2025 Forecourt Performance Report: A closer look at Canada’s retail gasoline market

While the study was done before this time of market uncertainty, rising unemployment and a trade war with our largest trading partner to the south, Canada’s retail gasoline sector remained relatively stable according to the 2024 National Retail Petroleum Site Census from Kalibrate Canada, Inc.

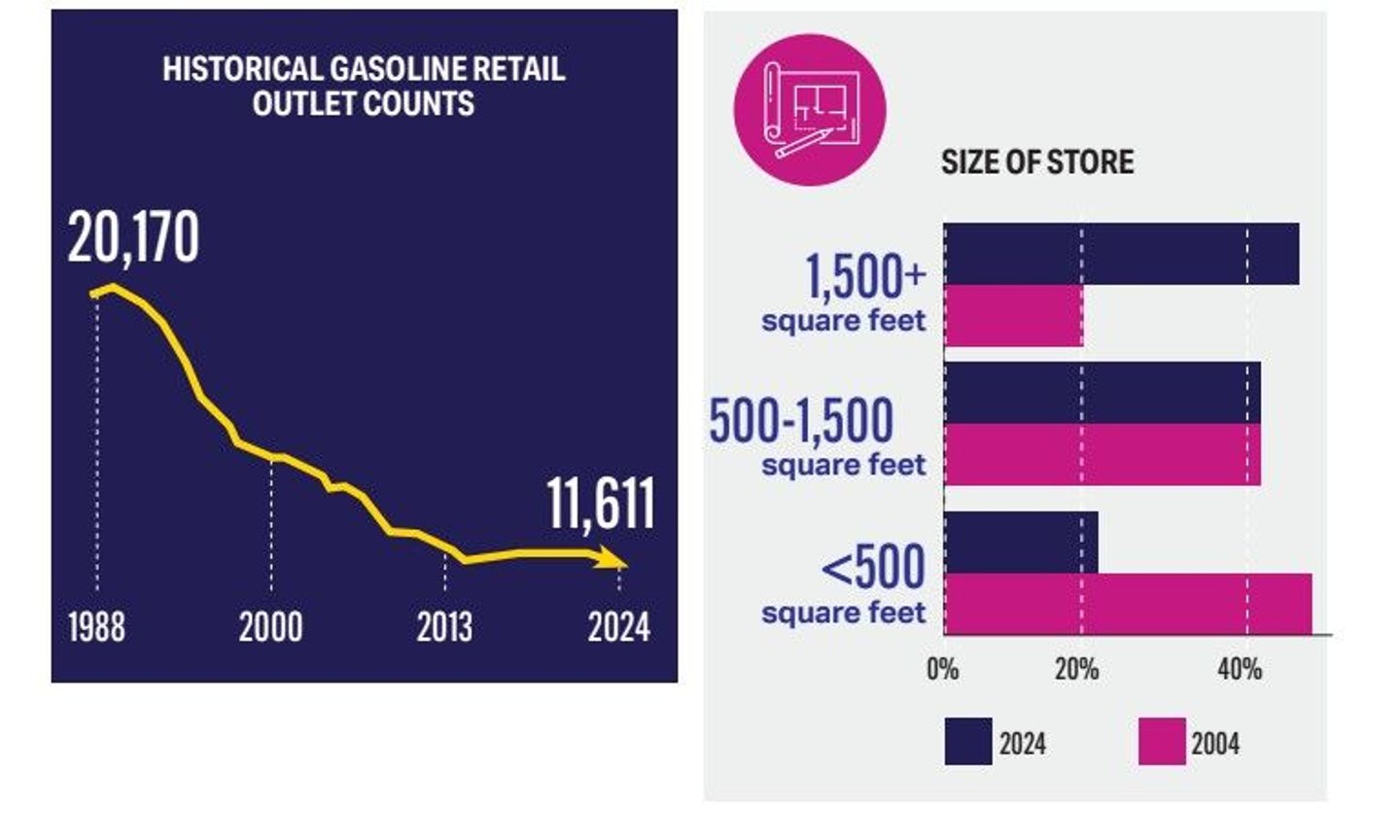

The report— the complete report is available for purchase from Kalibrate Canada Inc.— that details the structure and market dynamics of Canada’s gasoline stations and fuel marketers, finds that as of the end of December 31, 2024, there are 11,611 gasoline stations across Canada, which equals 2.8 outlets for every 10,000 persons. According to Kalibrate, there has been a decrease in the number of gas stations from 2023, some 102 fewer sites or a 0.9% decrease from 2023. Still, while for the last decade the number of gas stations remained relatively stable, the number of stations has dropped considerably since its peak in 1989 when there were a recorded 20,360 sites across Canada.

