2024 Tobacco + Vaping Report

When adult customers step into Family Variety in Bolton, Ont., a town northwest of Toronto with about 27,000 residents, they can walk straight ahead into the c-store to purchase lottery, cigarettes, snacks, drinks and the other usual items.

Or they can open the sliding door to their left, where Family Variety operates a small vape shop.

Prominent signage on the door indicates entry is restricted to adults 19 and over. Wide enough to accommodate about two adults at a time, the shop’s side and back walls feature floor-to-ceiling shelves of vaping devices (pens, pod systems, disposables), as well as e-liquids/juice, pods and cartridges in flavours like “super spearmint,” “explosion orange,” “tropical breeze” and “bussin’ banana.” Brands include Flavour Beast, STLTH, Allo, Fruitbae, Vuse, Level X, Pop Vapor, Veeba, Ghost and Salt Nix.

The only evidence of the vape shop to passersby at Family Variety—located in a busy shopping plaza alongside other retailers like Chatime, Hakim Optical, Dollarama and Bulk Barn—is a large white window covered with the words in big black lettering, “Bolton Vapes.” In adhering to provincial regulations, the covering blocks vaping products and promotions from being visible to minors.

Opened in June 2022, “it’s doing well,” says Family Variety owner Christopher Reyhani, a 2023 Future Leaders in Convenience + Car Wash winner.

The shop is connected from behind the counter to the convenience store, allowing the cashier to slide between serving c-store and vape customers—no extra staffing required. Bolton Vapes has 35 5-star Google reviews praising the wide selection and prices.

Customers seek alternative products

“The c-store industry is evolving, and consumers are looking for smokeless alternatives,” says Reyhani. “Vapour products have become popular over the past few years. With increased demand for vapour products, companies have grown in selection and value for the consumers.” Products with the best value, he notes, “last longer and cost less” than competitors

That includes market leaders like Pacific Smoke International headquartered in Markham, Ont., a wholesale distributor of electronic vaporizes and e-liquids including Flavour Beast and Allo. “We have established a strong foothold in the independent c-store market,” notes Gero Petrolito, who leads the convenience and gas channel at Pacific Smoke. (See Q&A below.)

As for Reyhani’s advice for c-store owners and managers? “With alternatives to nicotine-delivery, retailers should keep up to date with products that consumers are interested in.”

Delivering results in all sorts of ways

According to the Convenience Industry Council of Canada (CICC), cigarettes, e-cigs, other tobacco and pipe/cig tobacco are the top four declining categories at convenience. One of the big reasons for this is the rise in contraband, with bad characters brazenly taking to online marketplaces to move illicit product (see “Contraband battle moves online”below.)

Still, these categories deliver a whopping $3.9 billion in annual sales for the channel nationwide—roughly $175,000 per store—and account for 7% of total c-store sales and 45% of in-store sales.

“The nicotine category is still the number one non-fuel contributor to Parkland’s On the Run convenience store sales,” says James Rolph, Parkland’s director, Canada convenience retail. “Not only do they help generate traffic, our nicotine customers gravitate towards other in-store offers like coffee, sandwiches, beverages and snacks.”

The rise of reduced risk products

Rolph is also optimistic about the evolution in the category brought on by product innovation. Think vapes, nicotine pouches and heated tobacco sticks.

“As our customers move toward risk-reduced products, we see solid growth in these areas and aren’t forecasting a slowdown anytime soon,” says Rolph. “The exception to this would be in markets where flavour bans have been implemented or are coming into effect. For example, we are now into the third month post-flavour ban in Quebec, and to date have not seen the category rebound.” (See “Flavour profile by province” below.)

One example of a newer product is Zonnic, nicotine pouches from Imperial Tobacco Canada (ITCAN) that Health Canada approved for sale as a nicotine-replacement therapy. First launched on Oct. 31. 2023 in pharmacies in Quebec (where smoking cessation products only can be sold, not tobacco), Zonnic is now carried in about 5,800 outlets nationally, the majority—about 4,800 stores—being in the gas and c-store channel, as opposed to pharmacy. (By comparison. ITCAN cigarettes and its vaping brand, Vuse, is carried in 23,000 convenience outlets across the country.)

“Our rollout of Zonnic will continue to expand further into the c-store footprint, as we want to make sure these products are available where smokers buy cigarettes and can switch to less harmful options,” says Michael Bonelli, vice-president, commercial marketing and sales, at ITCAN, which has been undergoing a transformation into a smoking cessation solutions manufacturer.

“We still sell cigarettes, but vaping and cessation products are what we talk about 90% of the time,” says Bonelli. “Our whole business is now centered around providing less harmful products to the market, including through our partners in convenience. It’s paramount that we work with them.”

Japan Tobacco International (JTI) has numerous reduced risk products, but has yet to launch them in Canada.

