Aquafina, Core, Propel electrolyte water, SoBe Zero Calorie Lifewater and Driftwell a functional/enhanced flavoured still water beverage with magnesium and L-theanine, an ingredient to help promote relaxation and aid sleep.

According to Danny Stepper, CEO of LA Libations, a beverage company incubator, "Consumers are voting with our wallets, and sugar is something that people definitely want less of in (their) lives.”

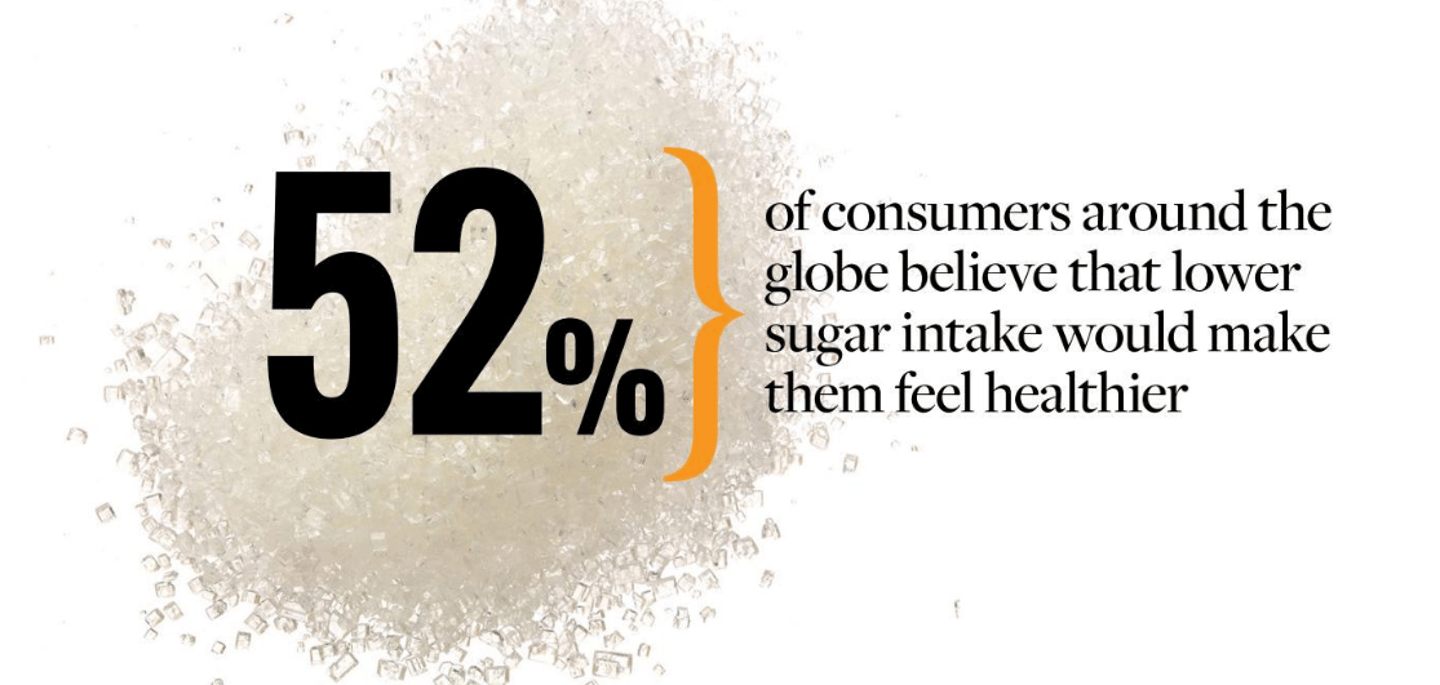

Euromonitor International’s Health and Nutrition global survey established “(an increase in) consumer knowledge about the ill-effects of high sugar consumption. Almost 52% of global consumers hold the view that lower sugar intake would make them feel healthier and 42% mentioned that they would attempt to limit their intake of refined sugars, with stronger intent generally reported among women and older respondents.”

Proliferation of choices

Nathaniel Lim, a senior analyst at Euromonitor International who focuses on non-alcoholic drinks, recently published an analysis on the growing demand for reduced-sugar beverages. He cited high global consumer interest “and growing government legislation efforts, such as sugar taxes” as key elements pushing reformulation and re-branding. This is reflected in the development/reformulation of a wide range of zero sugar products.

Paddy Spence, CEO of zero-sugar upstart, Zevia, recently said: “When we bought the business (in 2009), this was a $5 million brand, highly unstable and with the somewhat insane proposition of competing head on with multi-billion-dollar category leaders." Zevia beverages are currently available via many major retailers across Ontario and Quebec. In the U.S., Zevia has distribution in more than 20,000 stores up from 4,000 locations just three years ago. Sales are now more than US$100M—a 32% compound annual growth rate—and an IPO in July 2021 raised about US$500M in capital.

Spence sees a long runway for Zevia, even in the face of stiff competition from established brands: “Their philosophy is to have an incredible secret formula, lock it in the vault for 100 years, and hope the world doesn't change… We, on the other hand, believe the whole consumer landscape is changing and today brands in beverage not only need to win on taste, but they also need to win with clean ingredients.”

Goes to show, even with zero sugar, the future can still be sweet.