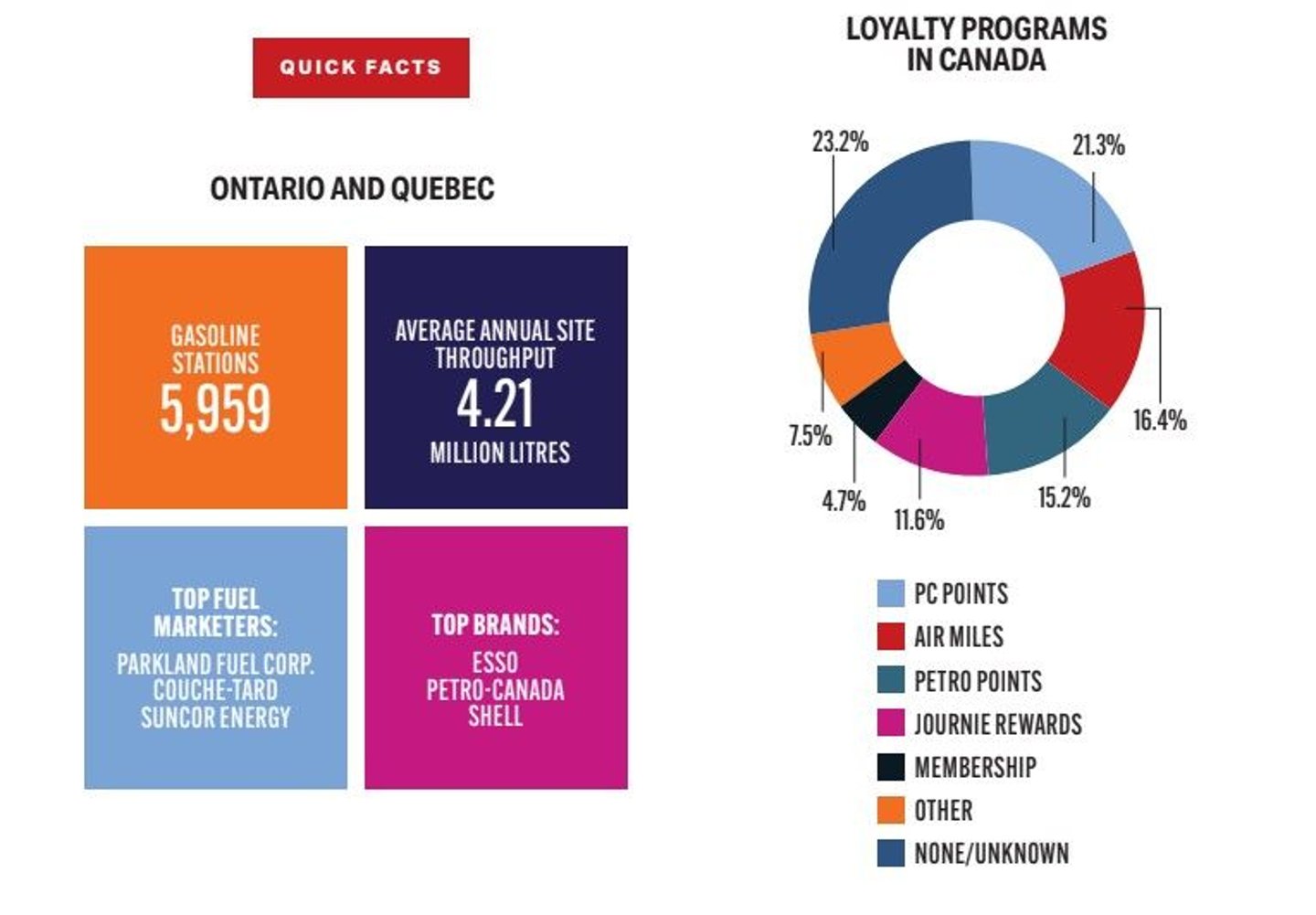

When broken down by region, a high number of gas stations are concentrated in Ontario and Quebec. Kalibrate finds that these two provinces combined have a total of 5,959 stations and have the highest average throughput, at 4.21 million litres per station. Major fuel marketers include Parkland Fuel Corp., Alimentation Couche-Tard and Suncor Energy.

The Atlantic provinces have 1,254 gas stations, with a throughput of 2.76 million litres annually. The largest marketers here are Couche-Tard, Sobeys Capital and Irving Oil. The Prairie Provinces have a combined total of 2,951 stations, with the average throughput pegged at 3.15 million litres. The West Coast, made up of British Columbia/Yukon has a total of 1,447 gas stations with a recorded annual site throughput of 3.56 million litres. The top fuel marketers here are Parkland Fuel, Suncor Energy and Shell Canada, with the top brands being Petro-Canada, Chevron and Esso.

According to Kalibrate, the decline in the number of gasoline retail locations across Canada was likely the result of oversaturation in the market in the late 80s, followed by a period of rationalization amongst fuel marketers. That involved focusing on sites that were selling higher volumes of fuel and subsequently shutting down those deemed inefficient. As the market adjusted to this new reality, the pace of closures has slowed, and the number of sites has remained relatively stable over the past year.

COVID also had a significant impact on Canada’s gasoline retail landscape. With provinces enacting work-at-home policies to reduce the spread of the virus and ease the pressures on emergency rooms and hospitals, Canadians drove less. Statistics Canada reported that in 2021, lockdowns led to “2.8 million fewer commuters, compared with five years earlier. The number of Canadians ‘car commuting’— that is, travelling to work by car, truck or van as a driver or as a passenger—declined by 1.7 million from five years earlier to reach 11 million in May 2021.”