“We are currently monitoring the business environment and assessing the impacts of potential regulatory changes in the future, in so far as products that have the potential to reduce risk are concerned,” says Elaine McKay, head of corporate affairs and comms, JTI Macdonald Canada.

Of heated tobacco sticks (HTS), McKay says the category remains small in Canada “mainly because of the unfavourable format and taxation,” but that it’s showing “continuous growth driven by increases in immigration post-COVID.” HTS are popular in parts of Asia and Europe.

Nicotine pouches is another relatively small product category, but “has growth potential if you benchmark Canada against the U.S. market.” For now, though, she says “there remains an uncertainty around how regulation will develop in Canada.”

Still, despite the regulatory challenges, it’s clear the tobacco and vaping category isn’t without opportunity and potential.

Flavour profile

Canada: In 2021, the federal government proposed regulations that would restrict flavours in vaping liquids to tobacco, mint, menthol and a combination of those flavours, and prohibit all sweeteners and sugars as well as most other flavouring ingredients in vaping liquids. Since August 2022, the response to these proposed regulations has been under review. However, the federal intention to finalize the regulation was called into question in March 2023 when the revised Departmental Plan was published without making reference to it.

Quebec: On Oct. 31, 2023, Quebec banned the sale of any e-cigarette liquid other than tobacco flavour, joining Nova Scotia, Prince Edward Island, New Brunswick, Northwest Territories and Nunavut with such legislation.

Ontario and Saskatchewan: C-stores can sell vape products at counter in menthol, mint, tobacco and flavourless (clear). Anything else, like fruit flavours, can only be sold in an age-restricted specialty vape store. If attached to a c-store, it must have its own door entry. (In other words, customers can’t walk through the c-store to get to a “vape room.”)

Manitoba and Alberta: C-stores in the two provinces can sell all flavours at counter to adults 18 and over. No cap on mL. Manitoba has tabled legislation that would increase the legal age for buying tobacco and vaping products to 19.

British Columbia: C-stores can sell tobacco flavoured e-substances. Flavoured products can be sold at age-restricted sales premises; like in Ontario, the store needs to have its own door entry and street address, and like Quebec, there is a liquid volume cap of 2 mL. B.C. requires convenience stores to provide a Letter of Intent through their government portal on all items the store is selling. Any new products need to be added to the store's NOI and posted to their B.C. government portal six weeks prior to selling the product. Annual sales reports must also be provided to government.

Contraband battle moves online

Illicit tobacco used to be sold largely out of the trunk of a vehicle, with some even set up in c-store parking lots.

“Now that transaction is being replaced by the click of a mouse,” says Jeff Brownlee, VP, communications and stakeholder relations, the Convenience Industry Council of Canada.

At press time, CSNC did a quick Google search and came across more than half a dozen websites selling contraband cigarettes and vaping products to Canadians. Some sites even feature customer ratings on products and expedited delivery though Canada Post’s Xpresspost. “That consumers can get their product delivered to their door by a Crown corporation legitimizes these websites to consumers,” says Brownlee. “The illegal activity is very blatant.”

Contraband is also being sold on online marketplaces.

Danny Fournier, manager, illicit trade prevention at RBH Canada—who spent more than 25 years in law enforcement specializing in organized crime investigations, including with the Quebec Provincial Police where he oversaw drug and contraband tobacco enforcement operations—says illicit trade of tobacco online has “not been very prevalent” until recently.

Contraband tobacco is estimated to represent 69% of the market in Ontario, 45% in British Columbia and 44% in Newfoundland, according to an EY Canada study in 2023 commissioned by the CICC.

According to RBH’s estimates, 25% of illegal cigarette sales are now online transactions.

“But if you include the next generation of products that are not combustible cigarettes, such as vapours, the percentage is higher than 25%, because some provinces have implemented bans on vaping flavour products,” says Fournier.

For example, there is little stopping people in Quebec, where vape flavours are banned, from making an illegal online order in Ontario. “There is no national coordination on this,” notes Fournier.

Highlighting the role the private sector can play, RBH Canada is working with the likes of Kijiji and Craigslist to remove ads hawking contraband.

“Kijiji alone was getting 100,000 new posts every day last fall for tobacco—I knew it would be large numbers, but I was expecting 10,000 or 20,000 per day—and so a combination of their technology and human intervention on our part helps identify and prevent those posts from going or staying up.”

One online marketplace where it doesn’t have cooperation: Facebook Marketplace. Fournier says they can’t get through to a real person to discuss the issue.

As for websites, RBH has had the most success working with the likes of Visa, MasterCard, Moneris and PayPal in curbing illicit sales, by shutting down their payment vehicles. Another option is to contact their ISPs, but some of them reside outside Canada.

Robust commercial operations of contraband tobacco online are reported to law enforcement.

