Spending under tension

It won’t shock readers of this magazine to hear that competing forces have been putting pressure on Canadian consumers. Retailers have had to constantly adapt to out-of-stock items on shelves, a multi-year pandemic, rising interest rates, and recessionary fears by raising their own prices. In turn, Canadian consumers have changed their shopping habits.

One-hundred and seventy-two dollars: this is what Numerator Canada’s latest consumer survey, “Purchasing Behaviour Under Pressure: The State of the Canadian Consumer”, indicates that the average Canadian household spent on typical fast-moving consumer goods (FCMG) per week last year. According to the study, that number, $172, has remained stagnant year-over-year since 2021, despite inflation making those goods more expensive.

“The first takeaway we perceived from the study is that Canadians are remarkably committed to a weekly budget – whether that’s consciously or unconsciously,” said Brian Ettkin, head of strategy and solutions for Numerator Canada, who presented the findings from the consumer survey in a webinar this week.

So how are Canadians choosing to spend that $172 budget? And how can you tailor these lessons to benefit your c-store or gas station?

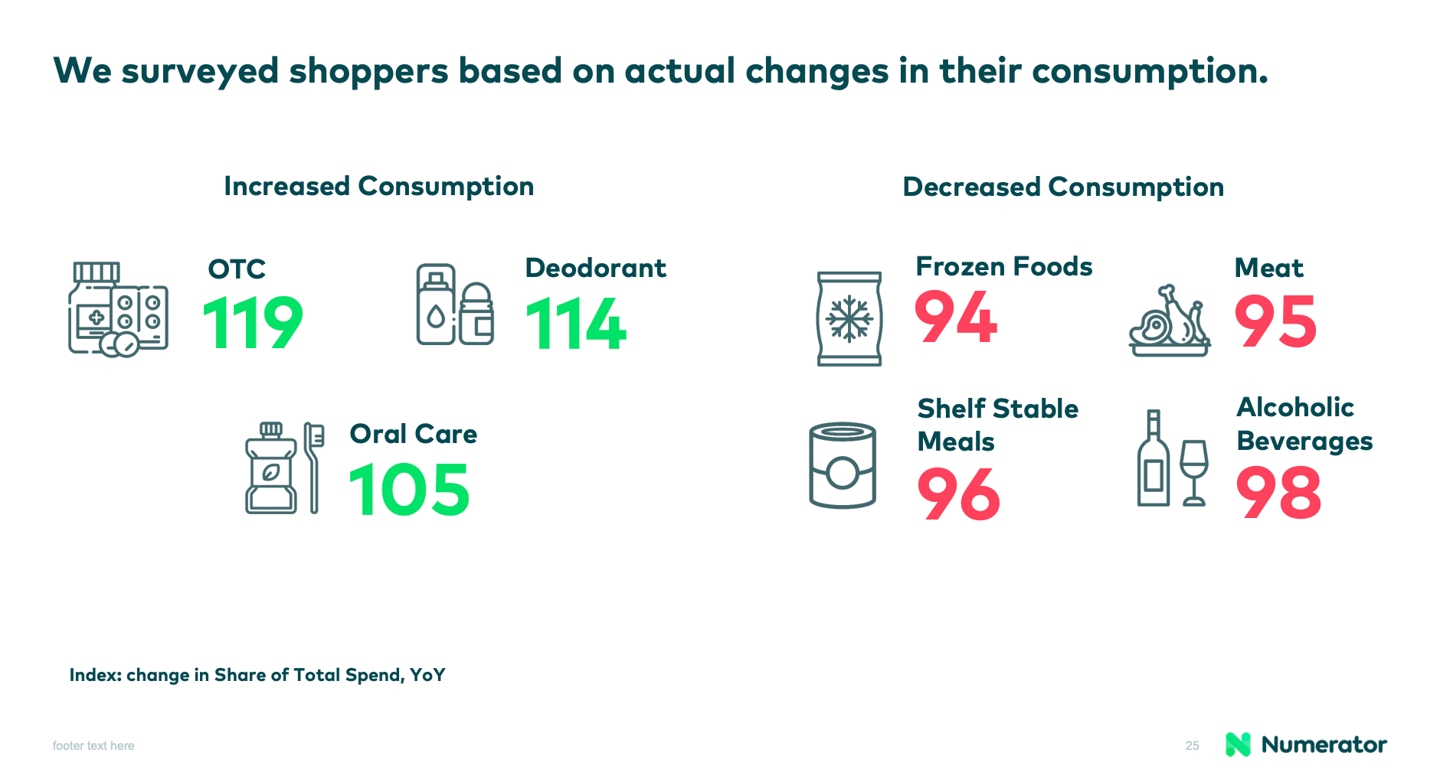

For starters, Canadians spent 8.3% more on health products in 2022, driven primarily by a 20.5% buy rate in personal health care products. In that category, Canadians bought 6.2% more pain relievers in 2022, versus 2021, and 33.7% more cold, cough and flu products. The data found that Canadians were also buying these items more frequently, with purchase frequency in the personal health care products category up 18.4% last year.

“Consumers are being forced to make trade-offs with other food and health and beauty aids (HABA) products in order to afford health care products,” says Ettkin.

On average, Numerator found that consumers are choosing to buy less in categories like FMCG (which includes products like milk, gum, toilet paper and soda), grocery, and household items – categories which saw 1%, 1.3% and 4.5% declines in dollar buy rate last year, respectively – while HABA items saw a relatively steep 5.2% increase.

In looking at the average dollar buy rate, the numbers seem bearable, but when considering the unit buy rate – how much of an item Canadians were purchasing – the numbers have a grimmer outlook. On average, Canadians bought 9.6% less FMCG items, 9.3% less grocery items, 15.5% less household items and 3.8% less HABA items.

Independent retailers have faced more of a pinch than other channels. Numerator found that on average, Canadians were visiting c-stores 0.1% more over the past twelve months, but purchasing 11.9% less items and spending 5% less.