In turn, Kalibrate finds that while 2024 fuel sales have increased, and have increased over the past four years, fuel sales are still lower than what they were pre-COVID.

The Shell, Petro-Canada and Esso brands appear at 45% of Canadian gas stations, however, just 11% of Canadian gas station prices come under the control of the oil companies associated with those brands.

Big oil does not control all retail gas operations

A common myth is that Big Oil controls gas stations and they are the ones that set gasoline prices in Canada. It is something Canadians love to grouse about over their Tims coffees, especially during holidays and most often during the summer months where prices change when it seems everyone is heading off to cottages. It is a summer tradition, one might say.

The reality, though, is very different.

In 2024, Kalibrate identified 90 distinct fuel brands in Canada, down from 97 in 2023. The top three brands—Esso, Petro-Canada and Shell—account for about 45% of Canadian gas stations.

While those top three brands are owned by refining companies—Imperial Oil, Suncor Energy and Shell Canada—Kalibrate notes that only some 1,333 or 11% of all the gas station sites in Canada

are marketer-controlled and have their prices set by the refiner. In fact, most sites are price-controlled by “independent proprietors or companies not involved in refining petroleum products . . . In 2024, the number of sites controlled by an integrated refiner marketer accounted for just 22% of all sites, totalling 2,582 locations. The number of sites controlled by refiners has generally declined over the past two decades, with nearly two thousand fewer sites under the price control of a refiner marketer.”