“Online sale of tobacco and nicotine products is growing exponentially given the ease and convenience of ordering online and delivery,” agrees Elaine McKay, head of corporate affairs and comms, JTI Macdonald Canada. “When we are able to identify these sites, we conduct research and gather actionable information that is then provided to law enforcement and regulatory bodies.”

Q&A with Pacific Smoke’s Gero Petrolito

A former VP in vendor engagement at LoyaltyOne (former operator of the Air Miles program), Gero Petrolito has led the convenience and gas channel at Pacific Smoke International since mid-2022 and recently caught up with CSNC.

What makes Pacific Smoke a market leader in Canada with brands like Flavour Beast, Drip’n and Allo? Our adaptability—it’s seen in our success throughout independent convenience where our diverse range of brands, including top performers like Flavour Beast, Drip’n and Allo, have gained significant loyalty among adult vapers. This success has paved the way for us to bridge the gap and extend our partnerships into major corporate chains like 7-Eleven Canada [its first national C&G partner]. A second new partnership will hit the shelves at the beginning of March, marking another milestone in our journey.

How important is the c-store channel? We anticipate the convenience store channel remaining a critical component of our growth strategy, contributing to our brands' visibility and sustained sales growth. There are still 3.8 million Canadian smokers that purchase their cigarettes at convenience stores—this provides a huge opportunity to convert smokers to a much less harmful alternative.

How do you recommend retailers approach the challenging regulatory environment? Despite the likelihood of increased taxation at both federal and provincial levels, vaping remains cost-effective to produce, allowing consumers to vote with their wallets and opt for a more affordable choice to satisfy their nicotine needs. As adults increasingly turn to vaping products, it becomes critical for stores to effectively navigate these regulations. C-stores can focus on education and compliance. It is important to understand display guidelines, usage regulations, and take strict adherence to age restrictions specific to each province. In a landscape where vaping represents a more affordable and safer alternative than cigarettes for nicotine users, convenience stores can position themselves as trusted partners in this evolving market.

What are best practices for c-stores carrying vaping products? We believe in the power of the right assortment. Like beverages, we recognize that the top SKUs drive the most sales, especially in the convenience channel where space is limited. By offering the best flavours, brands and price points in-store, we maximize volume while minimizing space requirements for success.

What developments are being made around the waste caused by vaping components? Planning is underway for a national recycling program, a significant step toward mitigating the environmental impact. However, challenges arise in provinces like British Columbia and Quebec, where a 2 mL restriction may inadvertently contribute to increased waste. By limiting pod capacity to 2 mL, consumers are compelled to purchase smaller pods, resulting in additional waste. While these restrictions aim to reduce access to minors, it is important to note that closed systems, disposables, and pods, governed by CRC rules, pose minimal risks compared to open containers. We have also introduced the innovative Level X line, which is a hybrid battery and pod system, whereby only the pods need to be replaced. This reduces the consumers' need to toss harmful electronic components like batteries. Balancing environmental concerns with regulatory goals is crucial for fostering a sustainable and responsible vaping industry.

What is the convenience store doing well in this category and where could they be improving? Stores do very well in validating age restrictions and ensuring legal compliance in the sale of nicotine and vaping products. Initiatives such as “Responsible Retailing” by the CICC and “ID Please” have proven effective in preventing the sale of these products to minors. A potential area for improvement lies in managing the shelf space and the assortment of vape inventory. Convenience stores can leverage category management principles to optimize return on investment and maximize sales. A sizable percentage of vaping products are sold in vape stores, and there is little data that can be leveraged, so convenience retailers need to become entrepreneurial in their sourcing of data to become a leader within the vaping category.