“In turn, Canadians are choosing to shop at drug, dollar and club stores more often,” says Ettkin.

[Read more: “Dollarama sales rise as consumers flock to lower prices amid high inflation”]

Overall, food spending saw a significant decrease last year. Numerator also found that changes in behaviour stretched beyond the cash register, and into Canadians’ consumption, with Canadians choosing to decrease their consumption of frozen foods, meat, shelf-stable meals and alcoholic beverages.

When asked if the change in how much they buy was intentional, 69% or more Canadians reported making a conscious decision to cut back on spending in each of the four declining food and beverage categories.

[Read more: “Transparency on food prices key to rebuilding trust for consumers”]

So what can you do as an operator?

In terms of keeping customers returning to your store, the survey suggests a couple of things that you can implement as an operator:

Promotions

“Across the board we see that people are putting less in their basket per trip. Part of that is the cost of products, but another part of it is that consumers are actually shopping around for the best deals,” says Ettkins, “Promotions will continue to be critical for keeping consumers in a category.”

In 2022, 51% of respondents said they would buy more frozen food products when they’re on sale, while 56% said the same for both meat and shelf-stable meals.

In terms of promotional offers, “Multi-buy/buy-one get one offers” fared the best with consumers, with 37% of respondents saying that would encourage them to increase their spending on alcoholic beverages, 45% saying it would encourage them to spend more on frozen foods, and 47% responding favourably to BOGO offers on both the meat and shelf-stable meals category.

Loyalty programs

Of the options to increase consumer spending on grocery products, loyalty programs proved themselves as a prudent choice for c-stores to implement.

When asked if points from retailer loyalty programs would encourage them to increase their spending, 38% of respondents responded positively in the alcoholic beverages category, 47% said it would encourage them to increase their spending on frozen foods, 42% said it would on meat and a whopping 51% said it would on shelf-stable meals.

[Read more: “Canadian Tire launches fee-based Triangle Rewards subscription program”]

Throughout the year, we’ve seen major retailers expand, implement or consider new ways to deliver loyalty programs to their customers. As the data shows, it's just one option to try to influence consumers. Between promotions, loyalty programs and tailoring your offering, the best advice may always be to meet your customer's needs.