So, as much as Canadians may wish to believe that Big Oil controls the price at the pump, the reality is prices are controlled by other market forces, seasonal changes in fuel blends and even refinery shutdowns for maintenance. Not that any of this will stop the annual tradition of grousing about gasoline prices over a Tims.

The retail gasoline marketplace is predominantly made up of self-serve gas bars, with 85.8% of reported outlets operating in this manner. There has been a notable shift away from full-serve offerings.

Electric vehicle charging landscape

An interesting trend highlighted by the Kalibrate study is the increasing number of electric vehicle (EV) charging stations at gasoline stations across Canada.

In 2024, 14.6% of new vehicle registrations in Canada were related to some form of battery electric vehicle (BEV) or plug-in hybrid electric vehicle (PHEV), representing 271,000 vehicles. This is an increase from just 518 vehicles in 2011.

In 2024, 555 gas stations offered charging stations for electric vehicles, an increase since Kalibrate began looking at EV charging in 2019, when only 119 stations had EV chargers and 201 in 2020! With its strong EV adoption rates, Quebec leads with 217 locations offering EV charging stations, followed by British Columbia with 106 locations offering EV charging and Ontario with 105 stations offering EV charging. Fuel marketing companies are also starting to step up with 27 providing EV charging stations, up from 11 in 2019.

Kalibrate anticipates more electric charging stations being added at gas stations in the coming years with the increasing number of electric vehicles being sold in Canada. However, it is best to keep in mind that for every BEV or PHEV that was sold in Canada in 2024, five gasoline vehicles were sold. That means the need for Canadian gas stations to continue to sell gasoline, and diesel will remain strong for many years.

The benefit to adding EV chargers is doing so helps in sustaining revenues for convenience stores, quick-service restaurants (QSRs), and car washes that are part of many gas stations. It needs to be

remembered that the average charging time for most EVs is around 20 to 30 minutes, a significant window of opportunity for incentivizing people to move into a convenience store or café or to use the car wash once the vehicle is charged.

EV charging stations can help move consumer perceptions of the traditional gas station from a place to simply fuel up to being a “destination stop,” where consumers can enjoy amenities such as free Wi-Fi or a café or QSR with curated local food and beverage offerings while charging their vehicle.

The changing c-store and loyalty offerings

There is an old joke that a c-store that is part of a gas station only sold “smokes and Cokes.”

Today, that is changing dramatically. While in 2004 nearly 45% of gas stations had a convenience store that was 500 sq. ft. or less in size and had a rather traditional set of snack and drink offerings, by 2024 small-sized stores are now seen much less. Now, the small kiosk-style convenience store only makes up some 21% of operations at gas stations, while larger sized convenience store offerings —anywhere between 500 sq. ft. to 1,500 q. ft. or more—makes up more than 37% of the convenience store locations.

Much of that size growth is being driven by large convenience store retail operators, such as Couche-Tard and 7-Eleven, making significant investments in the sector. The larger size also provides opportunities for such operators to enhance food and beverage offerings, from on-site freshly made meals, healthy snack offerings, such as fresh fruits and vegetarian and vegan meal packages, to beverage alcohol, with a good mix of craft brews and local wines combined with seasonal meals and snack packages.

QSRs are also becoming more common, adding extra value to the gas station operation with nearly 24% of locations now offering a QSR, thereby helping increase traffic to the gasoline and EV charging services.

Another way gas stations are working towards becoming a “destination stop” is by leveraging loyalty programs. Loyalty offerings are a means to attract customers to earn points that can be used to future fuel purchases to offerings in the convenience store and QSR operation, or the car wash.

In 2024, nearly 9,000 gas stations (77%) offered some form of loyalty program, an increase from 8,500 locations (73%) in 2023, the first year this data was collected. As to be expected, most loyalty programs being used are associated with PC Points, Air Miles, Petro Points, and Journie Rewards.

All this points to gas stations and their convenience operations evolving to meet changing consumer demands and to develop new or expand existing profit centres.