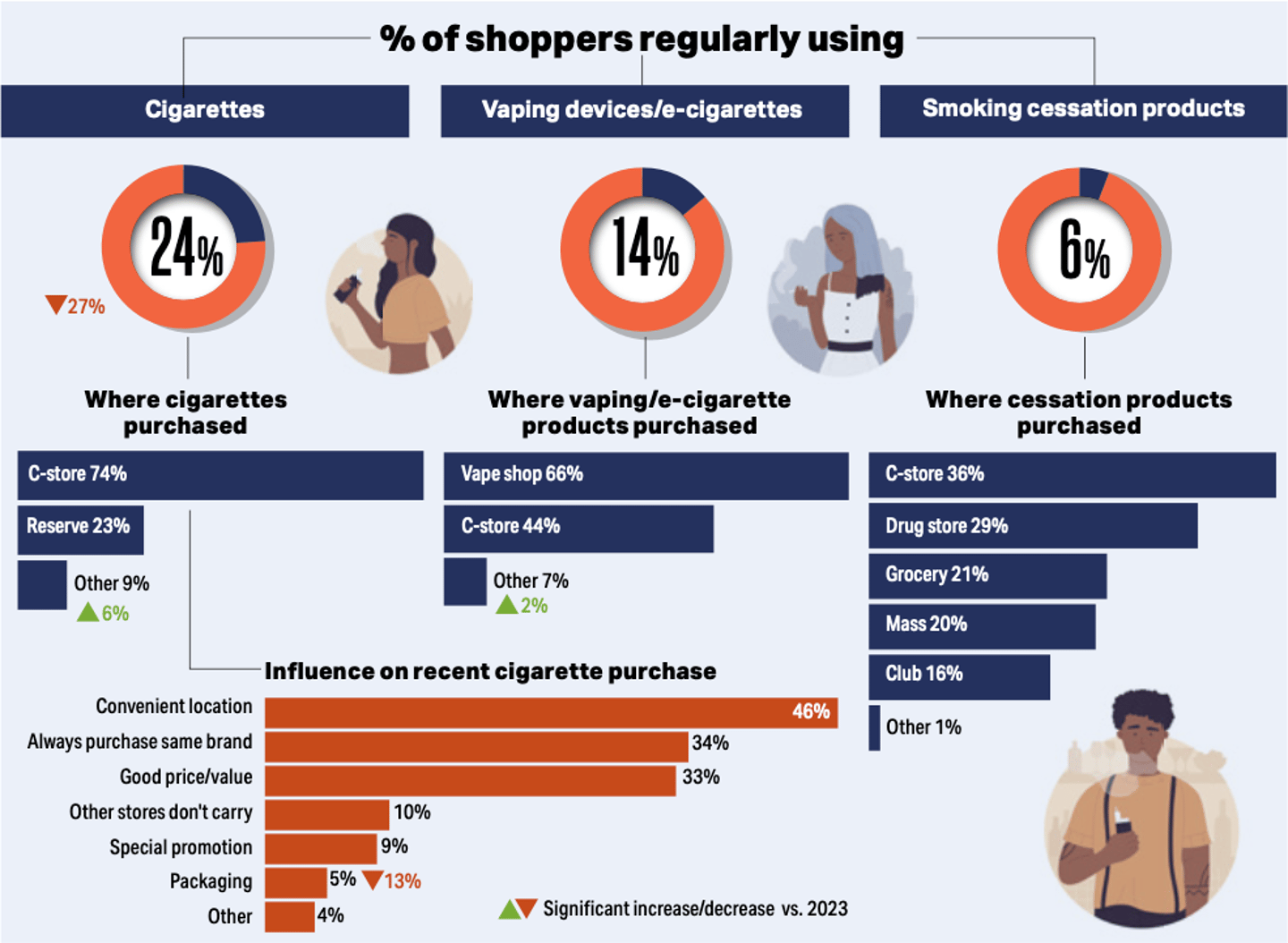

In 2024, there’s a notable drop in convenience shoppers who regularly use cigarettes, while new data reveals smoking cessation products are gaining market share.

Three-in-four smokers say they purchase from c-stores and that decision is influenced by convenient location, brand and price, according to the 2024 C-store IQ National Shopper Study.

· Males more than females are influenced by price (38% vs. 28%).

· Younger—millennials and generation Z—shoppers are more influenced by special promotions than older shoppers—generation X and boomers—(12% vs. 6%) and packaging (8% vs. 3%).

· Shoppers in the Atlantic region are most influenced by location (61%), compared to Quebec (44%), Ontario (42%) and B.C. (39%).

People purchase from multiple locations and this year those reporting they purchase from a reserve dropped to 23% from 26% in 2023 (but still higher than 19% in 2022). It’s worth noting that these numbers fluctuate greatly by province, with 35% of smokers in Ontario saying they purchase from a reserve, compared to Alberta (19%), B.C. (17%) and Quebec (10%). In Quebec, 78% of smokers say they purchase from a c-store vs. 66% in Ontario.

There is a notable generation divide when it comes to preferred habits.

Younger shoppers are more likely than older shoppers to use vaping devices (18% vs. 10%) and smoking cessation products (8% vs. 3%). In turn, the older cohort is more likely to use cigarettes (28% vs. 21%).

Two-in-three shoppers that use vaping or e-cigarette products say they purchase from vape shops, with a growing share choosing other channels, most notably online. One bright spot for the channel, males are more likely to purchase vapes and e-cigarettes at c-stores than females (52% vs. 39%), however younger shoppers are more likely to purchase at vape shops (70% vs. 55%).

New in 2024, we asked c-store shoppers about their use of smoking cessation products. More than one-third (35%) of shoppers who buy smoking cessation products say they do so at a convenience store, signally significant opportunity for a rapidly evolving category.

The 2024 Tobacco + Vaping Report originally appeared in the March/April 2024 edition of Convenience Store News Canada.